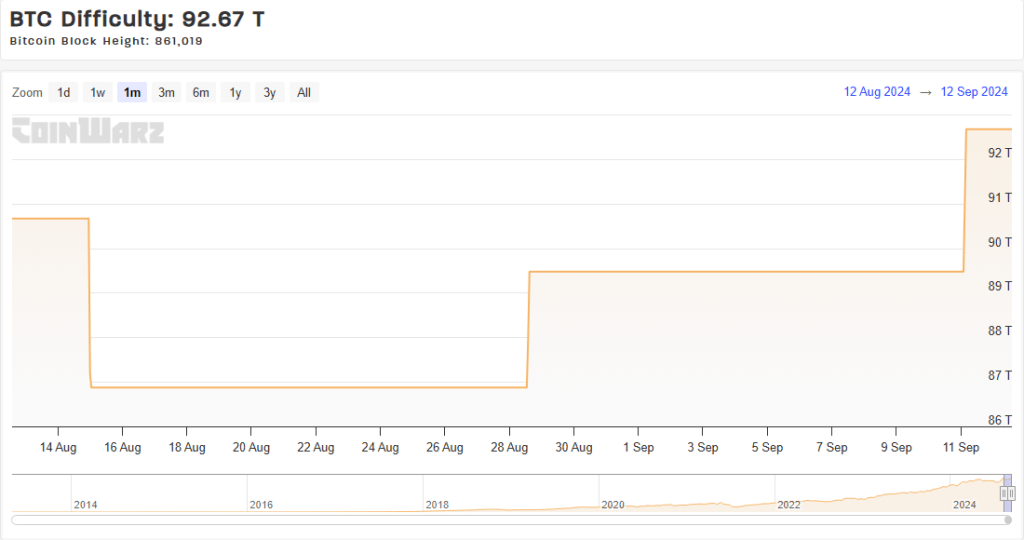

The issue in mining Bitcoin has surged to a brand new report degree, therefore squeezing revenue margins. Reaching 92.67 trillion, the problem index exceeded the earlier report peak of 90.67 trillion set in July this 12 months.

This 3.6% rise represents the elevated competitiveness ensuing from record-breaking hashrate values. It emphasizes how resilient and safe the community is changing into since mining Bitcoin requires extra computational functionality.

Supply: CoinWarz

Miners Liquidating Their Bitcoin Holdings

Apparently, since September 8, miners have offered nearly 30,000 Bitcoin, price round $1.71 billion. This vital sell-off factors to potential issues with liquidity or worries about future worth actions amongst miners.

The added problem comes at a making an attempt time for miners, nonetheless adapting to the repercussions of April’s “halving,” a programmed lower in mining rewards that has already halved potential earnings since then, serving to to clarify a tough 10% decline within the worth of Bitcoin.

Supply: CoinWarz

Miner Secures Block Reward Alone

Regardless of the difficulties, a single miner obtained a block reward of round $180,000. This unusual success underlines how a lot particular person miners should produce regardless of rising challenges.

NEWS: Solo #Bitcoin miner wins a $180K (3.169 $BTC) reward after efficiently mining block 860749. pic.twitter.com/KrBDOw99ue

— CoinGecko (@coingecko) September 11, 2024

The rising problem hasn’t discouraged miners from enhancing their operations, both. September noticed an all-time excessive in Bitcoin’s hashrate, which gauges the general computing capability sustaining the community. This suggests that within the close to future miners can be betting on an enormous worth rise.

Impact On Miners Listed Publicly

The rise in mining complexity has heightened competitiveness and strained revenue margins for publicly traded bitcoin miners. These difficulties have led main mining firms to reveal notable declines of their inventory costs and manufacturing charges.

This 12 months, shares of Marathon {Digital} Inc. are off 31%, whereas Riot Platform’s fell 54%. The inventory performances of quite a lot of broadly traded mining firms replicate the general difficulties of the crypto mining trade.

The consequences on Bitcoin’s worth are but unknown, with potential penalties for long-term community safety in addition to transient worth swings. Whereas some fear that the numerous quantity of BTC being offered by miners might set off promoting strain and a potential decline in Bitcoin’s worth, others think about the rise in mining problem as a superb indication for the safety of the community and investor belief.

Subsequently, each investor ought to monitor these developments to help one in making a clever selection about monetary technique. Reflecting the uncertainties concerning the current market situations, the optimistic attitudes of the Bitcoin group have additionally plummeted to 21% out of 51,341 respondents surveyed.

Featured picture from Bankless, chart from TradingView