- The Bitcoin miner capitulation might ease the promoting strain on Bitcoin from miners.

- Metrics supported the concept Bitcoin costs would have a bullish trajectory within the coming weeks.

Bitcoin [BTC] miner capitulation was gathering power and was akin to 2022 December.

Julio Moreno, head of analysis at CryptoQuant, famous in a submit on X (previously Twitter) that the hash price drawdown was at 7.6%.

It should be famous that costs aren’t down instantly on account of this hash price plunge.

Somewhat, the results of the halving and the market sentiment, in addition to the miner money necessities to improve their tools and stay aggressive, are some components that noticed Bitcoin falter from $71k to $60k in June.

The Bitcoin miner capitulation may be excellent news

Supply: Julio Moreno on X

The idea of Bitcoin miner capitulation is tied carefully to the hash price of the Bitcoin community. The hash price refers back to the computational energy of BTC miners, and it stood at 537.15 EH/s at press time.

The hash price drawdown chart mirrored a 7.6% drop, which was akin to the drop that got here after the FTX trade collapsed in November 2022 and market sentiment tanked additional in December 2022.

Supply: CryptoQuant

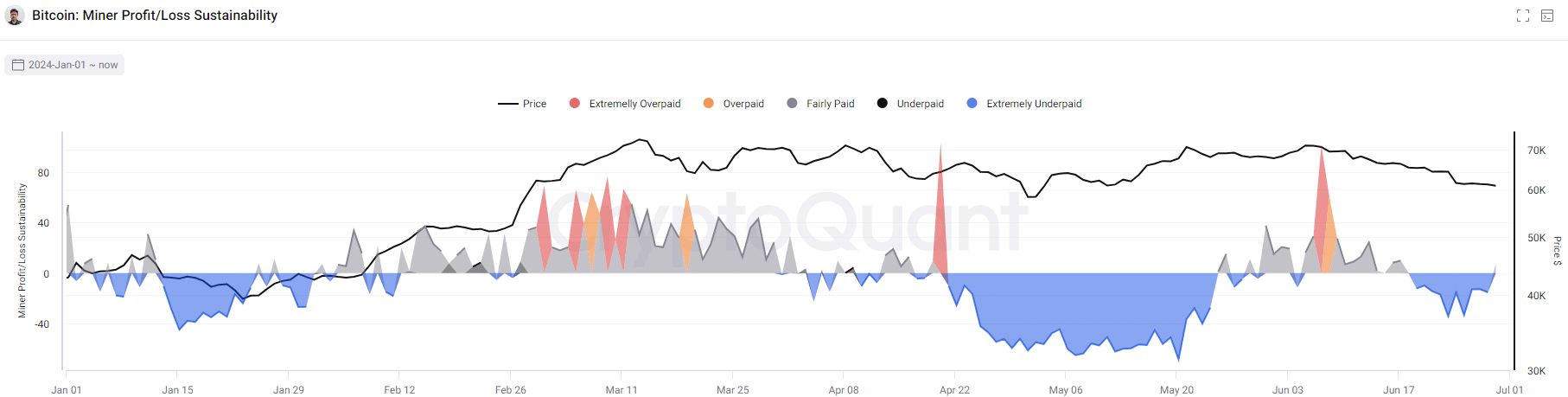

A take a look at the miner revenue/loss sustainability chart confirmed that miners had been extraordinarily overpaid in early June.

Two weeks later, they had been extraordinarily underpaid, as Bitcoin costs had dropped by 16.2% in that window.

At press time, the sustainability metric was crossing over from extraordinarily underpaid to pretty paid.

This metric’s motion into underpaid territory doesn’t instantly suggest an area backside, nevertheless it outlines that miners would possibly select to attend for higher costs earlier than promoting.

How heavy are the miner outflows in current weeks?

Supply: CryptoQuant

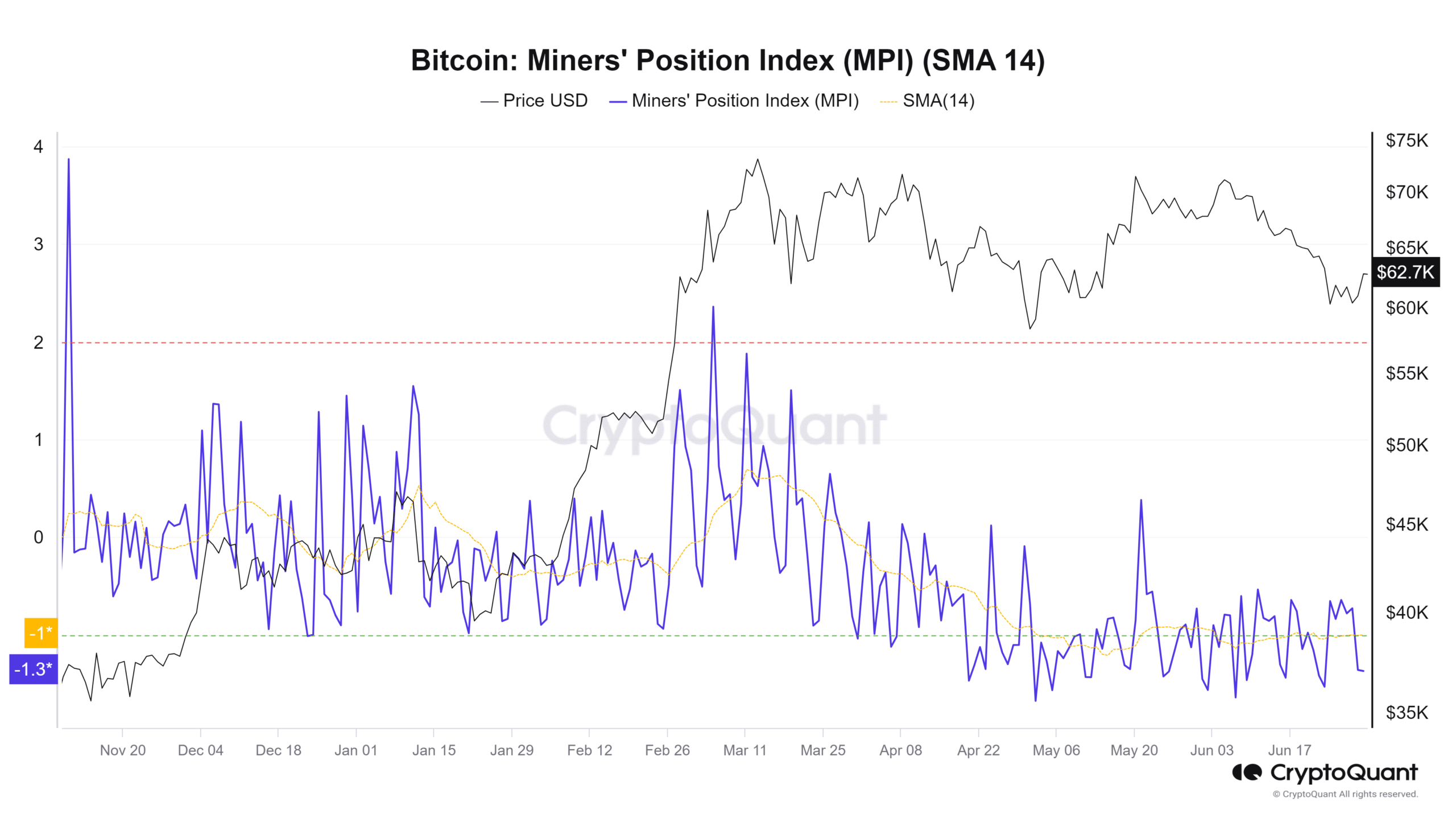

The Miners’ Place Index makes use of the 365-day shifting common of the miners’ USD outflows alongside present outflows to compute a ratio.

The ratio’s development reveals miner conduct, and whether or not they’re sending roughly Bitcoin to exchanges.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The info confirmed that miner outflows had been giant in February and March, fell barely in April and Could, and had been fairly subdued in June. Because of this miners are sending fewer cash than typical to exchanges.

Total, the hash price drop reinforces the concept of miner capitulation. The MPI findings present that miners have been liquidating fewer Bitcoin than typical, which was additionally a bullish signal within the long-term.