- Bitcoin miners are going through escalating prices and operational challenges.

- As a consequence, miners are exploring AI tech to boost effectivity.

Within the quickly altering world of Bitcoin [BTC] mining, operators are going through rising prices and rising technical calls for. As mining turns into more and more capital-intensive, the necessity for specialised {hardware}, dependable vitality sources, and knowledgeable administration has by no means been larger.

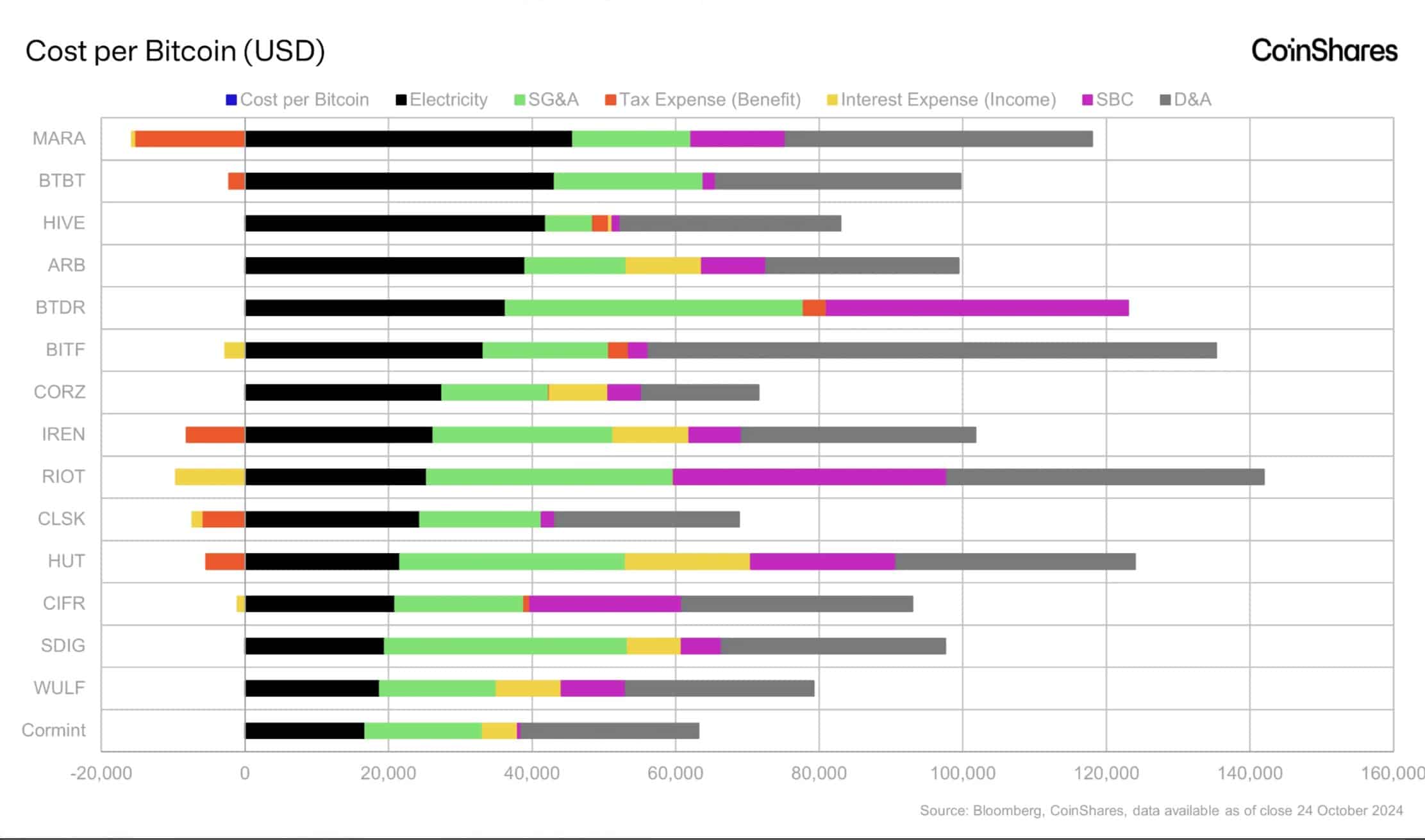

Knowledge reveals mining bills have surged, with common prices now exceeding $49,500, whereas money circulation pressures are compounded by rising rates of interest.

Amidst this backdrop, miners are exploring AI as they search to navigate monetary hurdles and improve operational effectivity in a unstable market.

Mounting monetary pressures threaten profitability

- Supply: Coinshares

- Supply: Coinshares

The Bitcoin mining sector is grappling with elevated manufacturing prices, with post-halving bills per Bitcoin typically exceeding present market costs. Rising operational prices – pushed largely by electrical energy, SG&A, and curiosity bills – are squeezing miners’ profitability and amplifying money circulation pressures.

With out vital capital reserves or different income streams, miners could wrestle to maintain operations or scale effectively within the face of tightening revenue margins.

Bitcoin mining and value volatility: A double-edged sword

Bitcoin’s latest value surge, pushed by ETF anticipation, briefly boosted miners’ revenues per coin. Nonetheless, following the most recent halving, which doubled manufacturing prices, profitability stays extremely depending on unstable market circumstances.

For a lot of miners, debt and excessive operational bills restrict their skill to capitalize on value spikes, as rising curiosity prices eat into potential earnings.

On this atmosphere, volatility is each a chance and a threat: whereas value will increase can enhance margins, sudden drops threaten money circulation and should drive some miners to cut back operations or promote property.

Embracing AI

Many Bitcoin miners are shifting their methods to spice up revenues by holding onto Bitcoin tokens and exploring AI functions. AI can assist streamline mining operations, permitting miners to optimize processes and higher handle vitality consumption.

Through the use of superior analytics, they’ll enhance effectivity and cut back prices, making it simpler to adapt to market modifications. This integration of AI not solely diversifies income streams but additionally positions miners for achievement in a aggressive panorama.

Decreasing Bitcoin’s Carbon Emissions by means of Sustainable Practices

Supply: Coinshares

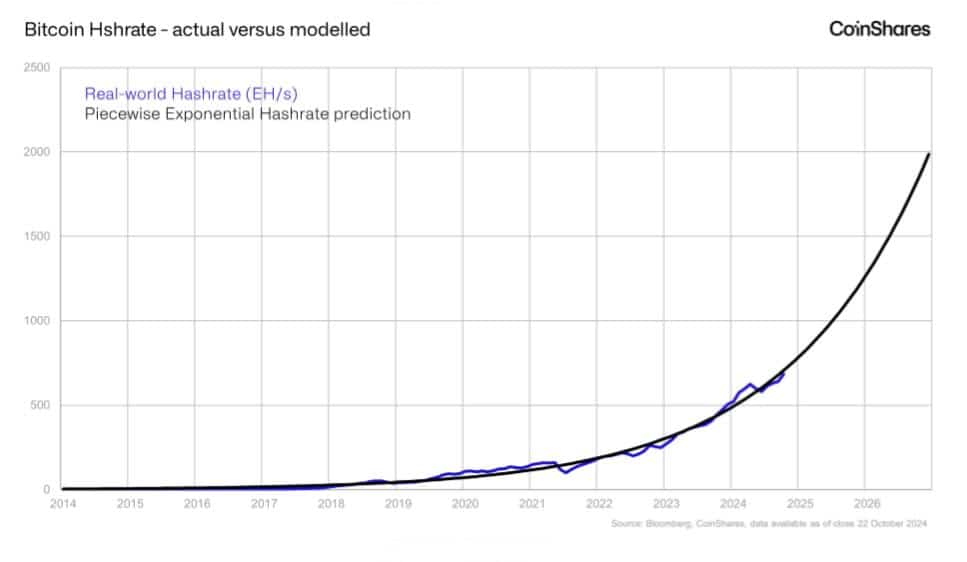

The Bitcoin community’s rising hash price – projected to achieve 765 EH/s – continues to drive up electrical energy demand, intensifying environmental considerations. As mining operations increase to take care of community safety and compete for block rewards, the related vitality consumption attracts vital criticism for its carbon footprint.

In response to trade forecasts, a strategic pivot to different vitality might cut back Bitcoin’s carbon emissions by as much as 63% by 2050.

Learn Bitcoin (BTC) Value Prediction 2024-25

For miners, renewable vitality affords a pathway to long-term value effectivity. By investing in photo voltaic, wind, or hydropower, mining firms might defend themselves from unstable electrical energy costs and mitigate regulatory dangers.

This shift could develop into essential for each profitability and public notion, positioning the trade to adapt to evolving environmental expectations.