- Bitcoin set a brand new all-time excessive for Open Curiosity, reaching $45.8 billion.

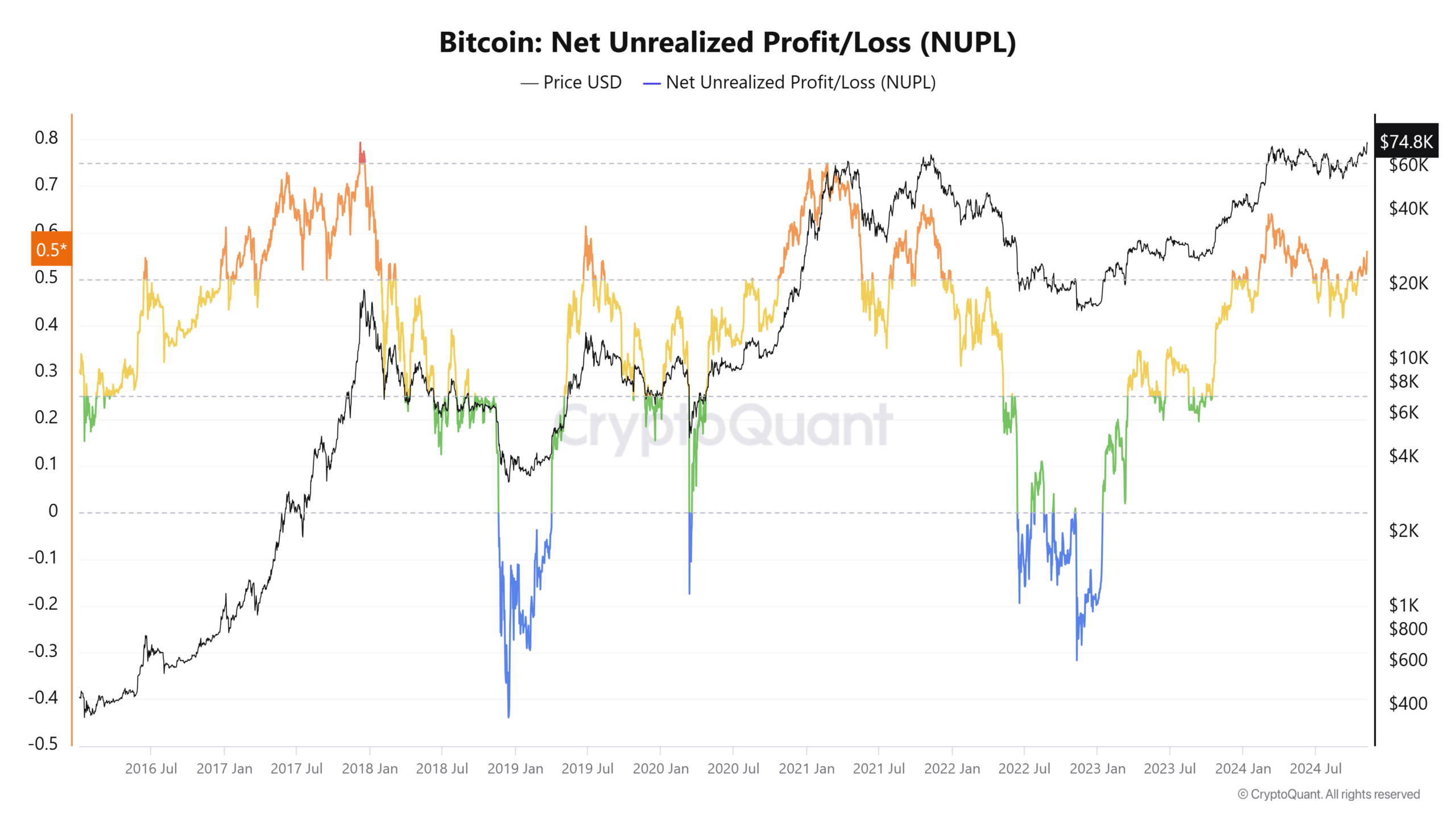

- The NUPL metric confirmed that the bull run is probably going nonetheless in its early phases.

Bitcoin [BTC] has set a brand new all-time excessive because the U.S. presidential election wound to a detailed, with Donald Trump because the clear victor.

Historic tendencies counsel that November and December could be strongly bullish months for crypto.

CryptoQuant founder Ki Younger Ju insisted that we would not see greater than 30%-40% positive factors right here onward, and never the 368% transfer we noticed within the earlier cycle.

But, Open Curiosity set a brand new all-time excessive of $45.8 billion whereas Bitcoin additionally set a brand new ATH at $76.4k, signaling sturdy bullish sentiment. Moreover, the on-chain metrics did weren’t near cycle prime ranges but.

Futures Open Curiosity soars previous 2024 highs

Supply: Coinglass

Up to now three years, the Open Curiosity has been rising steadily. The rally from October 2023-March 2024 took the OI from $11.9 billion to $38 billion.

These highs had been damaged on the seventeenth of October after which once more on the seventh of November.

Rising costs and Open Curiosity point out wholesome bullish sentiment, though the worth discovery part might see excessive volatility. Merchants needs to be cautious of deep pullbacks within the coming months.

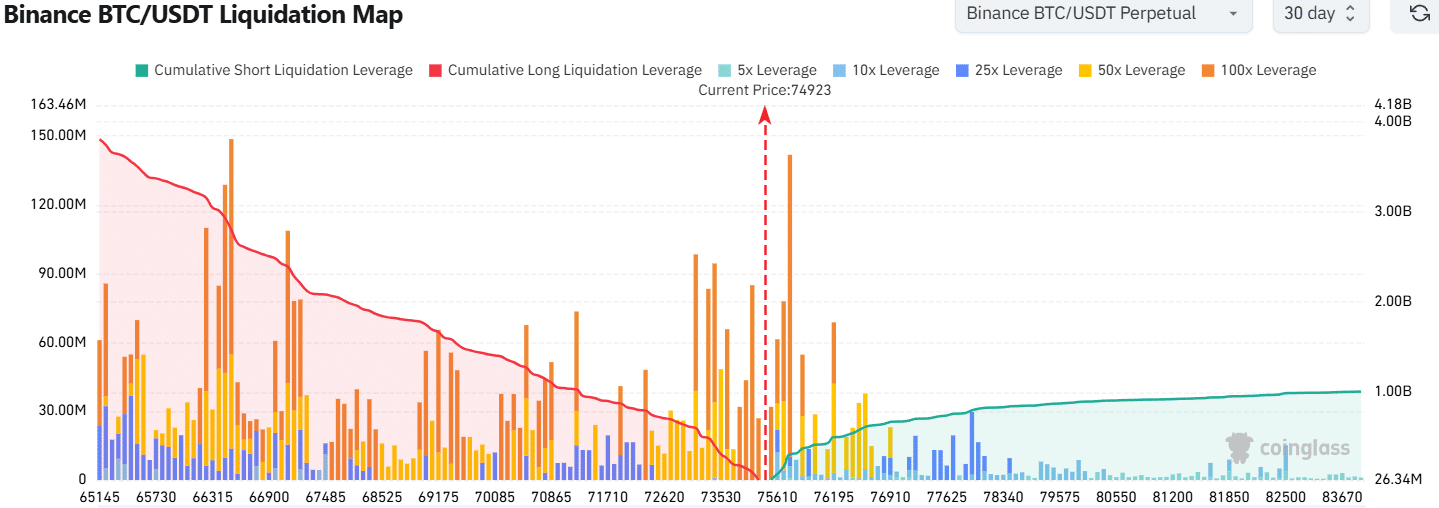

Supply: Coinglass

As issues stand, some brief sellers appear wanting to commerce in opposition to the bullish momentum BTC exhibited over the previous three weeks. The liquidation map confirmed {that a} cluster of excessive leverage liquidations ranges had been current at $75,740.

Lengthy liquidations of an identical measurement had been additionally current at $73,205, however as issues stand, a drop towards $70k could be way more painful than a continued uptrend.

NUPL echoes early bull run stage of earlier cycles

Supply: CryptoQuant

The Internet Unrealized Revenue and Loss (NUPL) was at 0.559 at press time. It was at an identical degree in December 2016, with Bitcoin prized at $900, and in November 2020 when BTC was buying and selling at $15.4k.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The NUPL has reached a excessive of 0.793 and 0.748 up to now two cycles. A studying of round 0.7 could be a robust signal that a big portion of traders are in revenue and that the bull run has seemingly run its course.

At current, there’s a lengthy option to go earlier than that, drawing into query whether or not BTC will prime after a mere 30%-40% transfer greater.