- Bitcoin’s hash price confirmed resilience, whereas BTC struggled to cross the $70k mark.

- European regulatory response targets potential market abuse dangers related to MEV.

In contrast to earlier years, the fourth Bitcoin [BTC] halving was fairly completely different. Whereas miners’ block subsidy rewards have now been lowered from 6.25 BTC to three.125 BTC, they proceed to earn further transaction price rewards for every block mined.

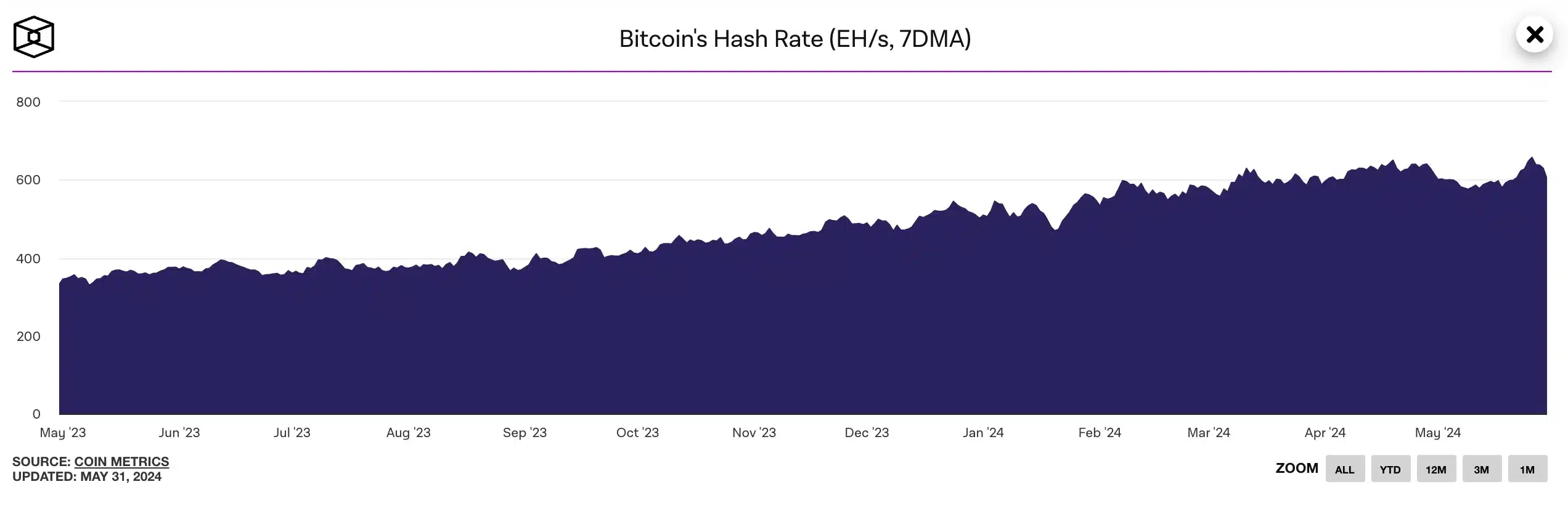

In previous halvings, Bitcoin’s hash price dropped because of inadequate transaction price rewards. This time, the hash price stayed close to all-time highs, rising from 630 EH/s to 640 EH/s post-halving, pushed by elevated transaction price rewards.

Nevertheless, on the time of writing, it dropped again to 602 EH/s.

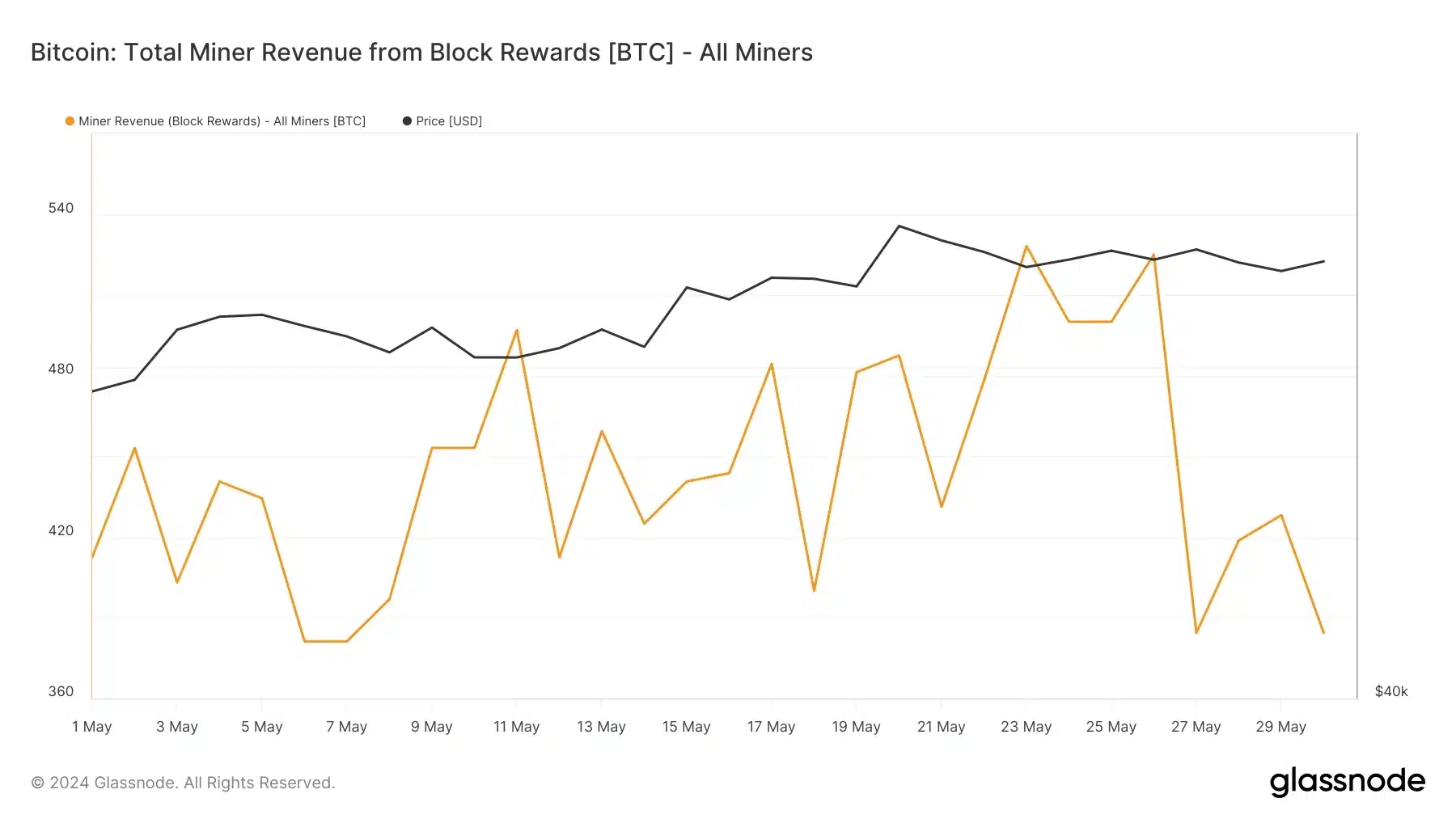

Supply: Glassnode

Moreover, whereas Bitcoin’s hash price confirmed resilience, then again, its value appears to be struggling to cross the $70k mark.

What metrics recommend about Bitcoin mining

In line with on-chain information from The Block, Bitcoin’s hash price has been declining since twenty sixth Could, indicating potential dangers to the community. In such conditions, miners would possibly battle to generate income from their operations.

Supply: The Block

This was additional confirmed by Glassnode’s, miners’ income block information. As of the most recent replace, on-chain information reveals that miners’ income has dropped considerably to 384.375 BTC, down from 525 BTC on twenty sixth Could.

Supply: Glassnode

Nevertheless, some nonetheless view this case as a web optimistic for Bitcoin, as highlighted in a current InvestAnswers stream.

“That is good because typically miners wouldn’t jump in to mine Bitcoin unless the price is going up and big enough to sustain a lot of this.”

Wanting on the Bitcoin mining issue information, it may be seen how onerous it’s to search out the proper hash for every block. Please be aware that this issue doesn’t have an effect on the worth of the mined BTC. So, BTC’s costs play an vital position in figuring out the profitability of miners.

What’s the matter round MEV?

However block rewards aren’t the one approach for miners to earn. Most Extractable Worth (MEV) refers to potential income that miners can get by making use of methods like frontrunning, sandwich assaults, and so on. that depend on their means to reorder transactions in a block.

Recognizing the menace that MEV can pose to buyers, the European Securities and Markets Authority (ESMA) lately shared its plan to limit MEV utilized by miners and validators, contemplating it as potential market abuse.

Whereas the proposal continues to be within the draft stage, stakeholders have till June’s finish to remark. If it will get authorised, it might have important implications for validators and miners worldwide.