- Bitcoin open curiosity not too long ago declined from $23 billion to $20.7 billion.

- Regardless of the drop in open curiosity, BTC’s worth stays above $68,000.

The Bitcoin [BTC] open curiosity and worth motion are seeing notable shifts as market volatility will increase forward of the U.S. election week. Knowledge signifies a pointy drop in BTC’s open curiosity on all exchanges, suggesting that merchants have gotten extra cautious amidst unsure market circumstances.

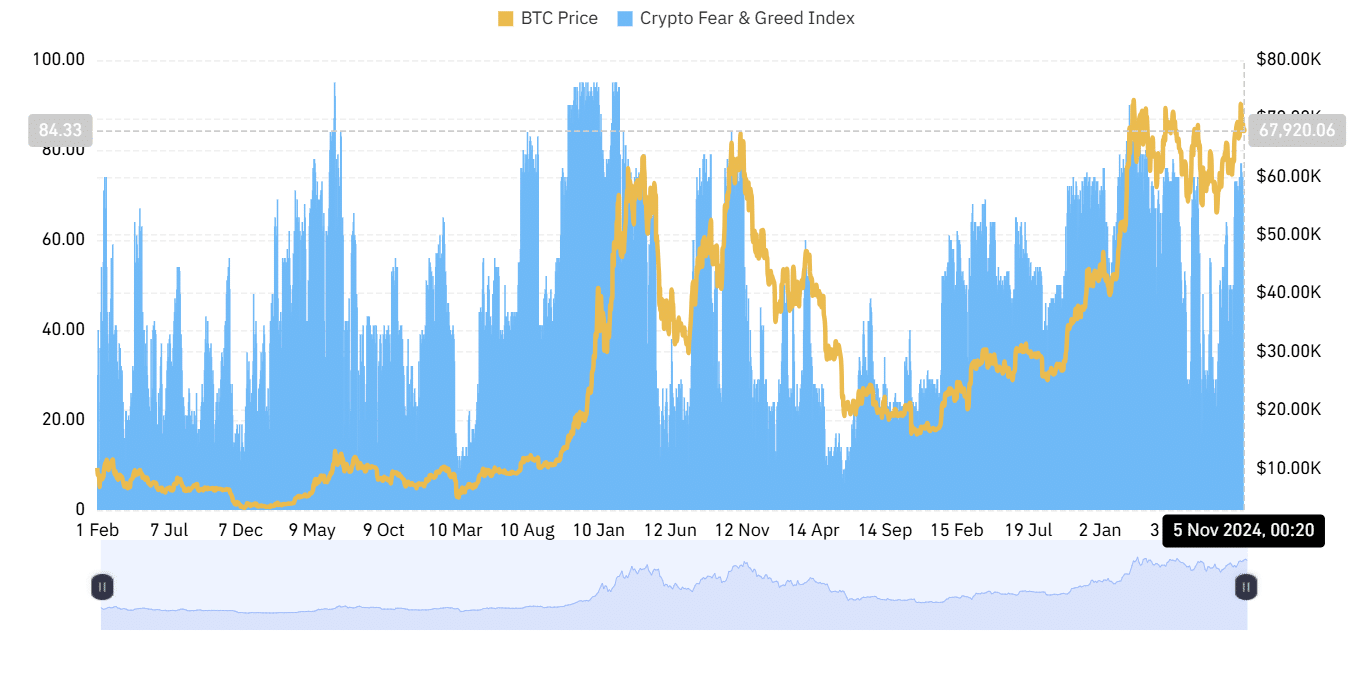

The present panorama displays a cautious but speculative surroundings, coupled with rising volatility within the S&P 500 (tracked by the VIX index) and the excessive readings on the Crypto Worry & Greed Index.

Bitcoin open curiosity decline: An indication of warning or a chance?

Bitcoin open curiosity has not too long ago dipped from over $23 billion to $20.7 billion, reflecting a shift as merchants unwind leveraged positions.

Traditionally, decreased open curiosity signifies much less market leverage, hinting that merchants could also be pulling again from riskier bets. This development could possibly be influenced by the approaching U.S. election, as political occasions typically carry added uncertainty and volatility to monetary markets.

Supply: CryptoQuant

Apparently, regardless of the drop in open curiosity, Bitcoin’s worth has remained regular above $68,000, suggesting underlying power. This resilience could point out that whereas leveraged positions have decreased, spot shopping for stays robust, probably pushed by long-term holders.

For merchants, the discount in open curiosity may sign a pause in speculative exercise, however for long-term traders, it reinforces confidence in Bitcoin’s upward potential.

U.S. election’s affect on Bitcoin Open curiosity and market volatility

The VIX, or Volatility Index, for the S&P 500 has risen to about 21.97, signaling heightened worry in conventional markets. Traditionally, excessive VIX ranges align with elevated warning in riskier belongings like cryptocurrencies.

Traders look like making ready for broader market fluctuations because the U.S. election approaches, influencing each equities and digital belongings like Bitcoin.

Supply: TradingView

The Relative Volatility Index (RVI) for Bitcoin, at the moment round 47.7, signifies potential worth swings with out a robust directional development.

With the RVI near 50, Bitcoin may expertise additional fluctuations, aligning with the cautious sentiment because the election nears. A regulatory shift following the election, significantly concerning digital belongings, may add to Bitcoin’s volatility.

Bitcoin Open curiosity and sentiment indicators: Optimism amid warning

Regardless of the elevated warning, the Crypto Worry & Greed Index sits at 70 (Greed), indicating that whereas warning exists, total sentiment stays constructive. This hole between excessive sentiment and cautious buying and selling habits suggests the market could also be ready for extra certainty following the election.

Traditionally, Bitcoin has proven consolidation patterns or slight pullbacks earlier than resuming traits in response to election outcomes.

Supply: Coinglass

The mixture of excessive sentiment and declining Bitcoin Open curiosity may indicate that merchants are hesitant to extend leverage but anticipate BTC’s worth resilience.

This sample of elevated sentiment with decrease leverage typically results in a consolidation part, the place optimistic traders anticipate volatility to settle earlier than absolutely re-entering the market.

Outlook for Bitcoin’s worth and Open curiosity post-election

With the U.S. election as a possible catalyst, Bitcoin’s futures actions could depend upon each political and macroeconomic developments.

Merchants will doubtless look ahead to a breakout above $70,000 or a secure consolidation above key help ranges to verify a post-election upward development. Conversely, any surprising election final result or new regulatory insurance policies may briefly disrupt Bitcoin’s path.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Because the election approaches, Bitcoin seems poised in a holding sample, supported by long-term confidence but tempered by short-term warning.

Metrics corresponding to Bitcoin Open curiosity and the Worry & Greed Index shall be essential for gauging market sentiment. Relying on the election’s final result, Bitcoin may both consolidate or set its sights on new highs within the months forward.