- Bitcoin miners exiting the cycle might sign a market backside, paving the way in which for recent curiosity

- And but, particular circumstances should align for a confirmed bull rally

Every week of bearish downturn noticed Bitcoin [BTC] fall beneath $61k from its earlier $65k resistance. Nevertheless, at press time, optimism gave the impression to be brewing available in the market, with the crypto valued at near $62k.

The second week of This autumn would possibly see a worth correction although, particularly as profit-takers money in on their good points and exit the cycle. Amongst them are miners who’ve been capitulating as BTC nears $62K.

Nevertheless, except the underside is absolutely exhausted, it is likely to be laborious for bulls to set off a sustained rally.

Miners’ exit might trace at a market backside

On the each day worth chart , BTC’s weekly motion mirrored mid-August’s worth motion when a rejection close to $65k halted a possible bull run.

Throughout that point, miners exited the cycle after 5 consecutive days of downward strain, with their holdings dropping from 1.817M to 1.814M.

Supply : CryptoQuant

An analogous development was seen just lately too. Over the previous week, as Bitcoin retraced from $65k to $60k, miner reserves famous a big decline, dropping from 1.814M to 1.811M at press time.

Sometimes, the departure of weaker traders usually results in a extra secure market, permitting stronger fingers to build up positions at favorable costs.

If this development holds, miners breaking even might sign a market backside. As weak fingers exit to lock in earnings, it may current new consumers with preferrred dip-buying alternatives.

Nevertheless, as famous earlier, for a bullish cycle to start, flipping $61k into assist is essential. Whereas miner exits may also help verify this assist, different circumstances should additionally align.

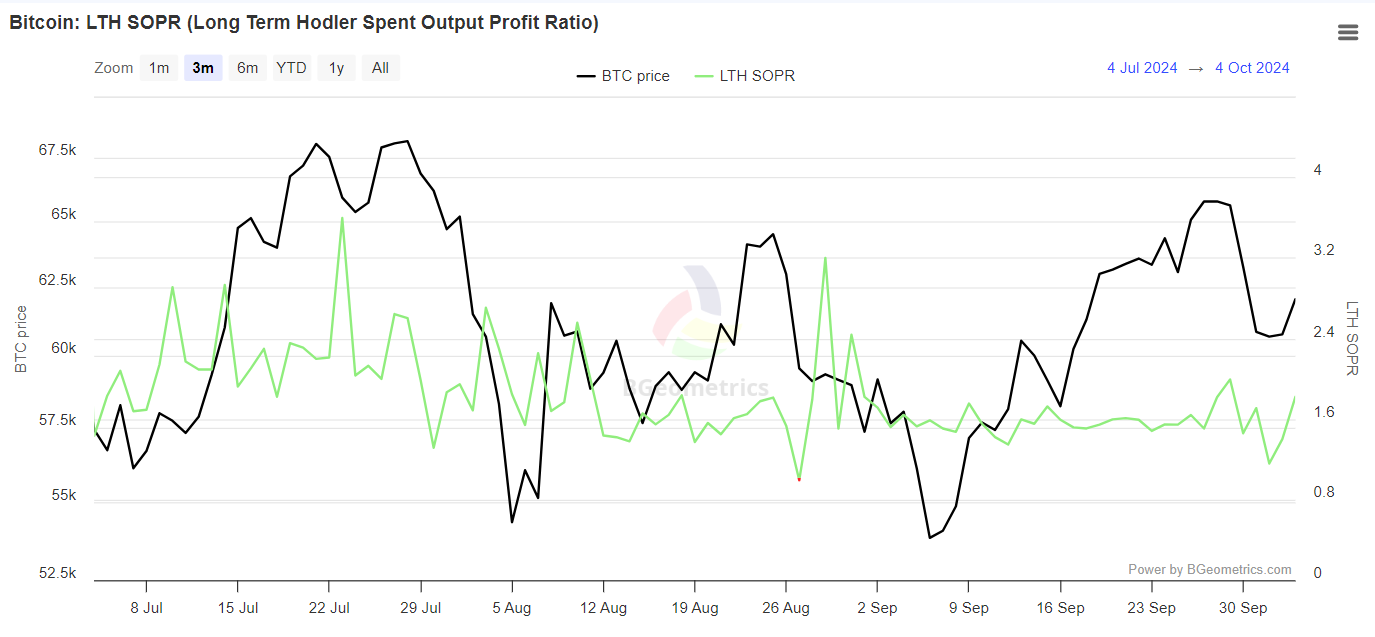

LTHs have faith in Bitcoin bulls

Not like miners capitulating to chop their losses earlier than the market dips additional, holders with Bitcoin for greater than 155 days look like promoting at revenue.

The LTH SOPR just lately made a better excessive. Traditionally, such actions have pushed positions into FOMO and fueled expectations for future good points within the subsequent cycle.

Supply : BGeometrics

If LTHs keep away from panic promoting – which appears probably – a near-term worth correction would possibly take maintain. This might permit the $61k resistance to flip into assist, with bulls then concentrating on the subsequent resistance at $64k.

Briefly, Bitcoin’s drop from $65k to $60k was key in shaking off weak fingers, establishing $61k as the subsequent assist stage.

This decline filtered out much less dedicated traders, permitting stronger holders to accumulate positions.

Nevertheless, whereas the figures indicated a stable basis, AMBCrypto investigated additional to find out if the latest rally was real or only a brief squeeze.

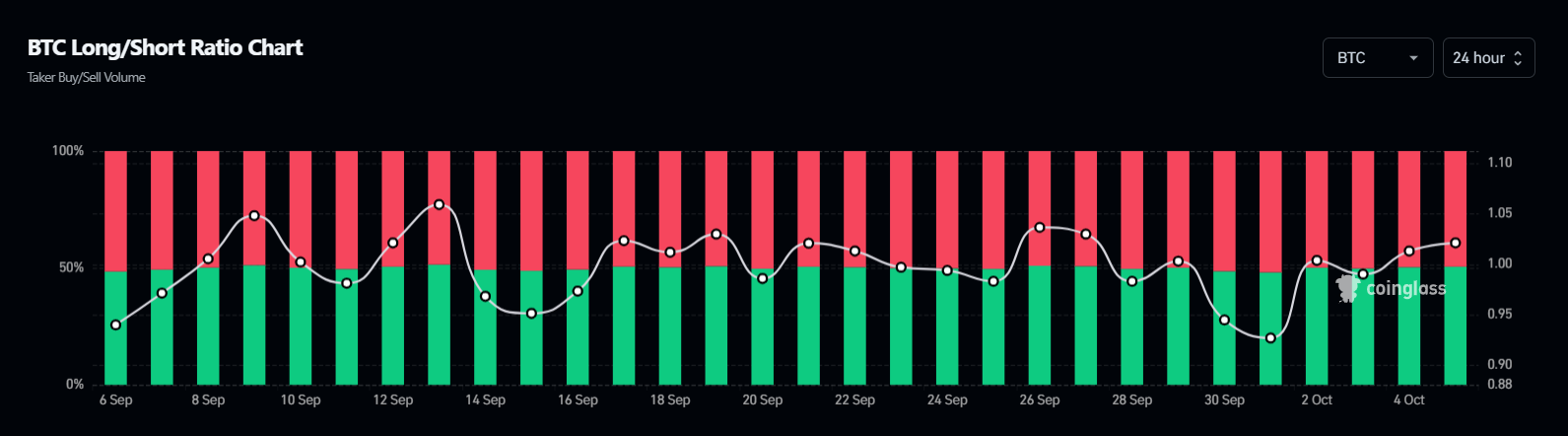

BTC longs are regaining management

Over the previous 4 days, lengthy positions have regained dominance within the by-product market, stopping brief sellers from successfully shorting Bitcoin.

Supply : Coinglass

Whereas it is a bullish signal, it additionally implies that the inflow of lengthy positions has put strain on shorts, resulting in important liquidations.

Due to this fact, this doesn’t fully rule out a short-squeeze situation however may function an entry level for a bullish reversal, producing pleasure amongst consumers.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

General, with $61k confirmed as assist and renewed optimism from lengthy positions, bulls are prone to maintain $62k subsequent, which may result in a rally in the direction of $64K.

Nevertheless, for this to materialize, intently monitoring brief sellers is crucial.