- BTC miner reserves have been shrinking, signaling promoting strain at the same time as Bitcoin value trended upward.

- Bitcoin’s Hash Fee remained excessive, however declining reserves recommend miners are unsure about future costs.

Bitcoin [BTC] Miner Reserves have been shrinking since mid-2024, signaling elevated promoting strain at the same time as costs proceed to rise.

In the meantime, market information from CryptoQuant prompt that miners have been offloading Bitcoin, elevating questions on whether or not this pattern may set off a value correction or arrange the subsequent rally.

Bitcoin Miner Reserves have adopted a downward pattern, with many miners promoting extra BTC as an alternative of holding.

The decline doubtless signifies profit-taking, with miners capitalizing on rising costs. Moreover, some could also be promoting to cowl operational bills or mitigate monetary dangers.

Supply: CryptoQuant

Though Bitcoin’s value rallied on the finish of 2024 and early 2025, reserves have stayed low, indicating miners proceed promoting into energy somewhat than accumulating.

Lately, reserves have moved sideways, suggesting some miners is perhaps ready for extra favorable value situations earlier than making further strikes.

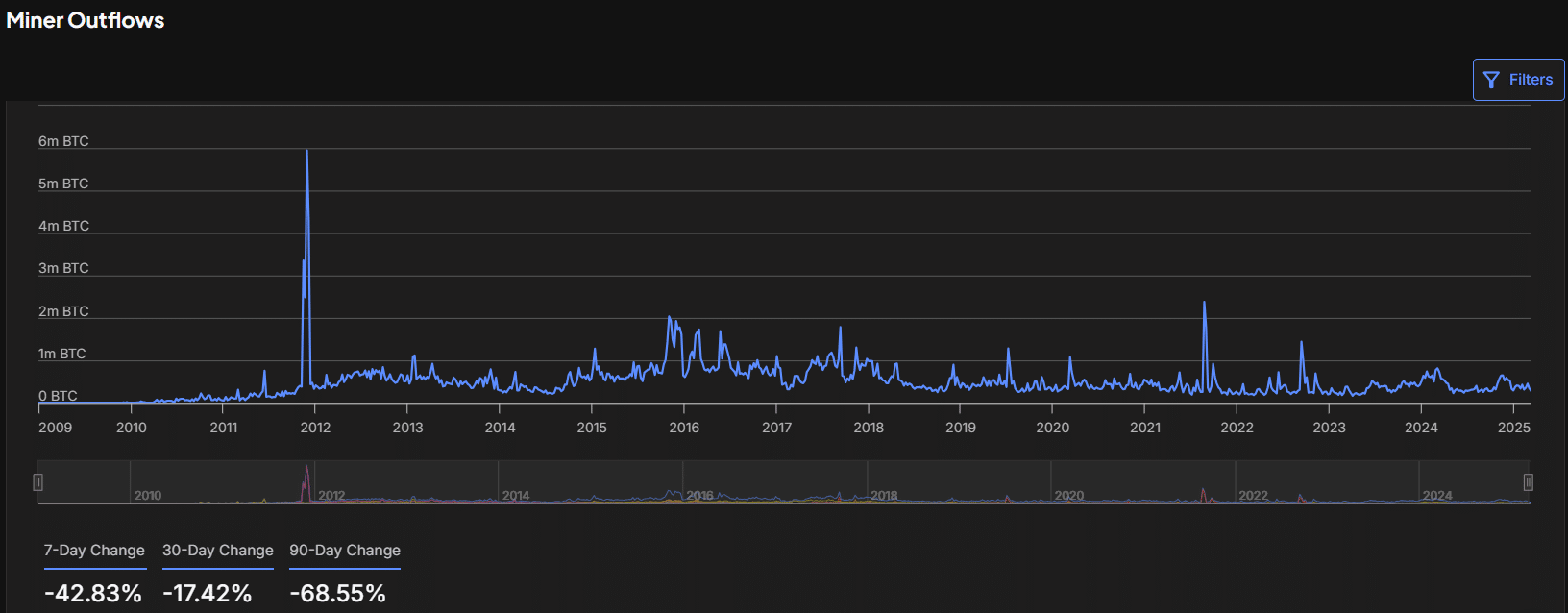

Miner outflows drop sharply

Current information from IntoTheBlock revealed a pointy decline in miner outflows over the previous few months.

During the last seven days, miner outflows fell by 42.83%, by 17.42% over 30 days, and by 68.55% over 90 days. This means a big discount in promoting strain in comparison with earlier months.

Historic tendencies present that giant miner outflows have coincided with key Bitcoin cycles. Notable spikes embrace early 2012, with over 5 million BTC, adopted by smaller peaks in 2016, 2021, and 2022.

Since 2023, miner outflows have proven a gradual decline, stabilizing at decrease ranges over the long run.

Supply: IntoTheBlock

A sustained drop in outflows might point out that miners are holding onto BTC, anticipating increased costs.

Alternatively, decrease outflows may additionally imply that fewer new Bitcoins are getting into the market resulting from diminished block rewards.

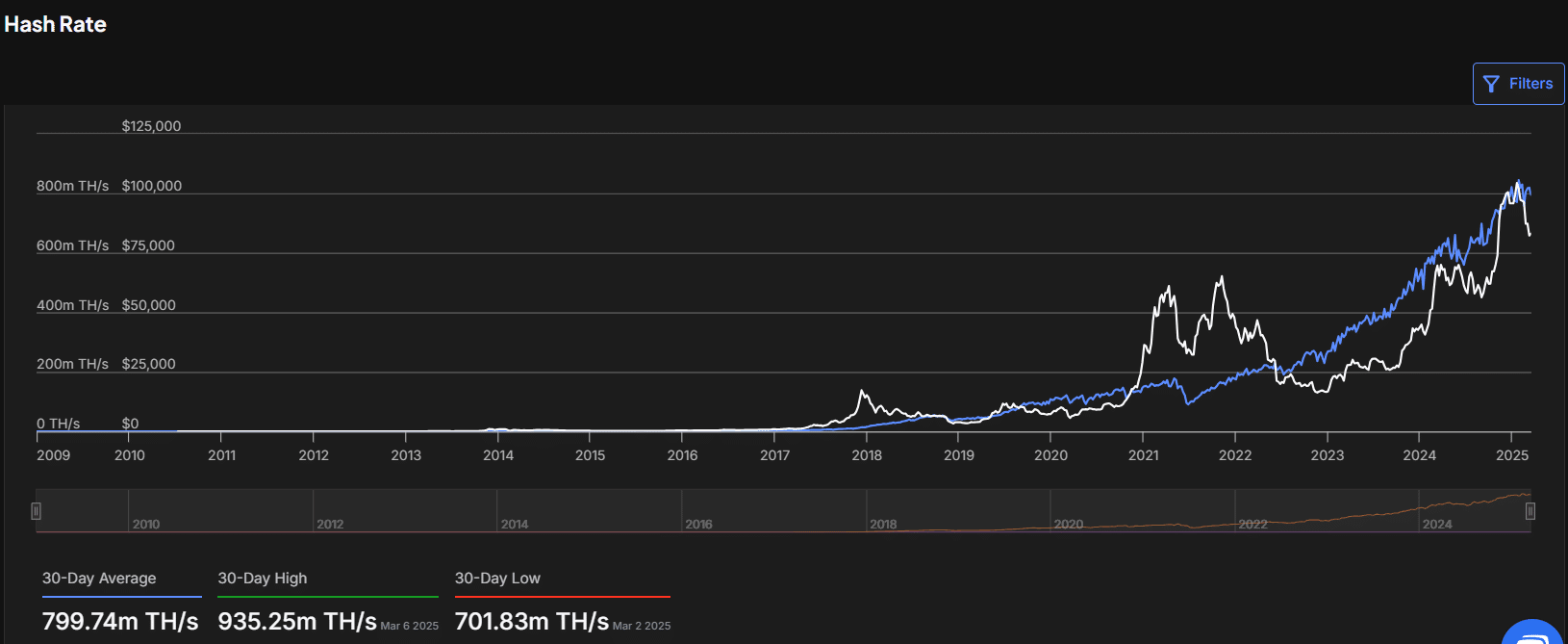

Hash Fee tendencies and mining exercise

On the time of writing, Bitcoin’s 30-Day Common Hash Fee stood at 799.74 million TH/s, with a excessive of 935.25 million TH/s on the sixth of March 2025, and a low of 701.83 million TH/s on the 2nd of March 2025. The rising Hash Fee displays robust mining participation and community safety.

The Hash Fee has traditionally adopted Bitcoin’s value, with main surges in 2021, 2024, and early 2025. Nonetheless, latest declines may point out miner capitulation or short-term changes in mining issue.

Regardless of this, the general pattern stays upward, reflecting continued community energy.

Supply:IntoTheBlock

Market watching miners’ conduct carefully

At press time, Bitcoin was buying and selling at $83,163.55, with a 24-hour quantity of $23.21 billion. The value has elevated 0.37% within the final 24 hours and a pair of.12% prior to now week.

With miner reserves at decrease ranges and outflows declining, traders are carefully monitoring whether or not miners will proceed promoting or holding their BTC.

In brief, if reserves begin rising, it may point out confidence in future value progress. Nonetheless, if promoting resumes, Bitcoin might face renewed downward strain.