- Bitcoin miners offered over $83 million in BTC just lately.

- BTC has dropped to the $67,000 value degree.

Bitcoin [BTC] has skilled declines over the previous few days, with essentially the most notable drop occurring on eleventh June. In response to this decline, miners have been promoting off their holdings to take some earnings.

Nonetheless, these gross sales aren’t being mirrored on the exchanges. Regardless of these circumstances, the open curiosity continues to take care of a good quantity.

OTC gross sales deplete the Bitcoin miner reserve

An evaluation of key Bitcoin miner metrics revealed a decline in miner holdings. The miner reserve, whereas sustaining a quantity of round 1.8 million, has skilled slight declines.

Nonetheless, monitoring the miner outflow confirmed a lower, indicating that the quantity being despatched to exchanges from miner wallets has declined.

The metrics could also be complicated at first as a result of the stream of BTC from miner wallets will not be seen, but the reserve has seen declines.

Nonetheless, the state of affairs turns into clearer when analyzing Over the Counter (OTC) gross sales.

Supply: CryptoQuant

An evaluation of BTC Miner OTC gross sales revealed that some main mining corporations have been promoting off their holdings. In line with a chart on CryptoQuant, there was just lately the biggest OTC sale since late March, with round 1,200 BTC offered.

It is a signal of miner capitulation, indicating that miners are promoting their BTC holdings, probably because of monetary pressures or to lock in earnings amidst market declines.

Most of these transactions don’t instantly influence change volumes however nonetheless cut back the general reserve.

How has BTC trended amidst sell-offs

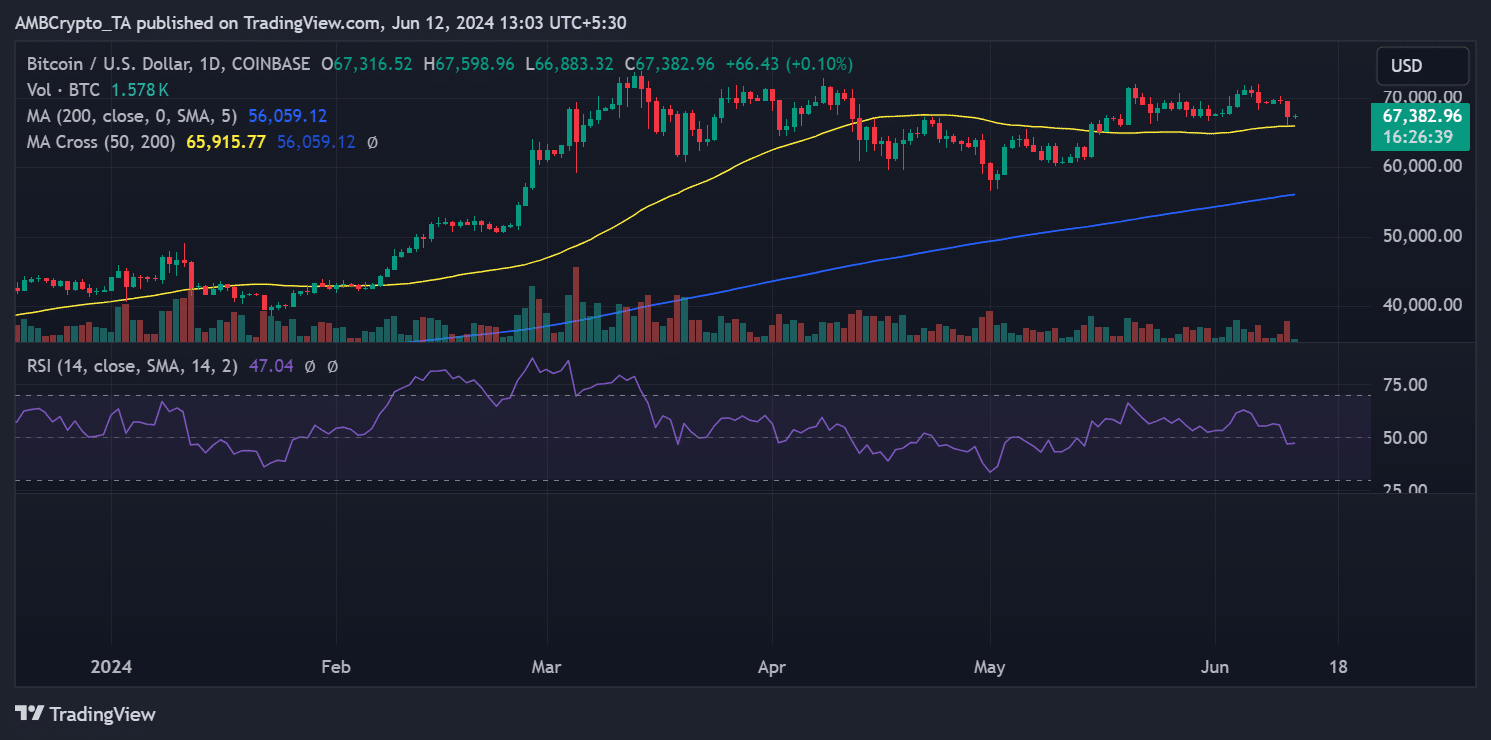

An evaluation of Bitcoin on a each day timeframe chart confirmed a adverse development during the last seven days. AMBCrypto’s evaluation of its value development indicated that between the sixth and seventh of June, Bitcoin’s value dropped from the $70,000 vary to round $68,000.

Nonetheless, BTC noticed one other main decline on eleventh June, taking its value decrease. Evaluation of the chart confirmed that it declined by over 3%, bringing its value right down to the $67,000 vary.

At this price, Bitcoin was transferring dangerously near its brief transferring common (yellow line), which has served as help at across the $65,000 value vary.

Supply: TradingView

As of this writing, BTC was buying and selling at round $67,400, with a slight try at an uptrend.

Evaluation of its Relative Energy Index (RSI) confirmed that it’s now beneath the impartial line, with the RSI at round 47. This means that BTC is presently in a bear development.

Bitcoin nonetheless getting a number of pursuits

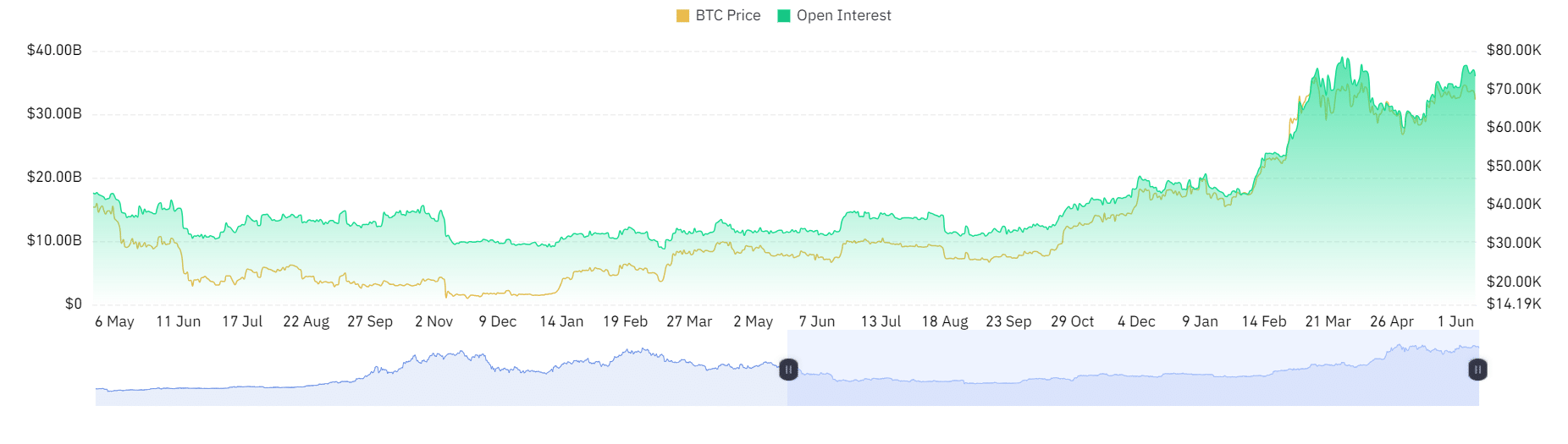

An evaluation of one other key metric revealed that regardless of the miner sell-off and the worth decline, Bitcoin continues to see a excessive quantity of curiosity.

This means that, even in a bear development, there stays vital engagement and potential optimism out there.

A take a look at the Open Curiosity chart from Coinglass confirmed it was round $34 billion as of this writing.

Evaluation of the chart indicated that its all-time excessive (ATH) was round $39 billion, a degree achieved in March when the BTC value was over $70,000.

This means that money influx has not stopped, and lots of merchants are shopping for in as a result of value drop.

Supply: Coinglass

Learn Bitcoin (BTC) Worth Prediction 2024-2025

Moreover, evaluating the present open curiosity (OI) to its all-time excessive (ATH) exhibits that there was no vital lack of constructive sentiment across the value of BTC.

Regardless of the current declines, merchants stay engaged and optimistic about Bitcoin’s potential.