- A number of on-chain metrics prompt that BTC’s charts would quickly flip inexperienced.

- Market indicators additionally hinted at a worth enhance.

Bitcoin [BTC] has been struggling of late because the bulls have didn’t take management of the market. Nonetheless, this sluggish worth motion hasn’t demotivated traders to carry no less than 1 BTC.

The intent of traders holding 1 BTC clearly signifies that they count on the king of cryptos’ worth to rise.

Demand for BTC is rising

CoinMarketCap’s information revealed that Bitcoin traders had a horrible month final month because the coin’s worth dropped by greater than 8%.

In reality, within the final seven days, the coin has witnessed a 4% worth correction. On the time of writing, BTC was buying and selling at $61,611.07 with a market capitalization of over $1.2 trillion.

Regardless of the most recent worth corrections, it was optimistic to see over 85% of BTC traders nonetheless in revenue, as per IntoTheBlock’s information. One other fascinating piece of information was revealed by a latest tweet from IntoTheBlock.

As per the tweet, there have been greater than 1 million addresses that had been holding 1 BTC. This was a transparent long-term pattern, as an increasing number of individuals purpose to attain whole-coiner standing.

Aside from this, AMBCrypto’s evaluation of Hyblock Capital’s information additionally revealed that traders had been prepared to carry BTC. As per our evaluation, BTC’s cumulative liquidation information has declined sharply after touching -500k a couple of days in the past. This meant that traders had been anticipating the coin’s worth to rise once more quickly.

Supply: Hyblock Capital

Bitcoin is displaying indicators of restoration

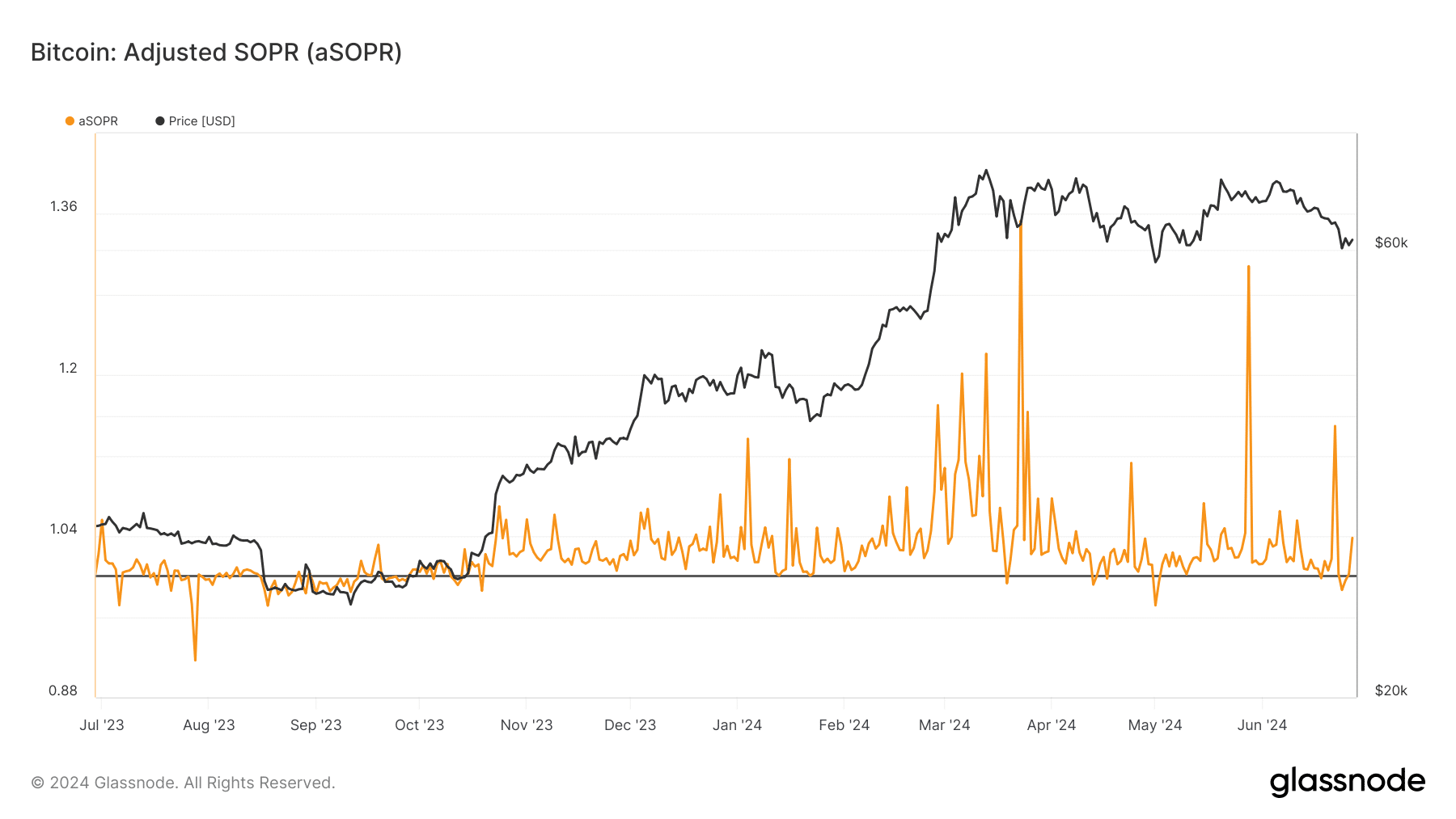

Traders’ confidence might need simply began to repay as BTC’s worth moved up marginally within the final 24 hours. BTC’s aSORP had fallen underneath the 1.0 threshold on the twenty fifth of June.

At any time when that occurs, it signifies a potential bull rally.

Supply: Glassnode

AMBCrypto’s evaluation of CryptoQuant’s information additionally identified fairly a couple of bullish metrics. For example, BTC’s Relative Energy Index (RSI) was in an oversold place. This would possibly assist enhance shopping for strain and, in flip, push its worth up.

The opposite bullish metrics had been lively addresses and the variety of transactions, as each of them elevated within the final 24 hours.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

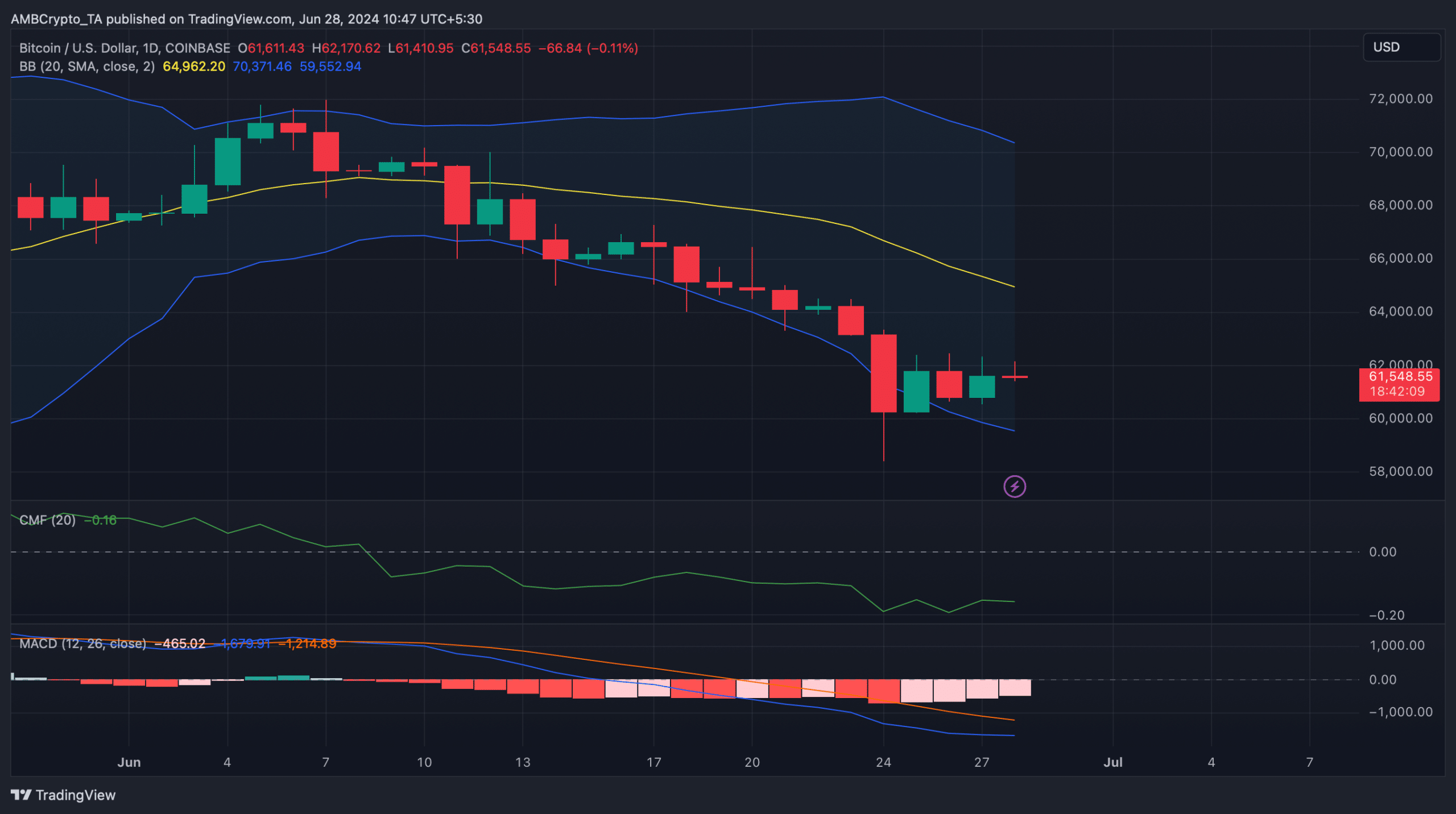

We then deliberate to take a look at Bitcoin’s each day chart to higher perceive whether or not it was about to start a bull rally. We discovered that BTC’s worth began to rebound after touching the decrease restrict of the Bollinger Bands. This typically leads to bull rallies.

The MACD additionally displayed the opportunity of a bullish crossover within the coming days. Nonetheless, the Chaikin Cash Movement (CMF) remained bearish because it was resting nicely beneath the impartial mark.

Supply: TradingView