- Bitcoin’s shopping for stress on Binance elevated sharply.

- Nevertheless, BTC may face headwinds forward as a number of indicators turned bearish.

After a brief pullback, Bitcoin [BTC] has as soon as once more began to inch in the direction of its all-time excessive.

Buyers took the chance to purchase the dip throughout BTC’s value fall within the latest previous, which might have performed a task in serving to BTC achieve momentum once more.

Will this enhance in shopping for stress propel BTC to a brand new ATH quickly?

Buyers are stockpiling Bitcoin

Ali, a well-liked crypto analyst, not too long ago posted a tweet stating that there was a major spike in BTC shopping for stress on Binance.

This clearly signaled rising bullish sentiment, suggesting upward value motion may very well be forward.

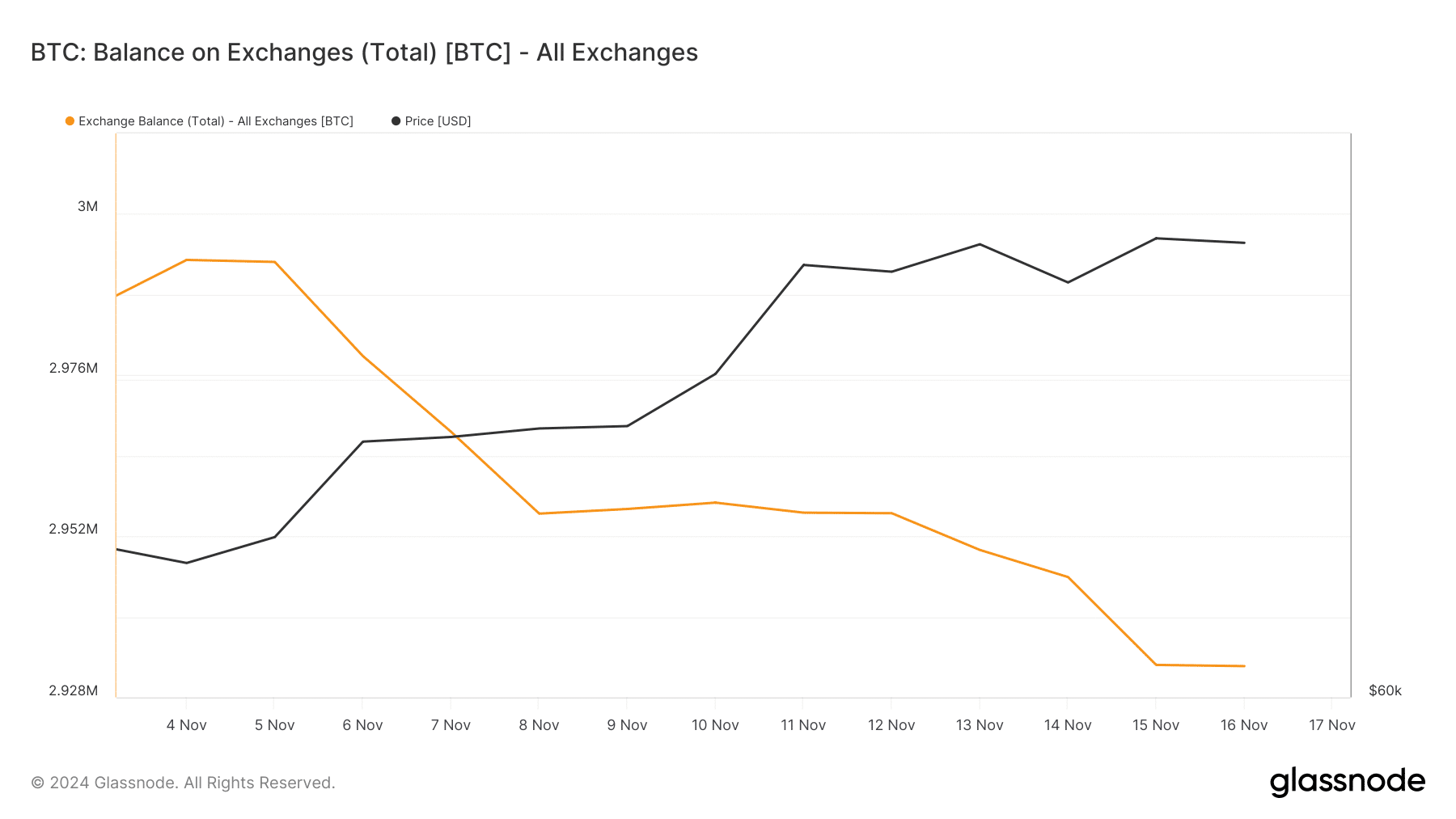

The truth that shopping for stress was excessive within the general market was additional confirmed by BTC’s change stability.

The metric dropped sharply over the past two weeks, indicating that traders have been stockpiling the king of cryptos.

Supply: Glassnode

CryptoQuant’s knowledge revealed that Bitcoin’s Coinbase premium was inexperienced. This meant that purchasing sentiment was robust amongst U.S. traders.

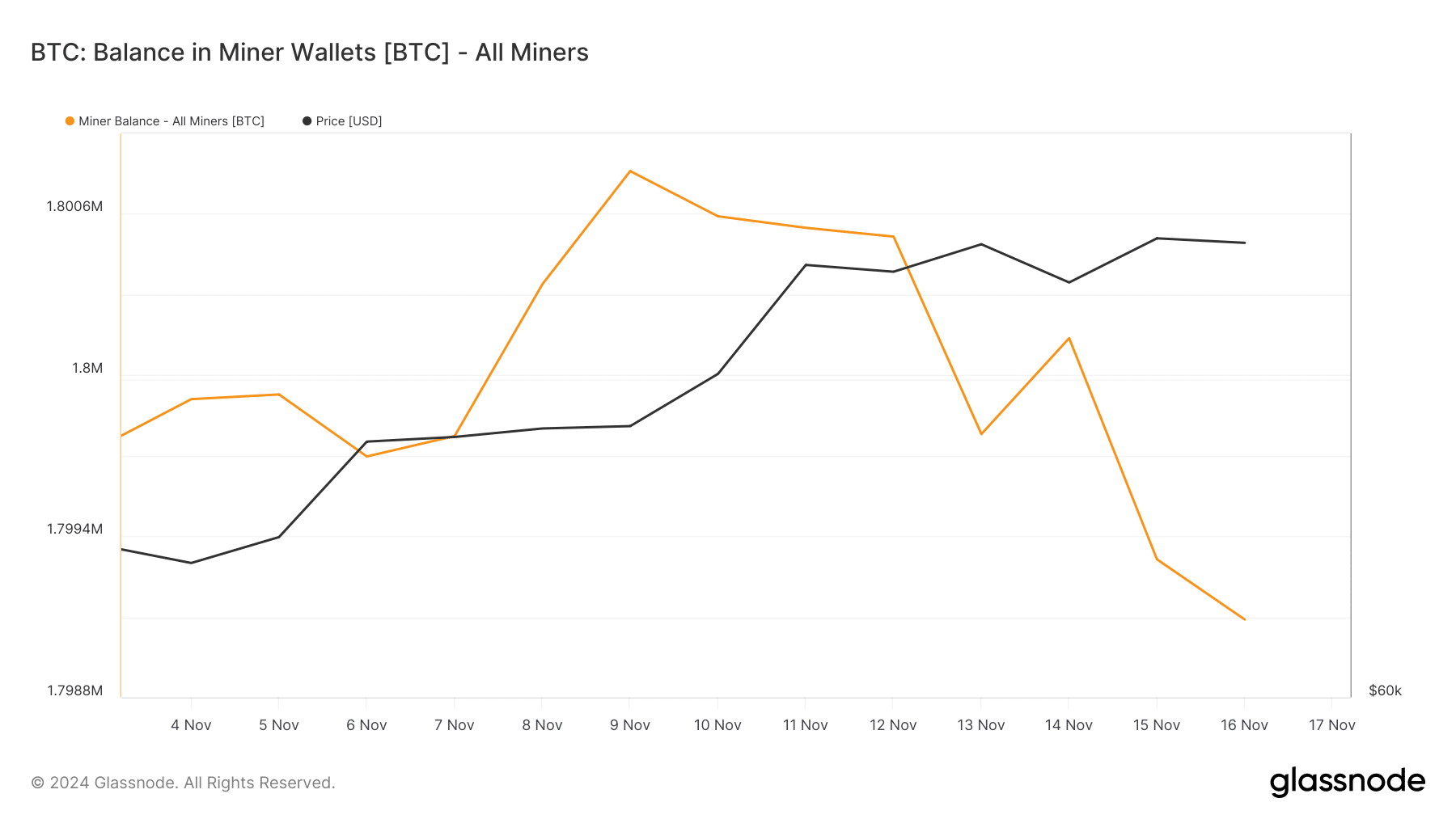

Nonetheless, Bitcoin miners didn’t present confidence within the king coin. This was evident from the appreciable drop in BTC’s miners stability—an indication of miners’ sell-off.

Supply: Glassnode

Will this be sufficient for a brand new ATH?

The hike in shopping for stress from traders has propelled 14% value progress over the past week, permitting BTC to succeed in nearer to $91k once more.

If the buildup pattern continues, it received’t be stunning to see Bitcoin reaching a brand new excessive quickly.

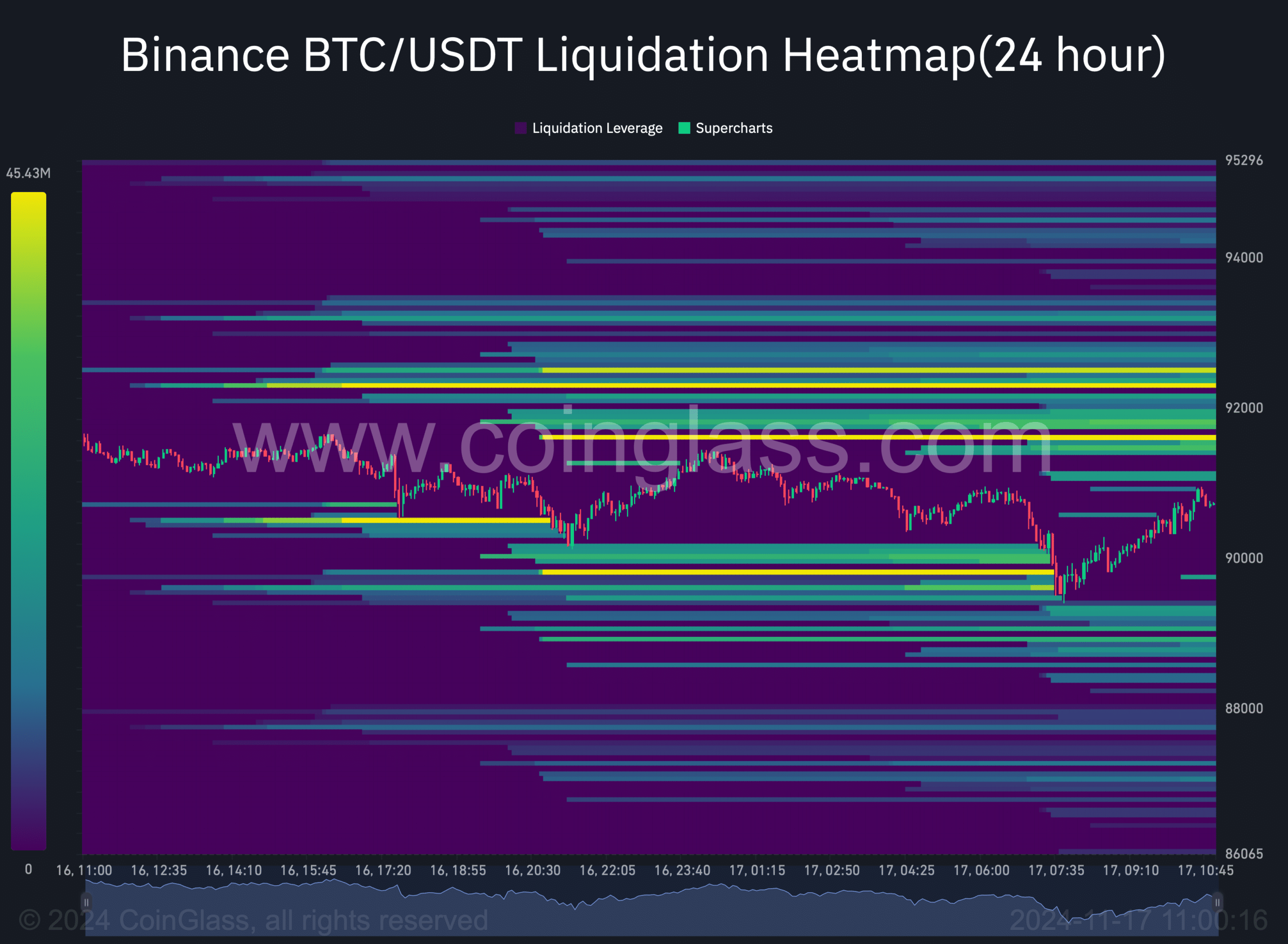

Within the short-term, it didn’t appear a lot of an issue for BTC to retest $91k. This was the case as BTC’s liquidation will rise above the $91.6k mark.

At any time when liquidation rises, it signifies that the probabilities of a value correction are excessive.

Supply: Coinglass

Nevertheless, not every thing favored a value rise. For example, BTC’s aSORP turned purple, which means that extra traders have been promoting at a revenue. In the midst of a bull market, it could point out a market prime.

The king coin’s Binary CDD instructed that the motion of long-term holders throughout the previous seven days was greater than typical. In the event that they have been moved for the aim of promoting, it might have a adverse affect.

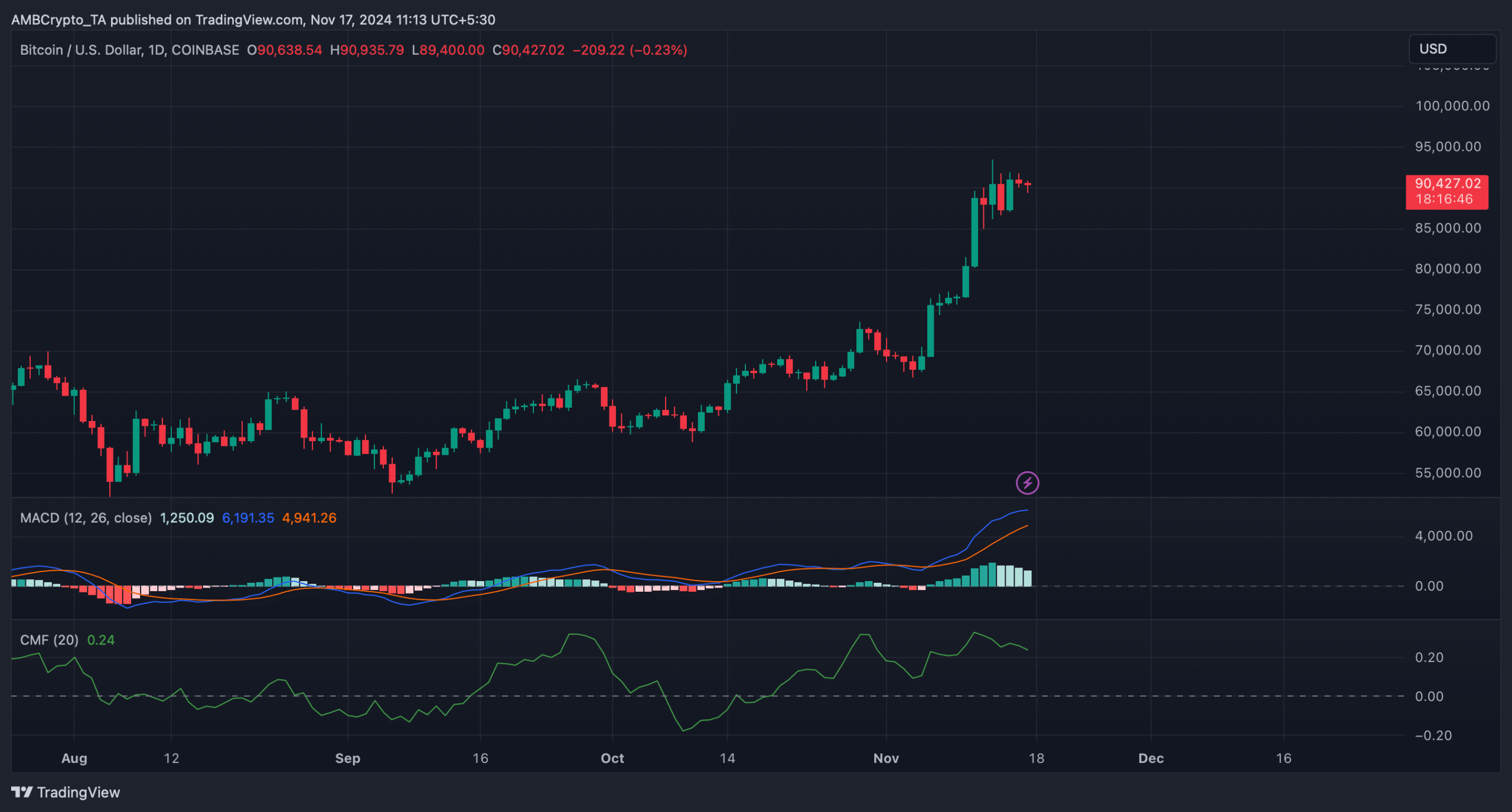

Supplementing the aSORP, Bitcoin’s Chaikin Cash Movement (CMF) registered a downtick. The indicator measures the shopping for and promoting stress of an asset.

Learn Bitcoin (BTC) Worth Prediction 2023-24

A falling CMF confirms a downtrend, which, on this event, might create issues on BTC’s roads to $91k.

Nonetheless, the MACD continued to point out a bullish benefit out there, suggesting that the opportunity of BTC retesting its ATH can’t be dominated out but.

Supply: TradingView