- Cash flowed out of BTC contracts, suggesting that the worth may fall to $65,000.

- Social dominance dropped to 7.07%, indicating that spotlight was transferring to different cryptocurrencies.

The whole Bitcoin [BTC] Open Curiosity has misplaced nearly $1 billion in worth between the twenty third and twenty fourth of Might. AMBCrypto discovered after analyzing the metric utilizing Santiment’s on-chain information.

On the twenty third, Bitcoin’s Open Curiosity (OI) was $11.75 billion. However at press time, the determine had decreased to $10.77 billion. OI is the worth of excellent positions in a contract.

In crypto buying and selling, there are two sides to a commerce— a purchaser and a vendor. When OI will increase, it means that there’s new cash coming into the market in favor of the patrons.

Lowering consideration might nuke BTC once more

A pattern like this means a bullish pattern. But when the metric signifies will get too excessive, the OI might function a bearish signal. Alternatively, a decline in Open Curiosity suggests a rise in positions closed which favors sellers.

Subsequently, the pattern above signifies that almost all merchants are usually not initiating new positions. For Bitcoin’s worth, this was a bearish signal, and it had began to replicate on the worth.

Supply: Santiment

At press time, BTC modified palms at $67,123. This was a 3.52% lower within the final 24 hours. Other than the decline in OI, Bitcoin’s decline might be linked to just lately accredited Ethereum spot ETFs.

From AMBCrypto’s investigation, it appeared that merchants have been rotating capital into ETH and different altcoins. Ought to this stay the case for a while, BTC might drop additional, and a transfer to $65,000 might be doable within the quick time period.

Just lately, we reported that Bitcoin’s worth might drop earlier than a return to $70,000. As such, it signifies that the prediction might be enjoying out already.

Be careful! A bounce could also be coming

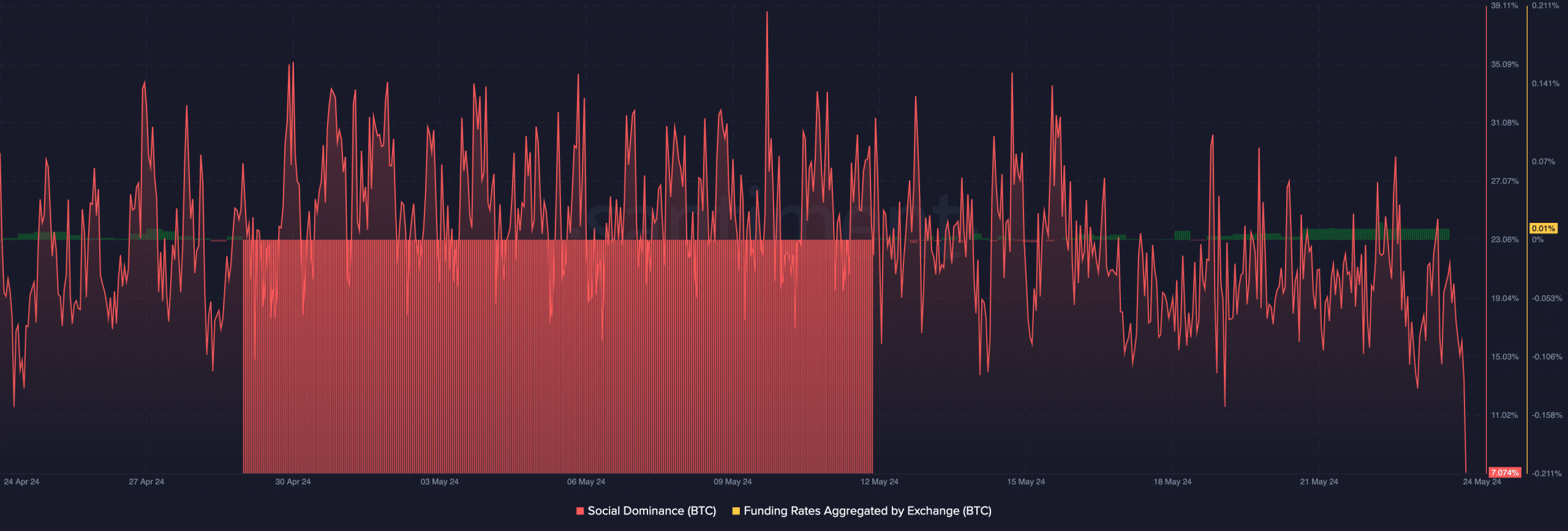

One other metric assessed was social dominance. As of this writing, Bitcoin’s social dominance dropped to 7.07%. Some days in the past, the metric was over 28%.

The decline on this metric implies that discussions associated to the cryptocurrency had fallen, suggesting that spotlight from the market was transferring elsewhere.

Ought to social dominance proceed to drop, the prediction of $65,000 might come to cross. Nevertheless, an additional decline might point out a backside for BTC.

Moreover, Bitcoin’s Funding Price was 0.01%. Funding Price is the price of holding an open contract out there. If the funding price is constructive, it implies that the contract worth is buying and selling at a premium in comparison with the spot worth.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

When the constructive price is unfavourable, it means the contract worth is at a reduction to the index worth. With the funding transferring decrease and the worth lowering, Bitcoin might stay bearish within the quick time period.

Nevertheless, it won’t take an extended whereas earlier than the worth rebounds.