- Bitcoin miners face a dilemma as they incurred their lowest mining rewards within the month of August, squeezing their income.

- Nonetheless, a strategic strategy might assist them navigate these challenges.

Bitcoin [BTC] confronted a unstable finish to August, with its value fluctuating inside a particular vary between $64,000 and $57,000. On the time of writing, Bitcoin was valued at $58,385.

As bulls try to breach the $64K barrier, Bitcoin miners are going through their lowest earnings of the yr, marking the worst efficiency in 11 months.

Consequently, AMBCrypto investigated whether or not this sharp drop in BTC rewards would possibly drive miners to exit the commerce.

August brings Bitcoin miners’ lowest income

In August, Bitcoin miners recorded their lowest revenue-generating month since September 2023, with the variety of mined cash dropping considerably.

Moreover, mining incurs excessive operational prices for Bitcoin miners. If the rewards fail to cowl these bills, miners might face capitulation.

In response to AMBCrypto’ evaluation of the chart under, miner income fell to $820 million in August, marking a decline of over 10% from July’s $927 million.

Supply : BitBo

Apparently, this August determine represents a 57% lower from the height of practically $1.93 billion in March, the identical month Bitcoin reached its ATH of over $73K.

This confirmed an enormous drop in mining income regardless of Bitcoin’s excessive value earlier within the yr – However why? AMBCrypto investigated.

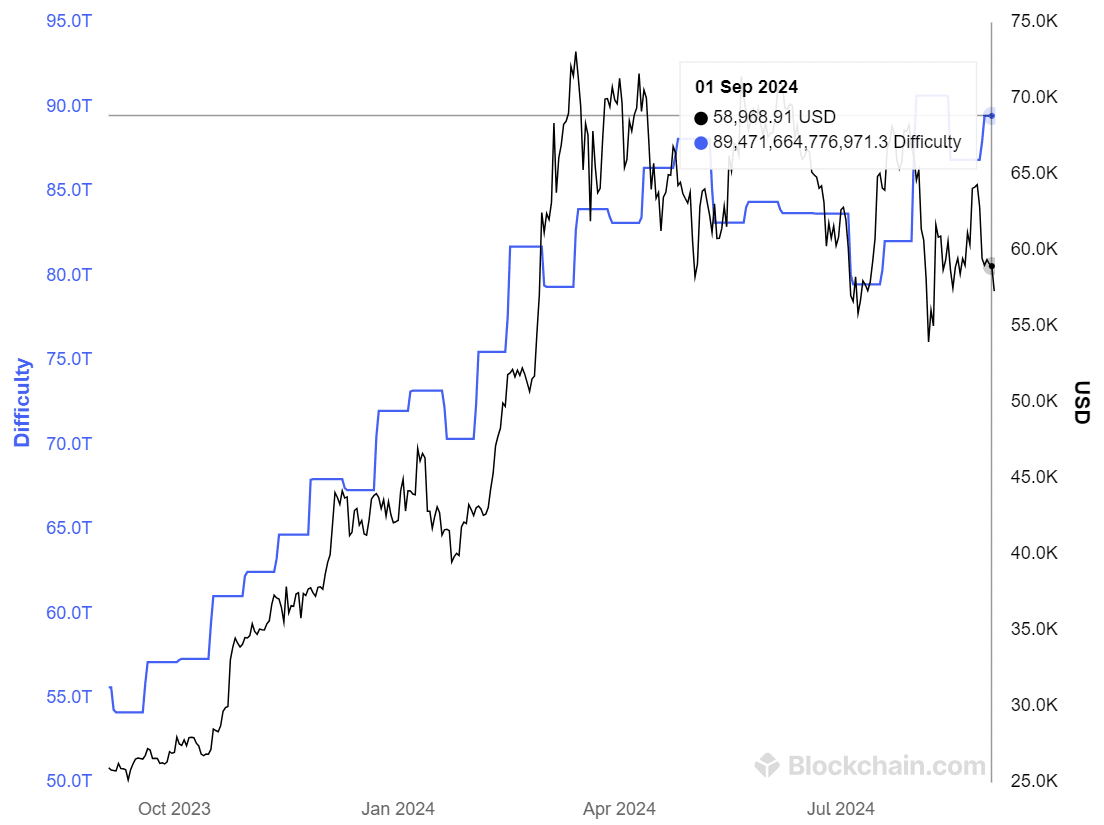

Following the final BTC halving in April, which decreased block rewards to three.125 BTC per block, mining problem elevated sharply.

Supply : Blockchain.com

In consequence, mining problem surged to an all-time excessive of 89.47 trillion in August, up 3% from 86.87 trillion in July.

With extra Bitcoin miners becoming a member of the community, validating transactions grew to become tougher, decreasing the variety of cash mined and the income earned.

In brief, this indicated that rising mining problem, pushed by the Bitcoin halving, has considerably squeezed miners’ profitability. So, are Bitcoin miners exiting the commerce?

Miners strategic positioning counters short-term volatility

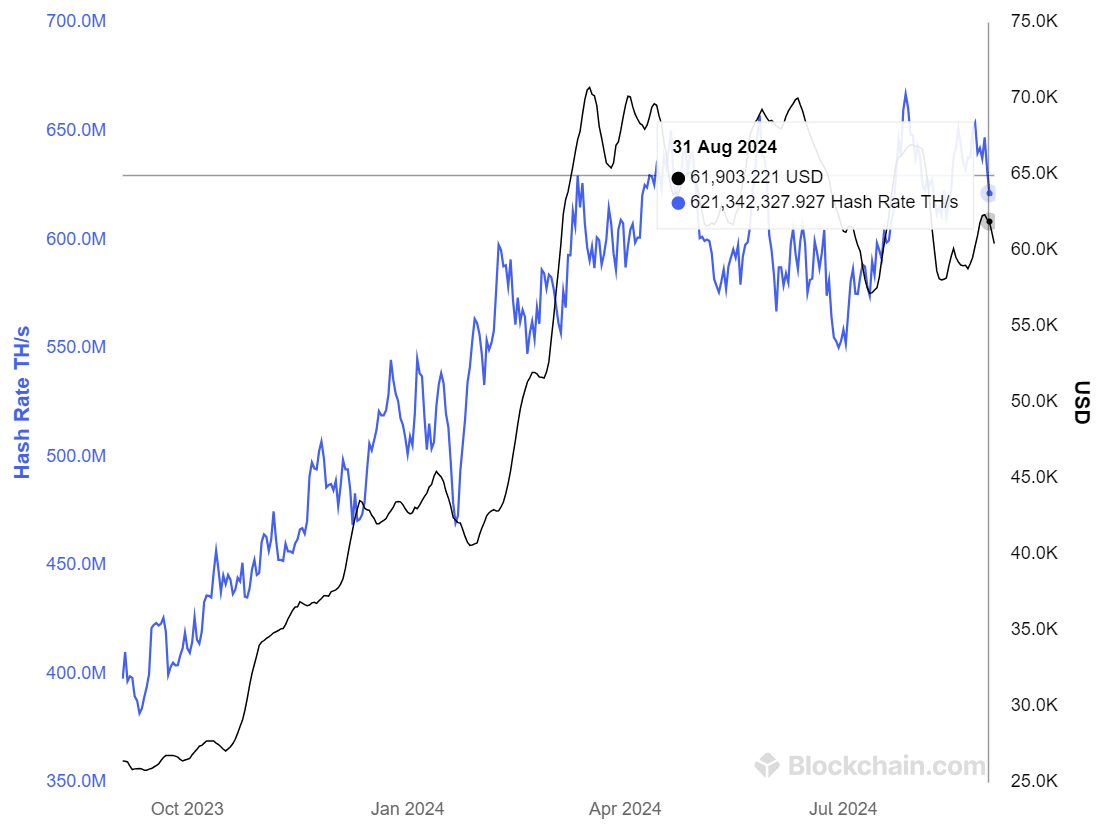

Put merely, the hash fee measures the entire computational energy getting used to mine and course of transactions on the Bitcoin community.

If this determine drops considerably, it may be an indicator that miners are leaving the community.

Supply : Blockchain.com

The chart above revealed a putting development. Apparently, at any time when BTC examined an important resistance stage, the hash fee additionally jumped.

In response to AMBCrypto, this urged that miners have been extra engaged or optimistic about potential value actions.

Nonetheless, the hash fee has absorbed a notable decline because the final week of July, falling from 667 million to 620 million, a drop of seven%.

Whereas not excessive, it urged that miners are reacting to altering circumstances, probably on account of decrease rewards.

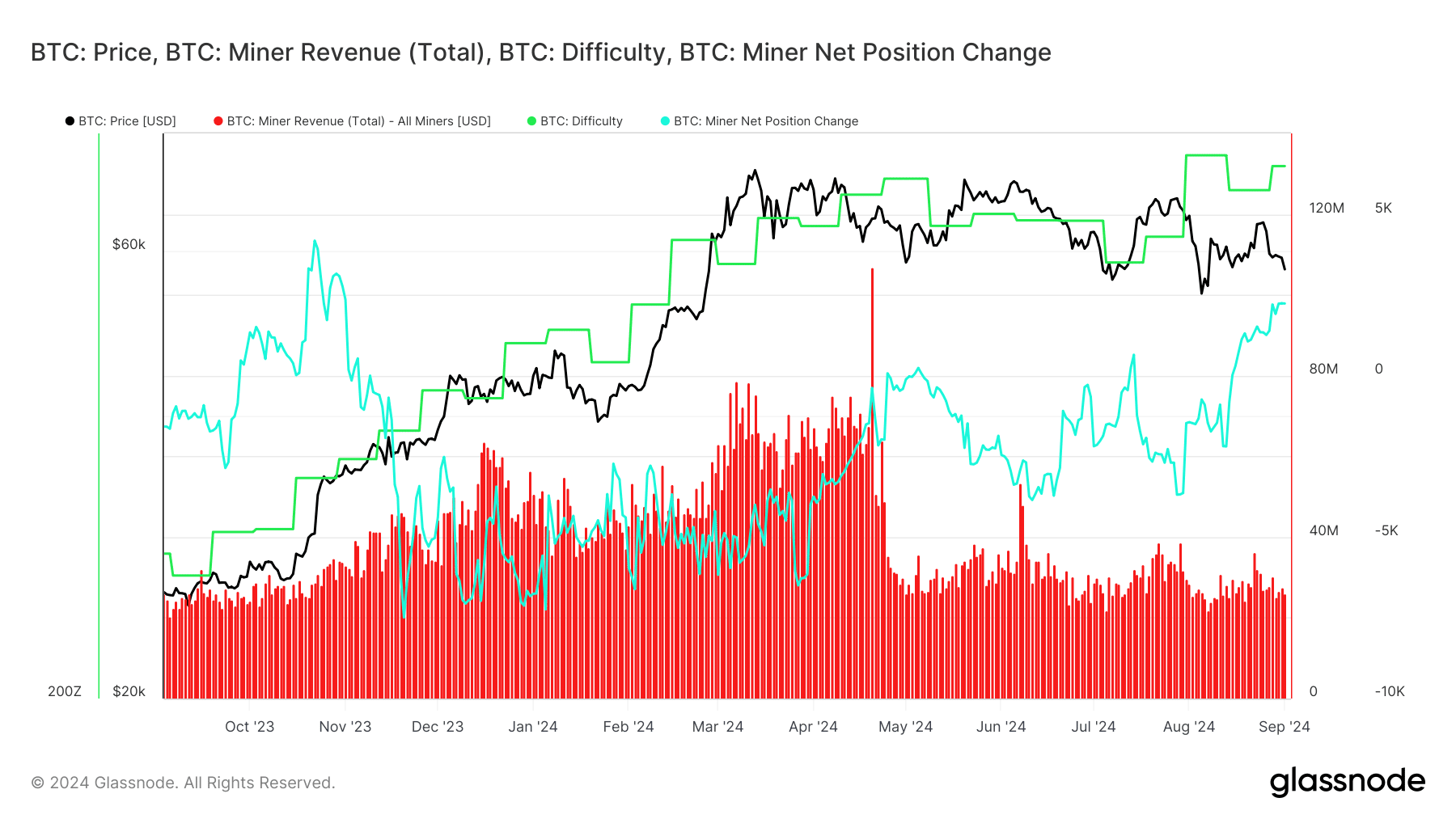

Nonetheless, the BTC miner web place change has shifted to optimistic since mid-August, regardless of decreased miner rewards.

Supply : Glassnode

This indicated that, although miner rewards have decreased, miners have begun accumulating extra Bitcoin somewhat than promoting it.

Moreover, AMBCrypto famous that miners may be strategically positioning themselves by accumulating BTC when costs are comparatively low.

Learn Bitcoin’s [BTC] Value prediction 2024-25

Total, regardless of squeezed profitability, miners stay assured in Bitcoin’s long-term positive factors as highlighted by the optimistic web change.

Nonetheless, this confidence might result in elevated mining problem in the long term, probably inflicting miner rewards to plunge additional.