- Bitcoin value volatility is triggering miner capitulation, signaling potential market shifts.

- CryptoQuant CEO suggests the present miner capitulation section may persist, advising warning in market participation.

Bitcoin [BTC] value fluctuations proceed to dominate the crypto markets, with the main cryptocurrency experiencing each surges and declines over the previous week.

Not too long ago, Bitcoin confirmed indicators of restoration, rising by 3.1% to press time buying and selling value of $58,941. This uptick comes after a dramatic fall under $54,000 final week, a value level unseen since February.

Regardless of this temporary resurgence, Bitcoin stays down 7.1% over the previous week and has declined 21.9% from its March excessive of over $73,000.

Miner capitulation: A persistent concern

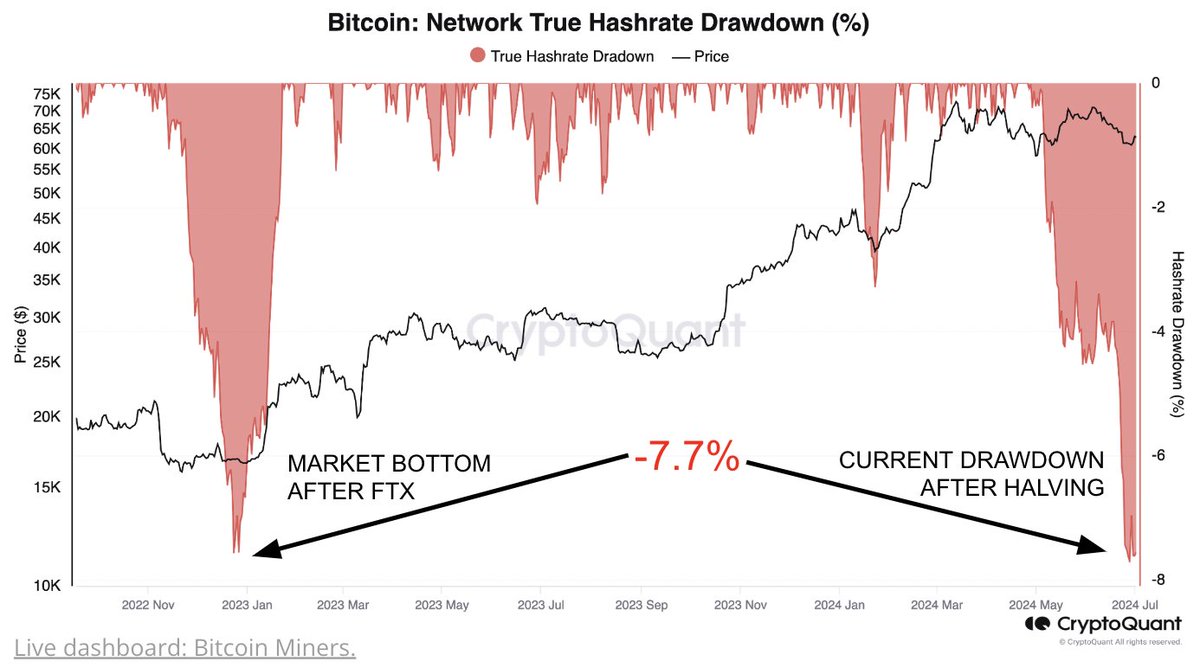

Ki Younger Ju, CEO of CryptoQuant, a famend cryptocurrency analytics agency, highlighted that Bitcoin miners are persevering with to face challenges, a situation often known as ‘miner capitulation’.

This time period refers to a interval the place mining earnings are squeezed as a result of falling Bitcoin costs, main miners to promote their holdings to cowl operational prices, doubtlessly driving costs down additional.

Ki Younger Ju notes that miner capitulation sometimes concludes when the each day common mined worth drops to 40% of the yearly common; presently, it stands at 72%.

This prolonged section of capitulation means that the market might expertise an absence of thrilling actions for the subsequent few months, emphasizing a technique of long-term optimism however cautious buying and selling within the brief time period.

Supply: CryptoQuant

In Ju’s phrases:

“Bitcoin miner capitulation is still ongoing. Historically, it ends when the daily average mined value is 40% of the yearly average; it’s now at 72%. Expect the crypto markets to be boring for the next 2-3 months. Stay long-term bullish but avoid excessive risk.”

Bitcoin fundamentals sign market stress

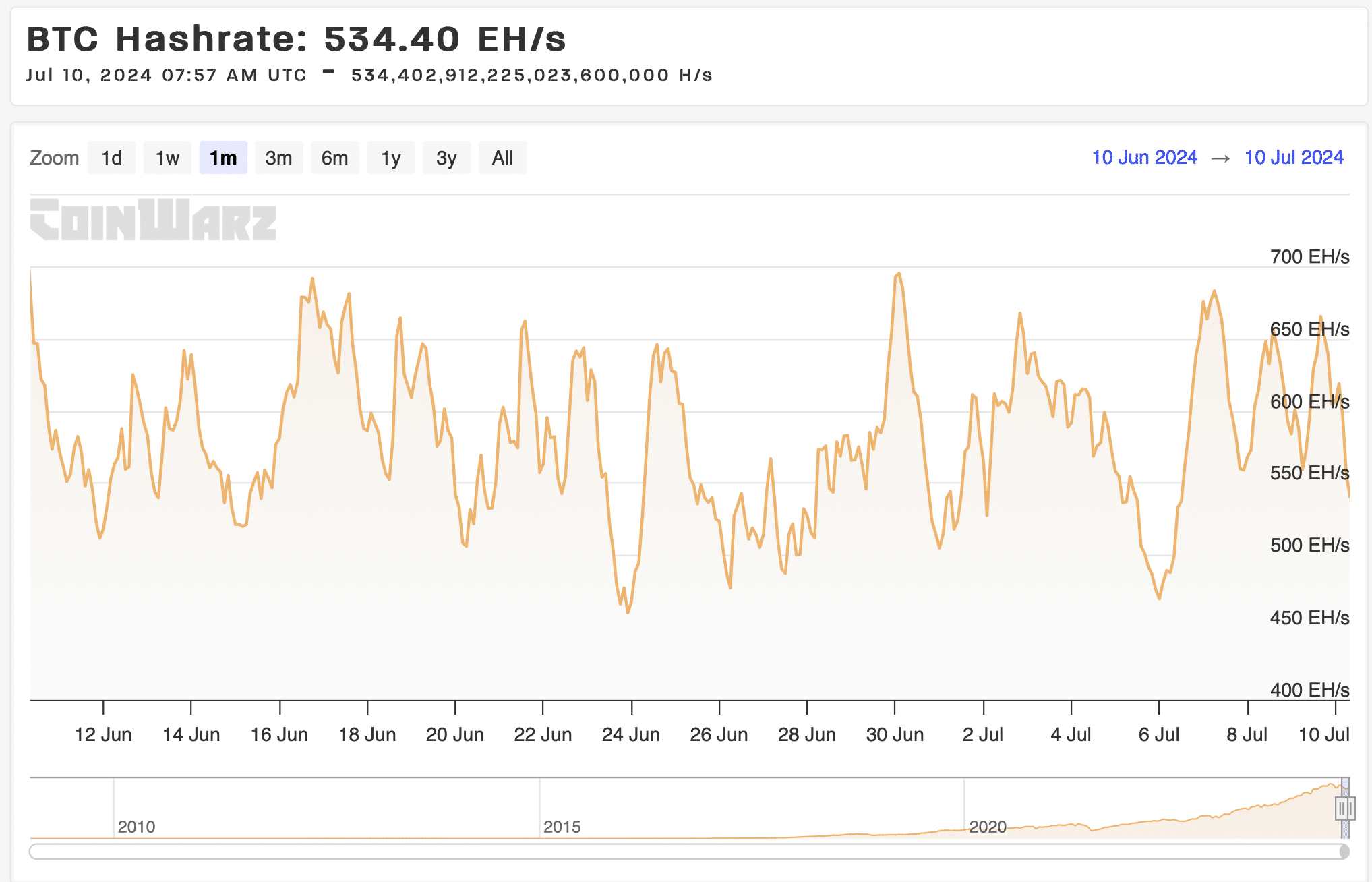

Amid the continued miner capitulation, the Bitcoin community’s complete computational energy or hashrate has not too long ago decreased to 540 exahashes per second (EH/s) from a peak of 751 EH/s in April, in keeping with CoinWarz information.

Supply: CoinWarz

This decline signifies that a number of miners are turning off their gear, seemingly as a result of profitability challenges.

CryptoQuant has noticed that vital drops in hashrate have traditionally aligned with market bottoms, suggesting that these might be indicative of turning factors in market dynamics.

Supply: CryptoQuant

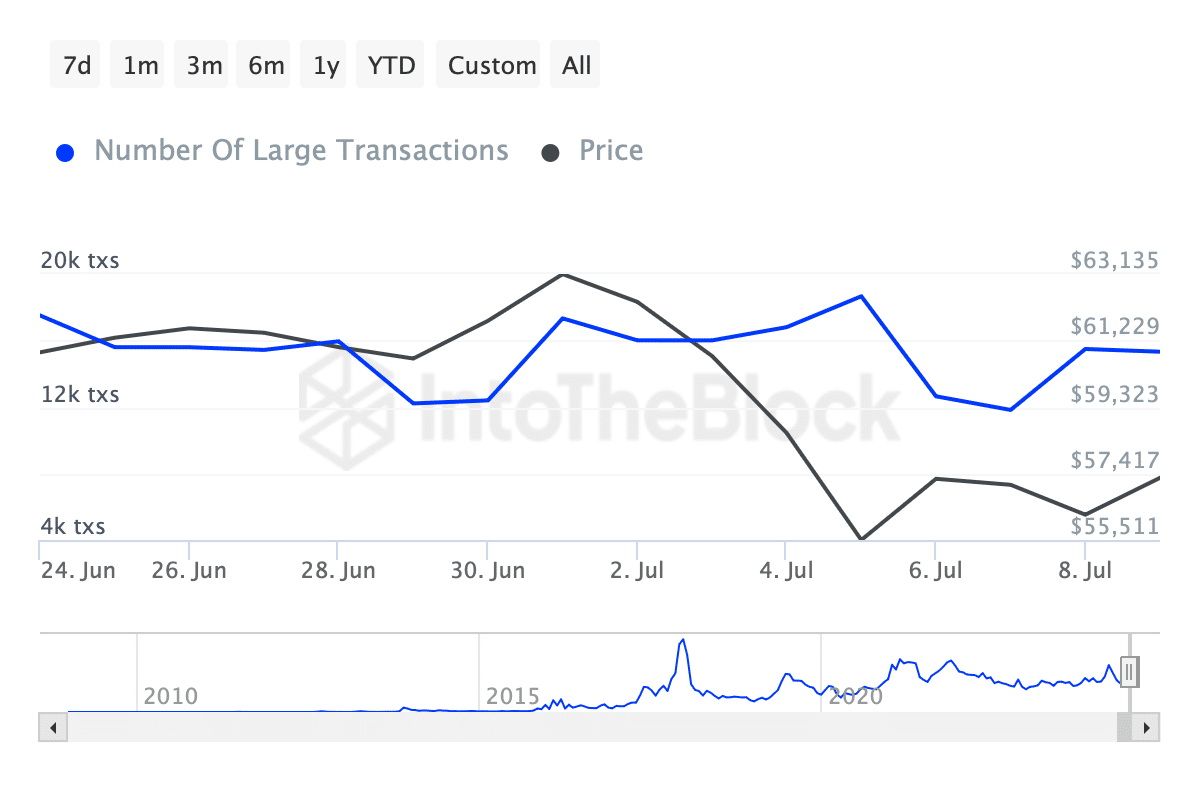

Moreover, transaction information from IntoTheBlock exhibits a waning whale curiosity. Significantly, the variety of Bitcoin transactions exceeding $100,000 has fluctuated alongside the value, reflecting the market’s volatility.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

At present, this metric has decreased to fifteen,330 transactions from over 17,000 in late June, underscoring the cautious stance many large-scale merchants and traders are taking.

Supply: IntoTheBlock

No matter all of those, AMBCrypto has not too long ago reported that there’s nonetheless a 25% chance of Bitcoin hitting a brand new all-time excessive (ATH) this yr.