- The weakening Yen might enhance Bitcoin amid liquidity injections and foreign money devaluations.

- Regardless of bearish alerts, Bitcoin edged as much as $62K, with eyes on $64K resistance.

A month in the past, Arthur Hayes, founding father of BitMEX trade, expressed optimism in regards to the weakening Japanese Yen (JPY), seeing it as a possible catalyst to inject liquidity and enhance Bitcoin [BTC] and the broader crypto market.

Yen falls to historic low in opposition to USD

Quick ahead, as of twenty sixth June, the JPY reached its lowest level in opposition to the U.S. greenback, marking the bottom in practically 38 years. This prompted hypothesis about potential interventions by authorities within the foreign money markets.

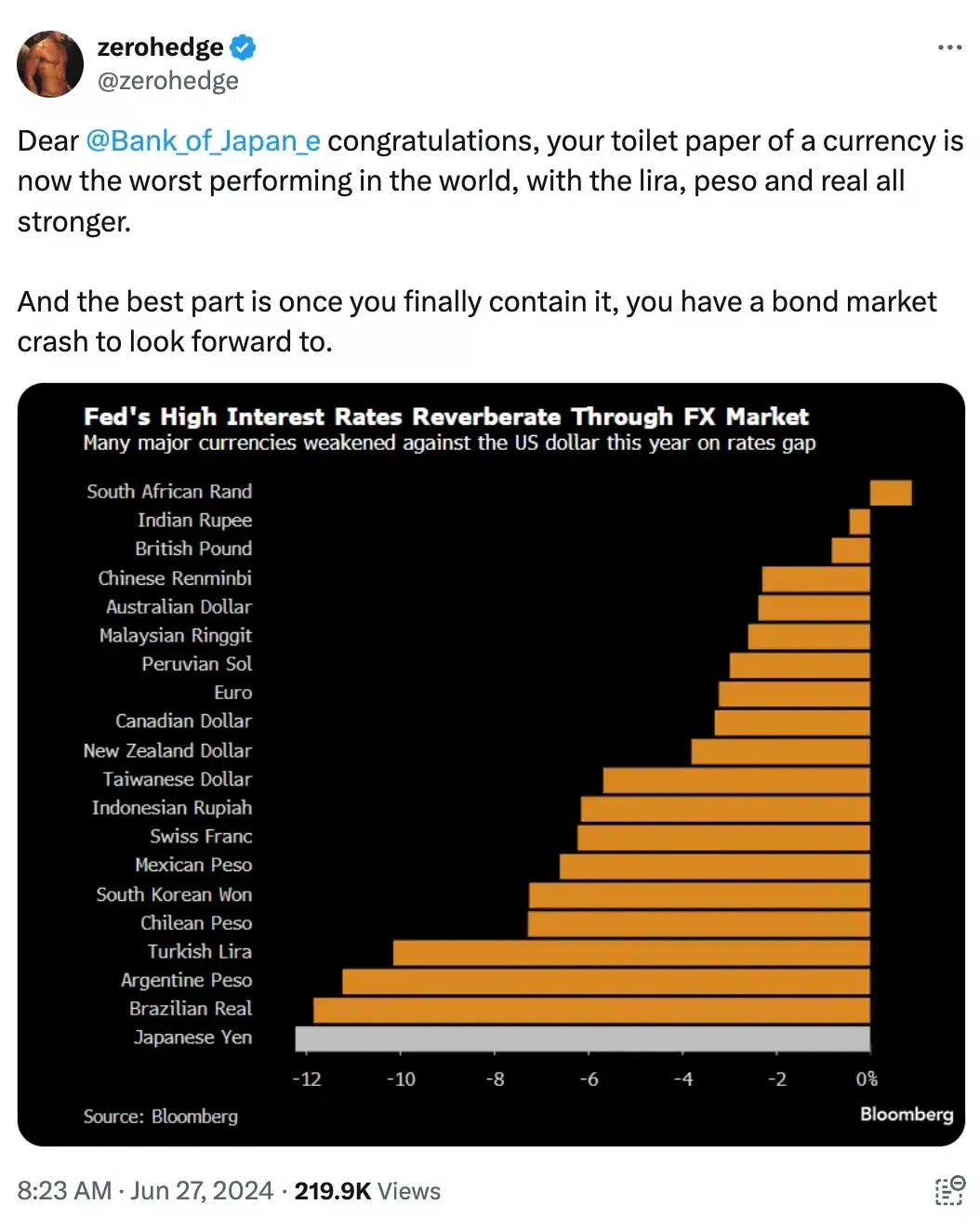

Many attribute this to the Federal Reserve’s determination to keep up excessive rates of interest, which has resulted within the JPY rating among the many world’s poorest-performing currencies.

Remarking on the identical and echoing Hayes’ views, The Bitcoin Therapist mentioned,

“Is Japan printing Yen to secretly buy #bitcoin? If so it would be the smartest move in the history of Japan. If not they will become a third world country really soon.”

In accordance with knowledge from FactSet, the Yen weakened to 160.82 in opposition to the greenback, surpassing the earlier report of 160.03 set on twenty ninth April, and marking its weakest degree since 1986.

Including additional to this knowledge set, Jeroen Blokland, Founder & supervisor of the Blokland Good Multi-Asset Fund famous,

“Over the last 12.5 years, the Japanese #Yen has lost a whopping 53% of its value against the US Dollar!”

Supply: Jeroen Blokland/X

This precipitated plenty of ripple results throughout the monetary group as highlighted by ZeroHedge, who commented with a contact of sarcasm, and acknowledged,

Supply: zerohedge/X

An excellent signal for Bitcoin?

However regardless of this Hayes sees {that a} weakening Yen would possibly set off aggressive foreign money actions amongst main economies, corresponding to Japan and China, doubtlessly resulting in foreign money devaluations and elevated liquidity injections (printing cash).

This suggests that Bitcoin, which is perceived as a hedge in opposition to fiat foreign money devaluation, may gain advantage from these macroeconomic situations.

Hayes anticipates that Bitcoin would carry out nicely in such a state of affairs, highlighting it as a resilient asset amidst international fiat foreign money instability.

Therefore, Hayes greatest put it when he mentioned,

“Crypto booms, as there is more dollar and yuan liquidity floating in the system.”

In the meantime, because the Yen confronted bearish stress, BTC appreciated by 0.56%, reaching a buying and selling value of $62,130.05.

Nevertheless, the Relative Energy Index (RSI), considerably under the impartial degree, indicated a robust bearish sentiment. However, if Bitcoin manages to surpass the resistance degree at $64,817, it might sign a possible shift right into a bullish part.

Supply: TradingView