- Miners offered over $13B BTC within the first half of December.

- Per Puell A number of, BTC wasn’t overvalued or in a purple zone but.

Bitcoin [BTC] miners have intensified promoting because the cryptocurrency crossed the $100K milestone. In December alone, miners offered 140K BTC, value $13.72B.

Per Santiment information, the dumping spree has shrunk the miner stability from over 2M to 1.95M cash as of this writing.

Supply: Santiment

BTC regular above $100K

Regardless of the aggressive sell-off, the king coin remained resilient above $100K.

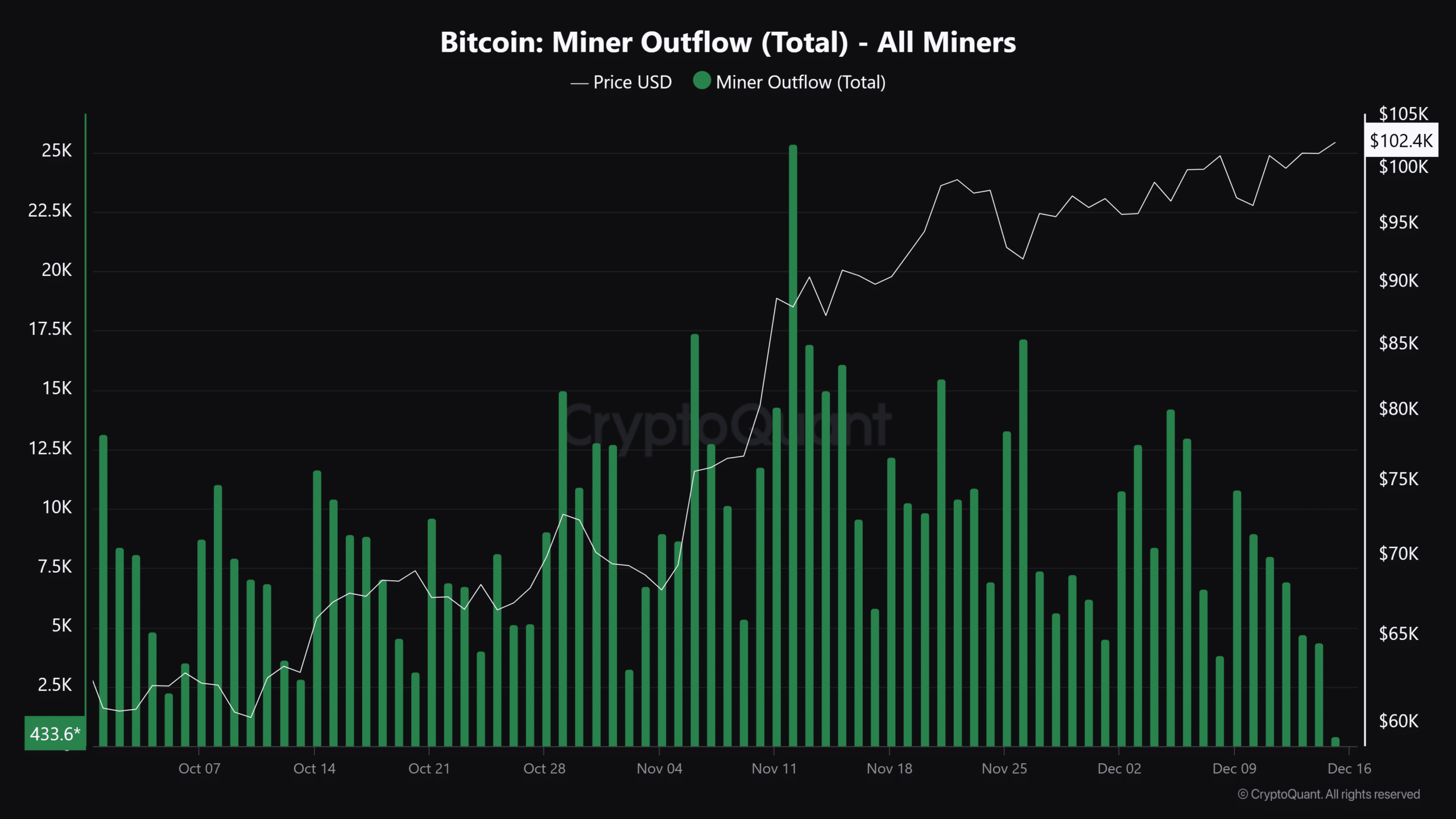

Nevertheless, the miner sell-off appeared comparatively much less intense when gauged by miner outflow. The metric tracks all miner wallets and their transfers to exchanges.

On the twelfth of November, BTC noticed the best every day miner sell-off of 25K BTC. However the stress has been on the decline, as proven by the retreating miner outflows.

Supply: CryptoQuant

Maybe, the majority of the sell-off may need occurred over the OTC (Over The Counter) markets.

That mentioned, the general December sell-off barely overwhelmed the demand from ETFs. Up to now two weeks, BTC ETFs logged $4.9B inflows. Over the identical interval, MicroStrategy purchased $3.6 billion value of BTC.

Excluding Mara {Digital} and different companies with BTC company treasuries, ETFs and MicroStrategy’s BTC demand hit $8.3B prior to now two weeks. This was barely lower than the $13.72B provide from miners.

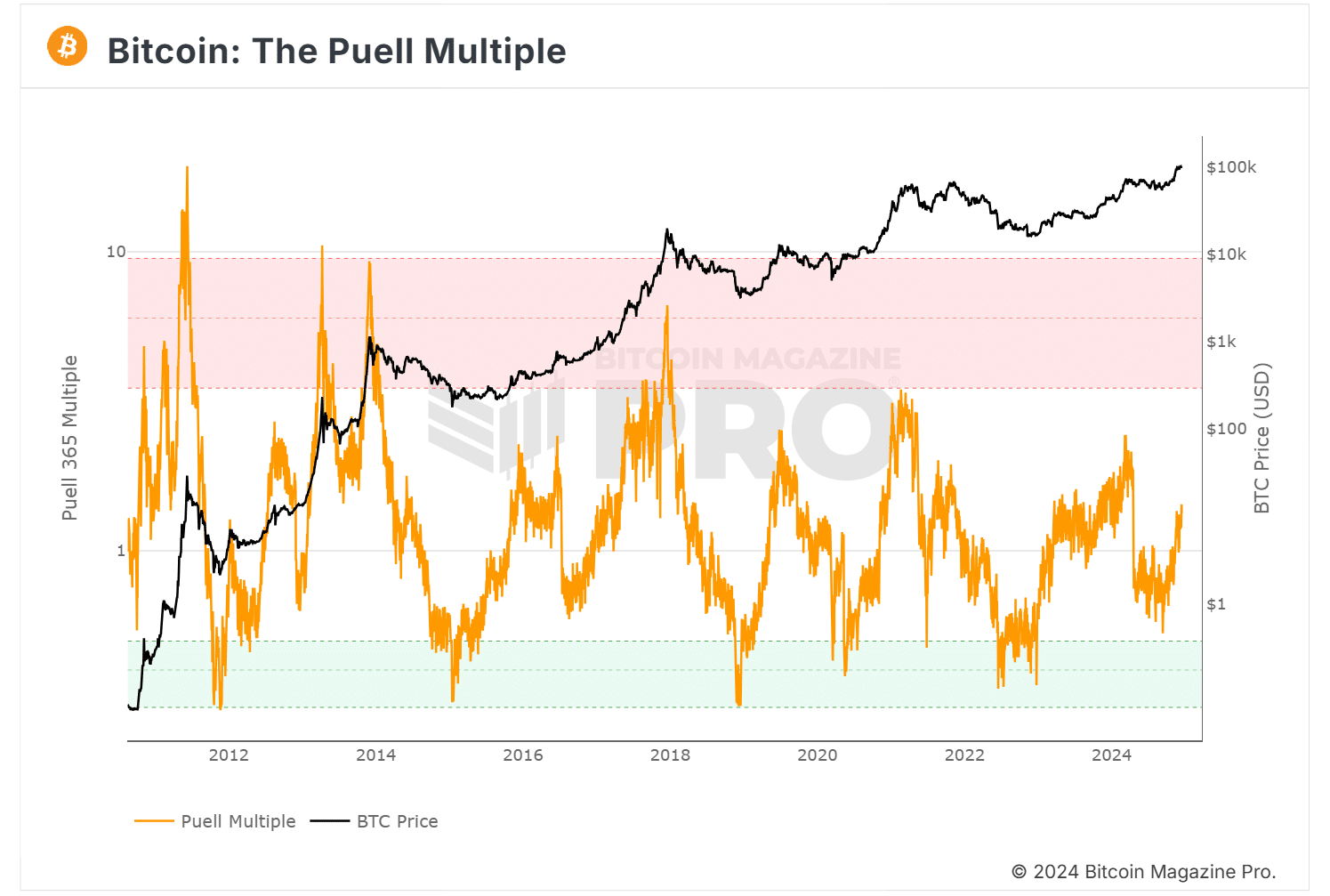

So, ought to intense miner promoting be a priority in your portfolio? We checked the Puell A number of for insights.

For the unfamiliar, Puell A number of permits customers to gauge BTC valuation and cycles from the angle of miners. If the metric soars to the higher band, BTC’s worth is deemed as unsustainably excessive.

On the flipside, a low Puell A number of studying suggests a comparatively undervalued BTC.

Supply: BM Professional

In early 2024, the metric hit 2.4 and marked an area BTC prime at $73.7K. At press time, the metric studying was 1.3 and had little room earlier than cross 2 or the higher band.

So, primarily based on Puell A number of and miners’ perspective, BTC wasn’t overvalued or elevated, however that would change if the metric soared above 2.

Within the meantime, BTC consolidated beneath $102K forward of the Fed charge determination on the 18th of December.