- Bitcoin miners noticed a decline of their balances, dropping to round 1.799 million BTC in September.

- Regardless of volatility, Bitcoin miners’ income remained secure, with a slight improve to round 2.5%.

Bitcoin [BTC] miners skilled combined efficiency in September as Bitcoin’s value confirmed vital volatility. Regardless of holding onto their BTC, miners noticed a decline in income in comparison with August.

Bitcoin miners’ balances decline

In September, Bitcoin Miners’ balances step by step decreased. Firstly of the month, the full stability was round 1.802 million BTC, nevertheless it had dropped to 1.801 million BTC by the top of the month.

This slight improve from a mid-month low of 1.800 million BTC mirrored a short upward development.

Supply: Glassnode

Nonetheless, as of this writing, the miners’ stability has declined additional to roughly 1.799 million BTC, per information from Glassnode. This degree is just like the place it stood in July when miners skilled a notable drop.

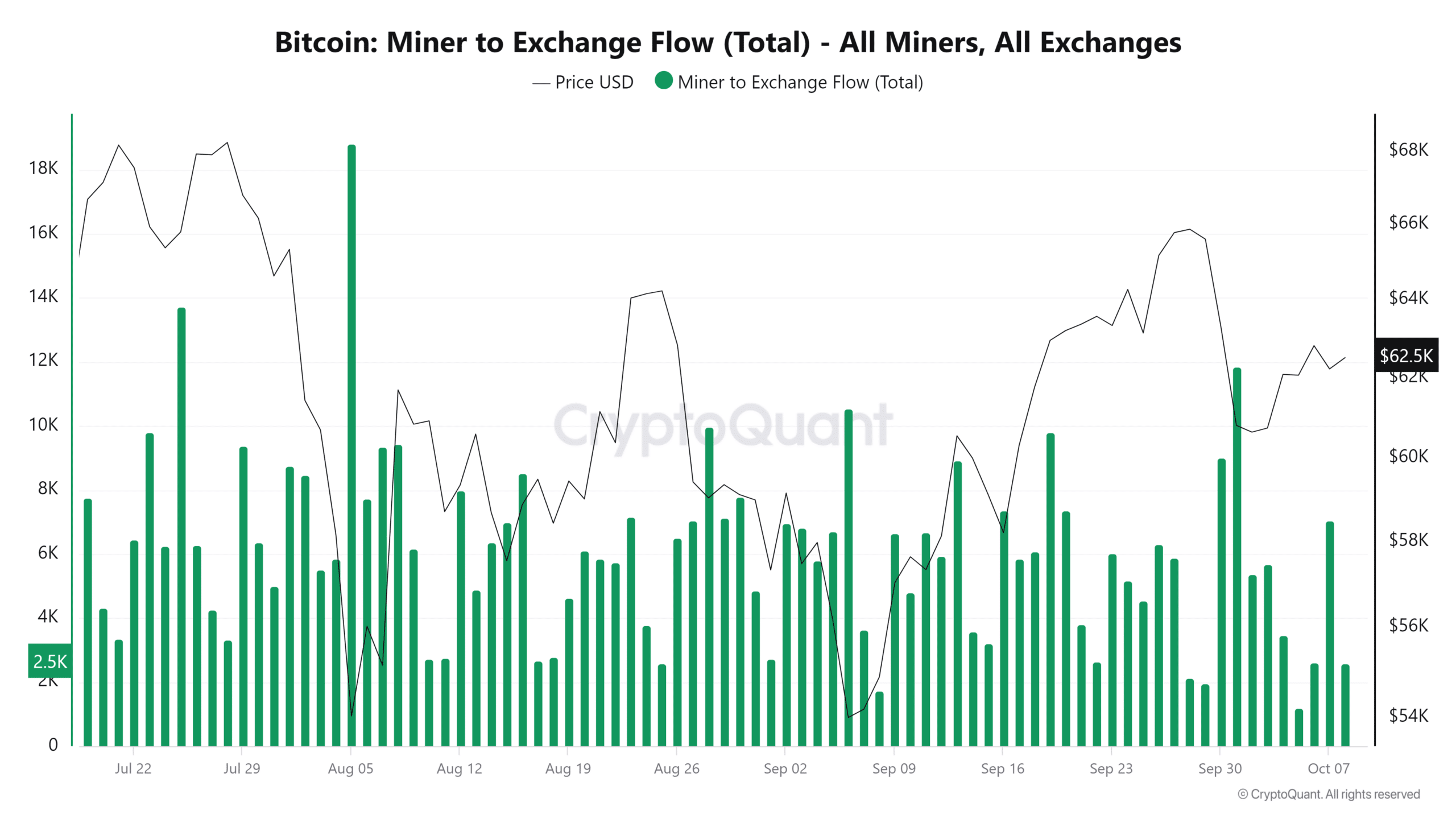

Fewer holdings moved to exchanges

Regardless of Bitcoin’s value volatility in September, miners moved fewer holdings to exchanges in comparison with August. Whereas there have been transfers, they have been notably decrease than the earlier month.

The most important single switch in September was 11,842 BTC, in comparison with over 18,000 BTC moved in August.

Supply: CryptoQuant

Moreover, Bitcoin Miners’ income metrics for the previous month confirmed no vital spikes or declines.

Although there have been small fluctuations, income elevated by as much as 2.5% on sure days, which was far much less dramatic than the 18% spikes seen in August.

The lowest level in miners’ income throughout September was round 1.2%; as of this writing, income has stabilized at round 2.5%.

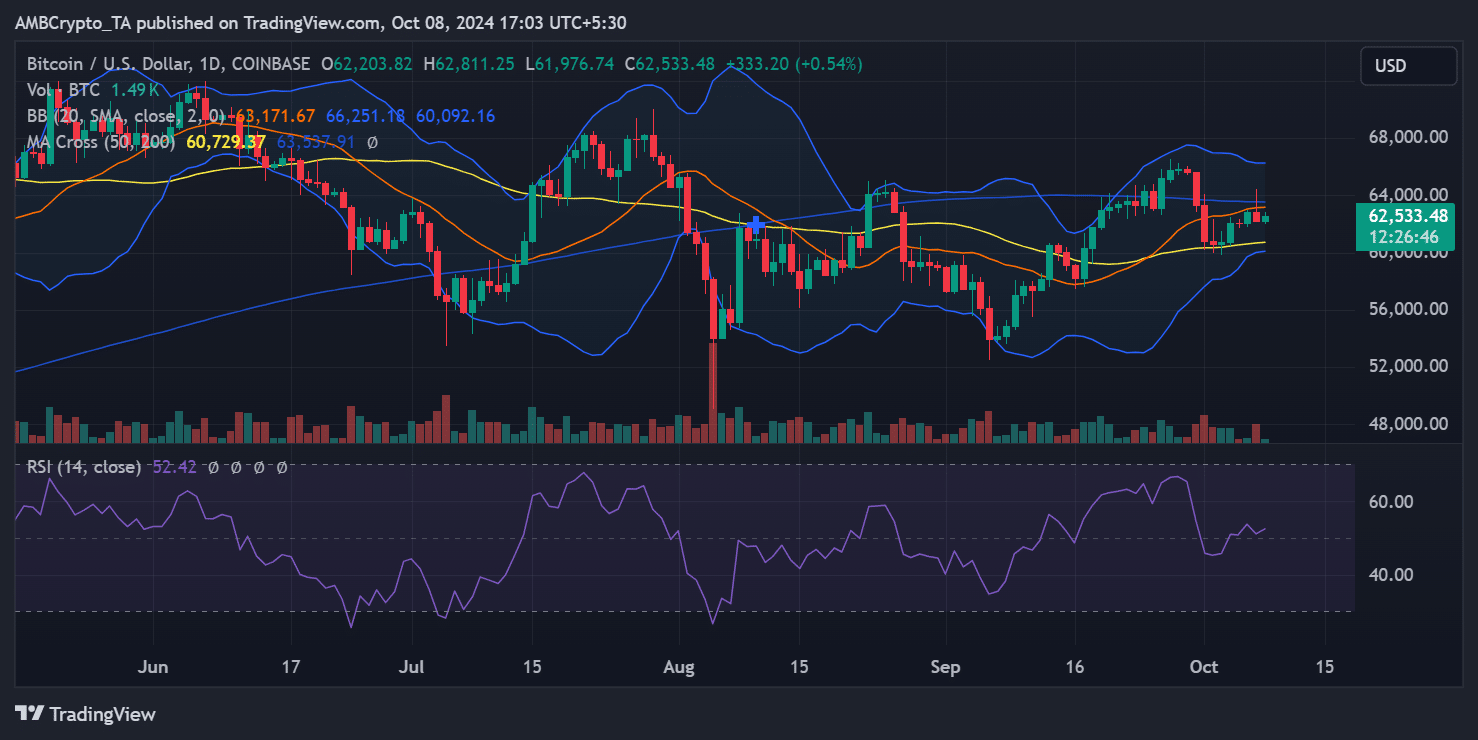

Bitcoin stays risky

Bitcoin’s value volatility continued into October. The extremely anticipated “Uptober” development has but to totally materialize, because the day by day value chart exhibits Bitcoin struggling to get better after early-month declines.

A Bollinger Bands evaluation signifies that value swings are nonetheless large, signaling continued volatility.

This ongoing volatility might imply that Bitcoin Miners will proceed to expertise combined metrics within the coming weeks.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

As of now, Bitcoin is buying and selling at round $62,480, displaying a slight improve of lower than 1%. Its 50-day shifting common serves as a strong help degree, whereas its 200-day shifting common at $63,700 stays a resistance level.

Miners have confronted a mix of declining balances and comparatively secure revenues amidst value volatility. With Bitcoin’s continued unpredictability, miners might even see fluctuating efficiency within the close to time period.