- Bitcoin’s restoration might rely on the exit of inefficient miners and the stabilization of the hash fee.

- Willy Woo hyperlinks present market developments with Bitcoin’s potential rebound post-halving and summer season market lulls.

Bitcoin’s [BTC] trajectory in 2024 has been marked by important volatility, Regardless of reaching an all-time excessive of $73,737 earlier within the 12 months, Bitcoin’s worth has considerably retreated, at present standing round $64,625.

This decline which is roughly 12.4% from its peak has sparked discussions amongst market analysts in regards to the potential for a rebound.

BTC to rebound quickly?

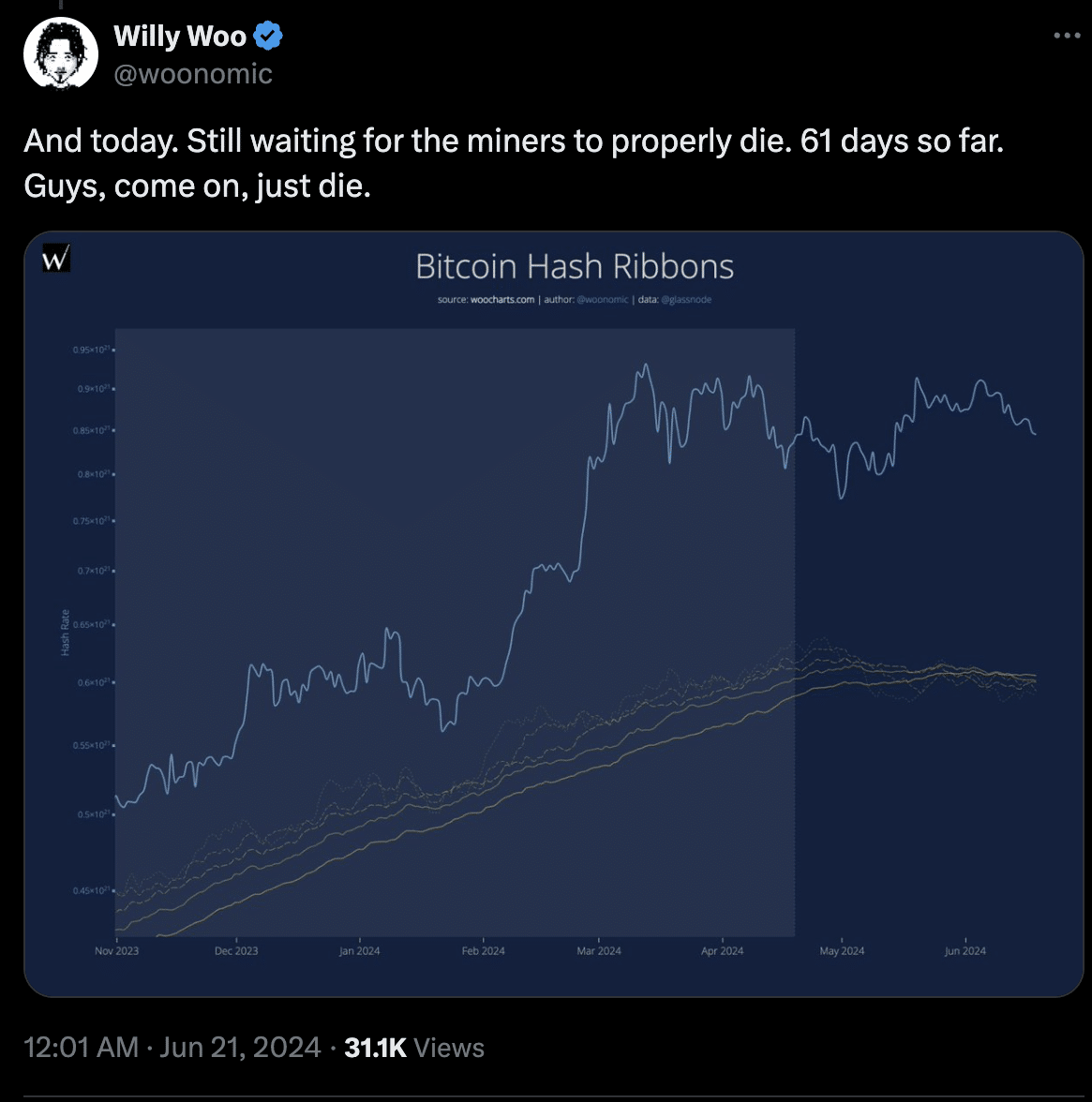

Willy Woo, a famend cryptocurrency analyst, took to social media, X, to focus on the pivotal components that may sign the start of Bitcoin’s restoration.

Central to Woo’s evaluation was the phenomenon of miner capitulation, which refers back to the exit of much less environment friendly miners from the market as a result of unprofitability.

In accordance with Woo, the value restoration for Bitcoin might begin as soon as these weaker miners have exited the market, permitting the hash fee—a measure of the whole computational energy utilized in mining and processing—to stabilize and recuperate.

Notably, miner capitulation happens when Bitcoin’s halving—a pre-programmed discount within the rewards given to Bitcoin miners—renders outdated {hardware} or high-cost operations unfeasible, pushing inefficient miners in direction of chapter.

As defined by Woo, this course of is painful however mandatory for the market’s long-term well being, because it purges inefficiencies and consolidates mining operations to extra succesful contributors.

These dynamics are crucial as they scale back the strain from fixed promoting by miners needing to cowl operational prices, doubtlessly paving the best way for value stabilization and subsequent will increase.

Supply: Willy Woo on X

Traditionally, post-halving intervals have been adopted by important value will increase after preliminary volatility. Woo attracts parallels with earlier cycles in 2017 and 2020, noting that present market situations mirror these earlier phases however with a delayed restoration.

Significantly, Woo defined that the restoration timeline can range, as seen in previous cycles.

For example, the 2017 restoration spanned 24 days in the course of the sluggish summer season months, a stark distinction to the 2020 restoration which lasted solely 8 days amidst the market chaos triggered by the COVID-19 pandemic.

Now, it’s been over two months (61 days) because the final halving, and the market remains to be awaiting the capitulation part’s completion, which Woo suggests might align with conventional sluggish monetary intervals such because the summer season months when many traders are much less lively.

Supply: Willy Woo on X

Is Bitcoin prepared?

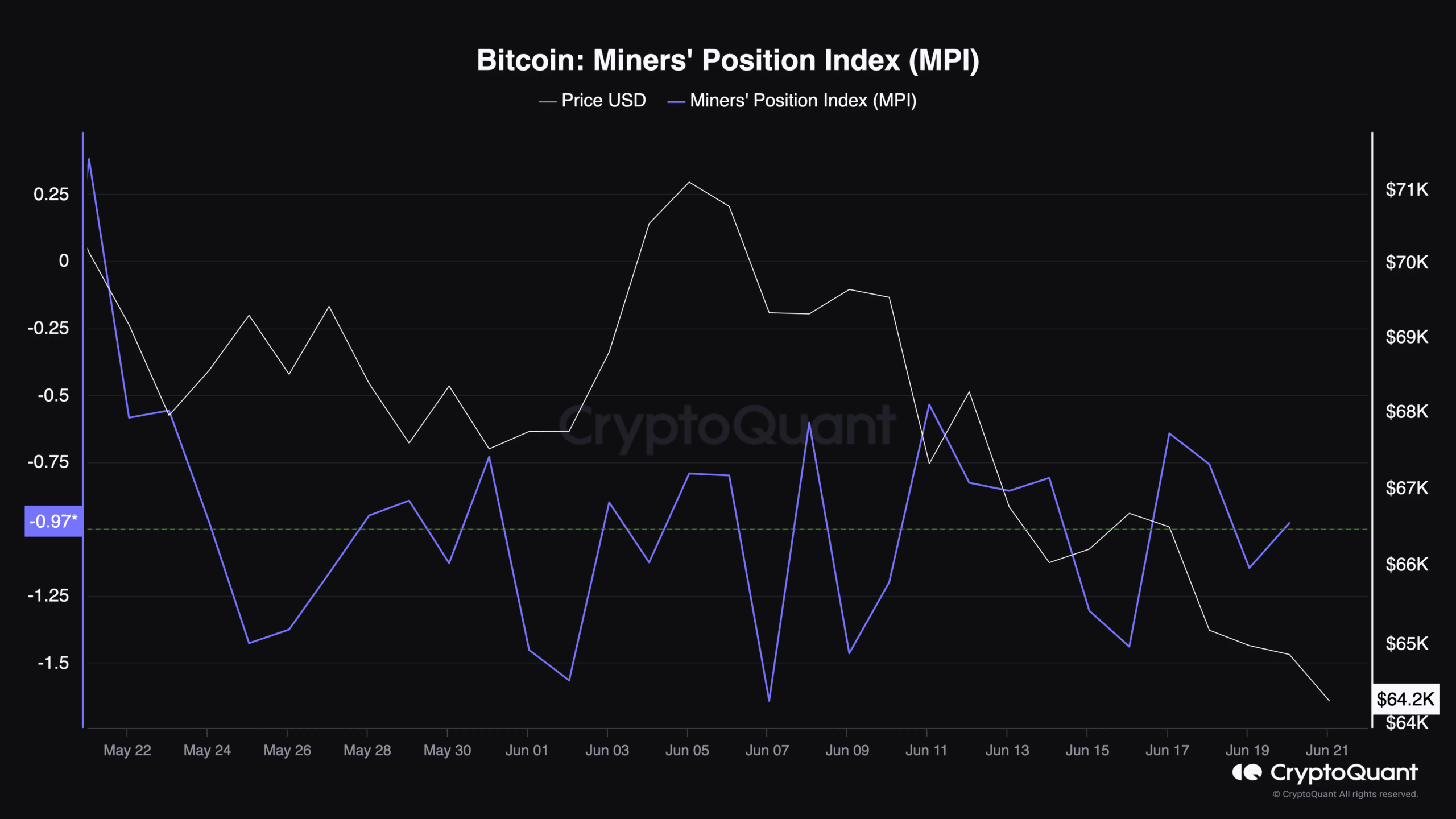

To additional perceive Bitcoin’s potential for restoration, AMBCrypto checked out particular metrics just like the Miner Place Index (MPI) and the Alternate Stablecoins Ratio USD.

Presently, the MPI stands at -0.97, indicating a possible lower in miner promoting strain, which may very well be bullish for Bitcoin costs.

Supply: CryptoQuant

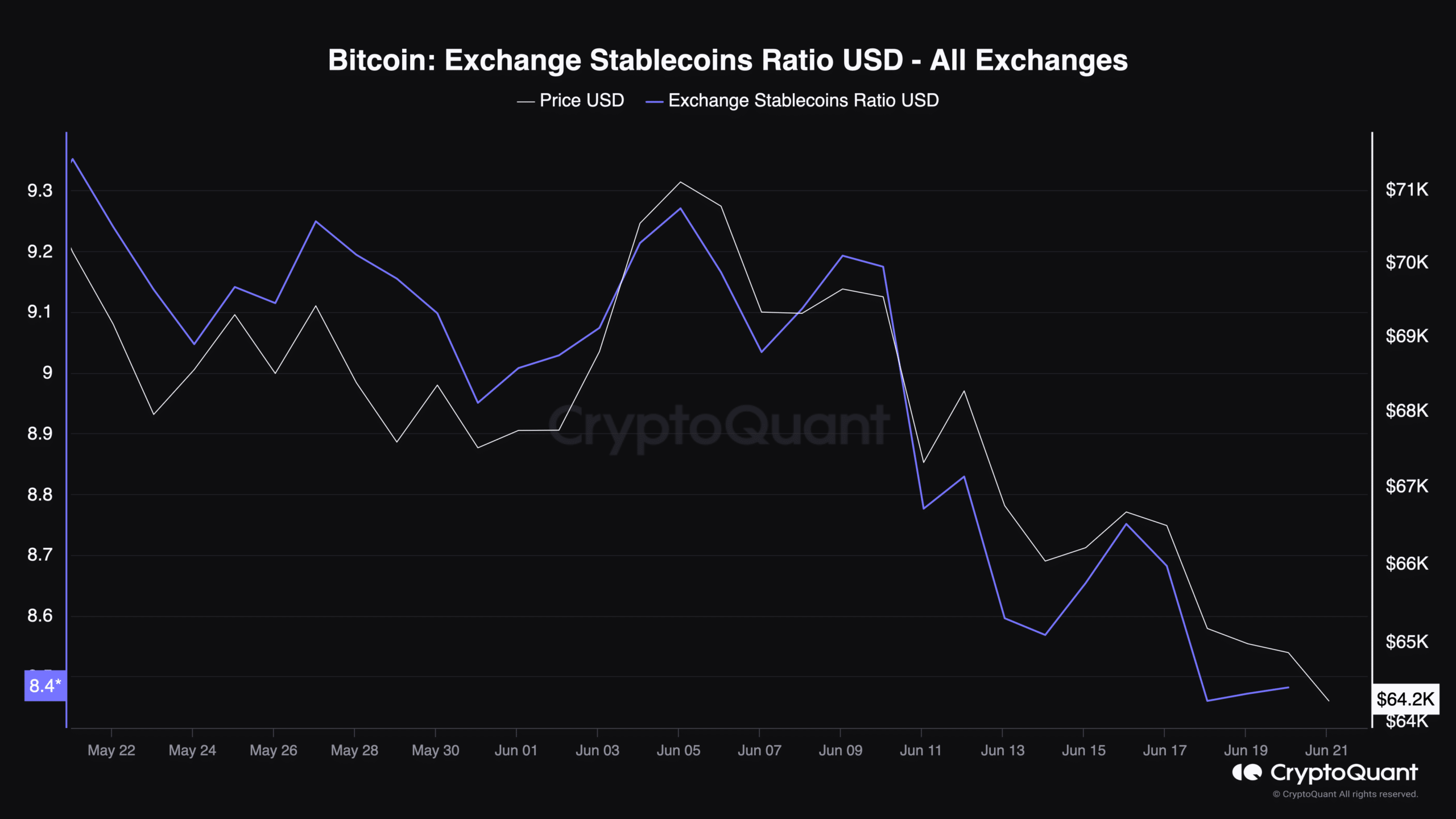

In the meantime, the Alternate Stablecoins Ratio USD, now at 8.48, has decreased barely by 0.97% within the final day.

This ratio assesses the shopping for energy potential on exchanges, with decrease values typically indicating stronger potential shopping for strain, which might drive value will increase.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Regardless of these technical indicators, the real-world impression on merchants, particularly these in brief positions, stays important.

With practically $1.84 million liable to liquidation ought to Bitcoin surge previous the $70k mark once more, the stakes are excessive.