- BTC’s Open Curiosity has surged to $40 billion.

- Funding charges have additionally remained constructive for days.

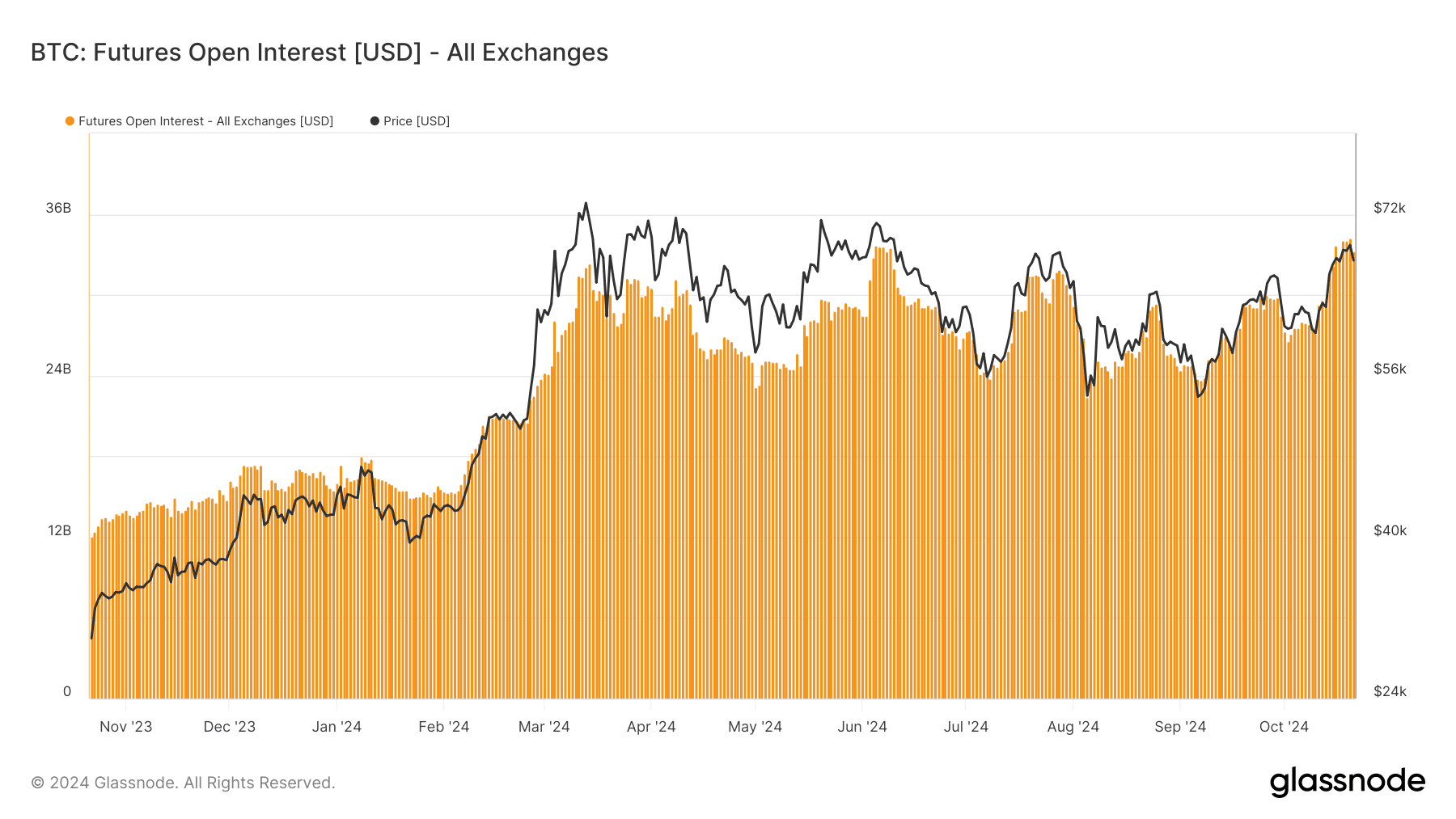

The Bitcoin [BTC] Open Curiosity (OI) throughout futures markets has surged to $40 billion, the very best stage in 2024. This rise suggests BTC is in an important section, with market contributors positioning themselves for attainable worth strikes.

Moreover, metrics like funding charges and worth motion supply deeper insights into broader market sentiment and potential future traits.

Bitcoin’s worth motion and Open Curiosity surge

Bitcoin’s worth has been on a constant upward pattern currently. It’s presently buying and selling at $67,578, with a big rise in Open Curiosity throughout numerous exchanges. S

ince early October, BTC has been driving a wave of bullish momentum, supported by robust market sentiment. The 50-day transferring common, presently at $62,120, has acted as a agency assist, pushing the value towards its current ranges.

Supply: TradingView

Technical indicators additional strengthen the bullish narrative. The Relative Power Index (RSI) is at 62.18, indicating that Bitcoin is in a bullish section however nonetheless has room to develop earlier than turning into overbought.

The Chaikin Cash Move (CMF) can be constructive at 0.12, highlighting sustained shopping for stress and robust inflows into Bitcoin.

This surge in Open Curiosity, in accordance with information from Glassnode, means that merchants are opening extra leveraged positions. The transfer anticipates additional upward momentum or a big upcoming worth motion.

Traditionally, a spike in OI is commonly a precursor to heightened volatility as merchants put together for substantial market modifications.

Supply: Glassnode

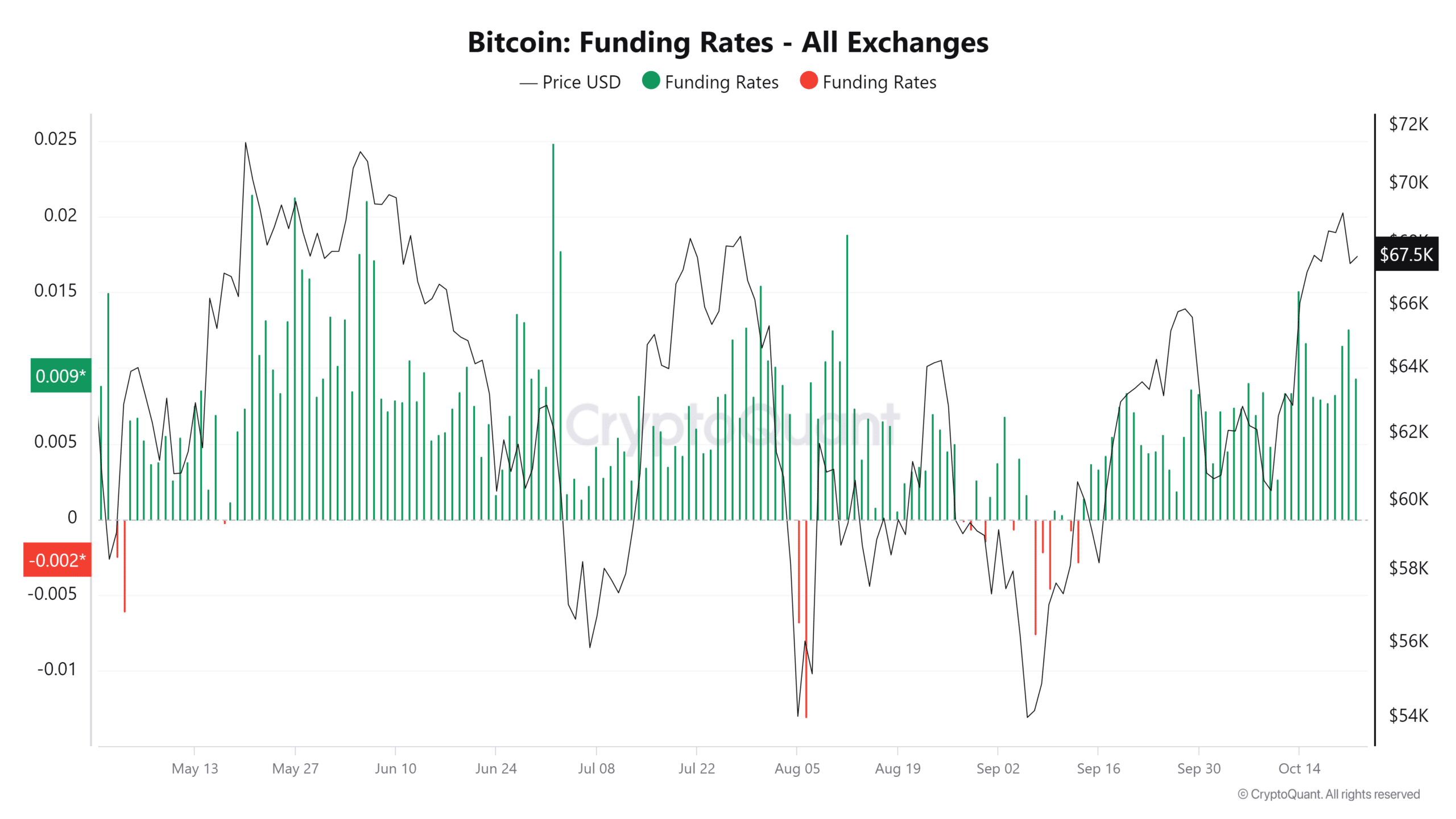

Bitcoin funding charges present bullish sentiment

An evaluation of Bitcoin’s funding charges throughout exchanges reveals persistently constructive charges. This means that merchants holding lengthy positions are paying a premium to these holding quick positions, additional signaling bullish market sentiment.

Supply: CryptoQuant

Nonetheless, whereas constructive funding charges recommend optimism, in addition they include a warning. Extended excessive funding charges can result in overleveraged situations, growing the danger of lengthy liquidations if the value all of the sudden corrects.

Since early October, funding charges have spiked alongside worth will increase, suggesting that whereas the market is bullish, it might be nearing resistance or profit-taking factors.

OI and volatility alerts forward

The surge in Open Curiosity and sustained constructive funding charges mirror rising optimism within the Bitcoin market. Nonetheless, with OI reaching $40 billion, merchants ought to put together for potential volatility.

The Common True Vary (ATR), presently round 96.16, signifies rising volatility, which might result in sharp worth swings in both path.

Learn Bitcoin (BTC) Worth Prediction 2024-25

One other worth surge might observe if Bitcoin can keep its present trajectory and break by means of key resistance ranges close to $68,000.

Nonetheless, the excessive OI and elevated funding charges additionally imply a possible worth correction is on the horizon, significantly if lengthy positions get liquidated throughout a worth drop. This units the stage for a attainable shake-up, making it important for merchants to remain vigilant within the coming days.