- Bitcoin’s mining issue has reached an all-time excessive on account of a surge within the community.

- BTC has remained above the $67,000 value vary.

Bitcoin [BTC] mining issue has reached a file excessive, pushed by a surge within the community’s hashrate. This improve happens as Bitcoin’s value rises, prompting miners to develop their operations to capitalize on the potential rewards.

The upper mining issue is a mirrored image of the community’s rising safety, but in addition presents challenges for miners as they face rising prices.

Rising hashrate indicators Bitcoin mining issue

All through 2024, Bitcoin’s hashrate has been steadily rising. As of mid-October, it reached a peak of 656.3 billion, indicating heightened mining exercise on the community.

The next hashrate means extra miners are becoming a member of the Bitcoin community, competing for blocks.

Supply: CryptoQuant

The first motivation for miners is BTC’s ongoing value rally, which has inspired them to ramp up their computational energy.

With BTC buying and selling at round $67,193, the inducement to safe new blocks has grown. Nevertheless, this has additionally led to an computerized adjustment within the community’s mining issue.

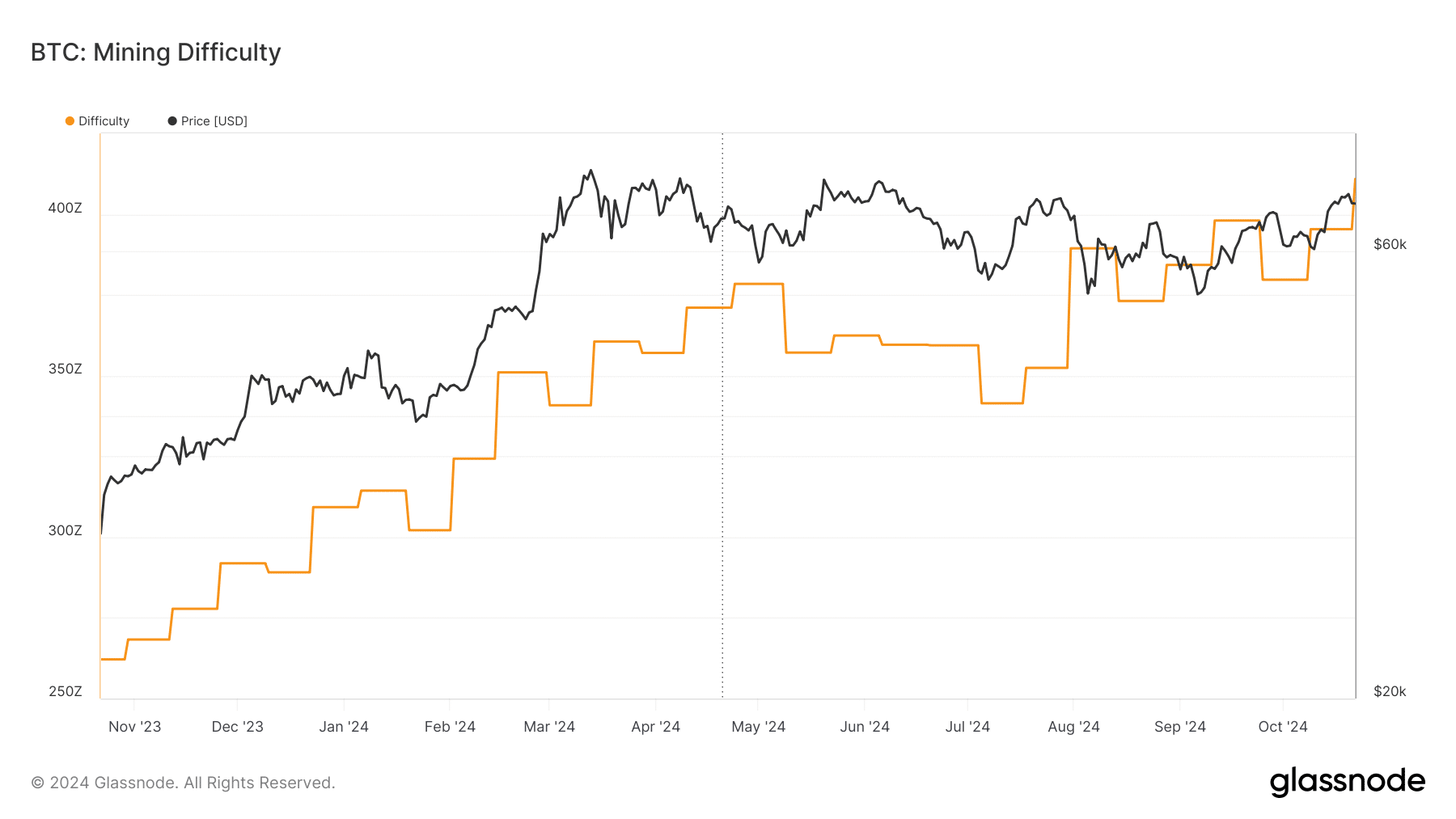

Bitcoin mining issue reaches new heights

Bitcoin mining issue has climbed to its highest stage ever following the surge in hashrate. The community mechanically adjusts mining issue each two weeks to make sure blocks are mined roughly each 10 minutes.

As extra miners be a part of the community, competitors intensifies, rising issue and the prices related to mining.

Supply: Glassnode

For miners, this rise in issue means they want extra computational energy and better power prices to take care of profitability. Whereas BTC’s rising value gives potential rewards, it additionally raises the price of securing these rewards, squeezing revenue margins for a lot of miners.

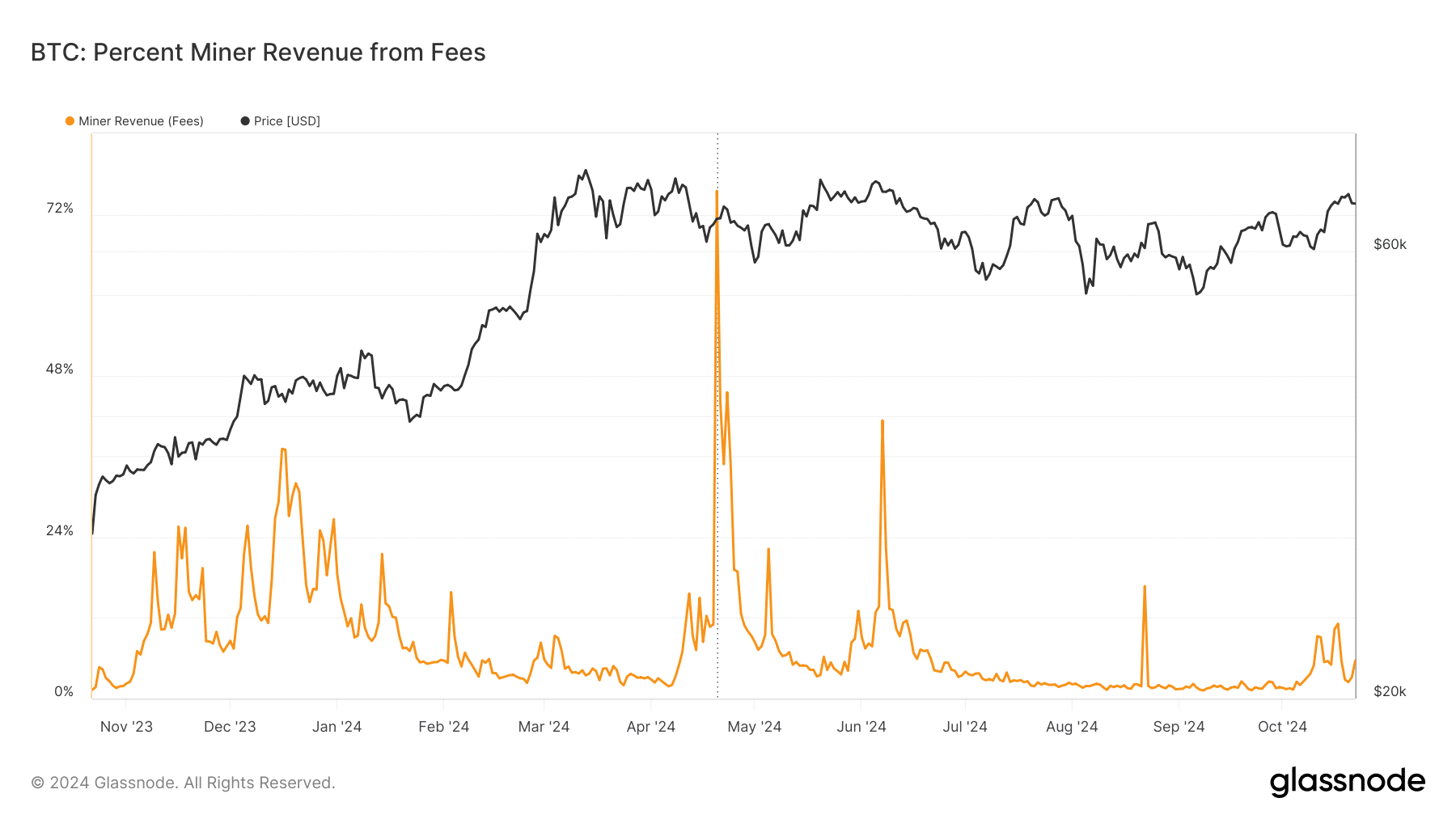

Miner charges see slight uptick, whereas Bitcoin value holds regular

Alongside the rise within the Bitcoin mining issue and hashrate, miner charges have proven a reasonable improve. Charges sometimes rise when there’s a surge in community exercise, with miners prioritizing transactions that provide greater rewards.

Though miner charges have spiked throughout community congestion in 2024, block rewards proceed to account for the majority of miners’ revenue.

Supply: Glassnode

Regardless of these community changes, Bitcoin’s value has remained comparatively secure, at present buying and selling at $67,193, down by 0.28%.

Learn Bitcoin (BTC) Worth Prediction 2024-25

The Common True Vary (ATR) indicator factors to potential volatility within the quick time period, suggesting that BTC’s value might see fluctuations because the mining ecosystem adjusts to the elevated issue and community exercise.

As Bitcoin mining issue and hashrate proceed to climb, the interaction between miner profitability, charges, and BTC’s value will probably be important to watch.