- Regardless of current bouts of decline, Bitcoin stays near the $10,000-level

- Miners dumped their largest batch of holdings in months as its worth hit a serious milestone

Bitcoin miners have offloaded a staggering 85,503 BTC during the last 48 hours, inflicting miner balances to drop to roughly 1.95 million BTC – Their lowest degree in current months. In reality, this marks the sharpest fall in miner holdings in 2024.

As anticipated, this raises questions on its affect on Bitcoin’s worth too.

Bitcoin miners’ promoting and worth developments

The current dip in miner balances is probably the most important since February, nevertheless it has not but instantly affected Bitcoin’s worth momentum. An evaluation of the miner provide on Santiment revealed that on 5 December, it had a studying of over 2 million.

Nevertheless, it had dropped to round 1.95 million, on the time of writing.

Supply: Santiment

Traditionally, important miner sell-offs typically align with market corrections, however 2024 has seen a divergence between miner exercise and worth developments. Regardless of these sell-offs, nevertheless, non-mining whales and sharks have continued to build up – Highlighting the complexity of market dynamics.

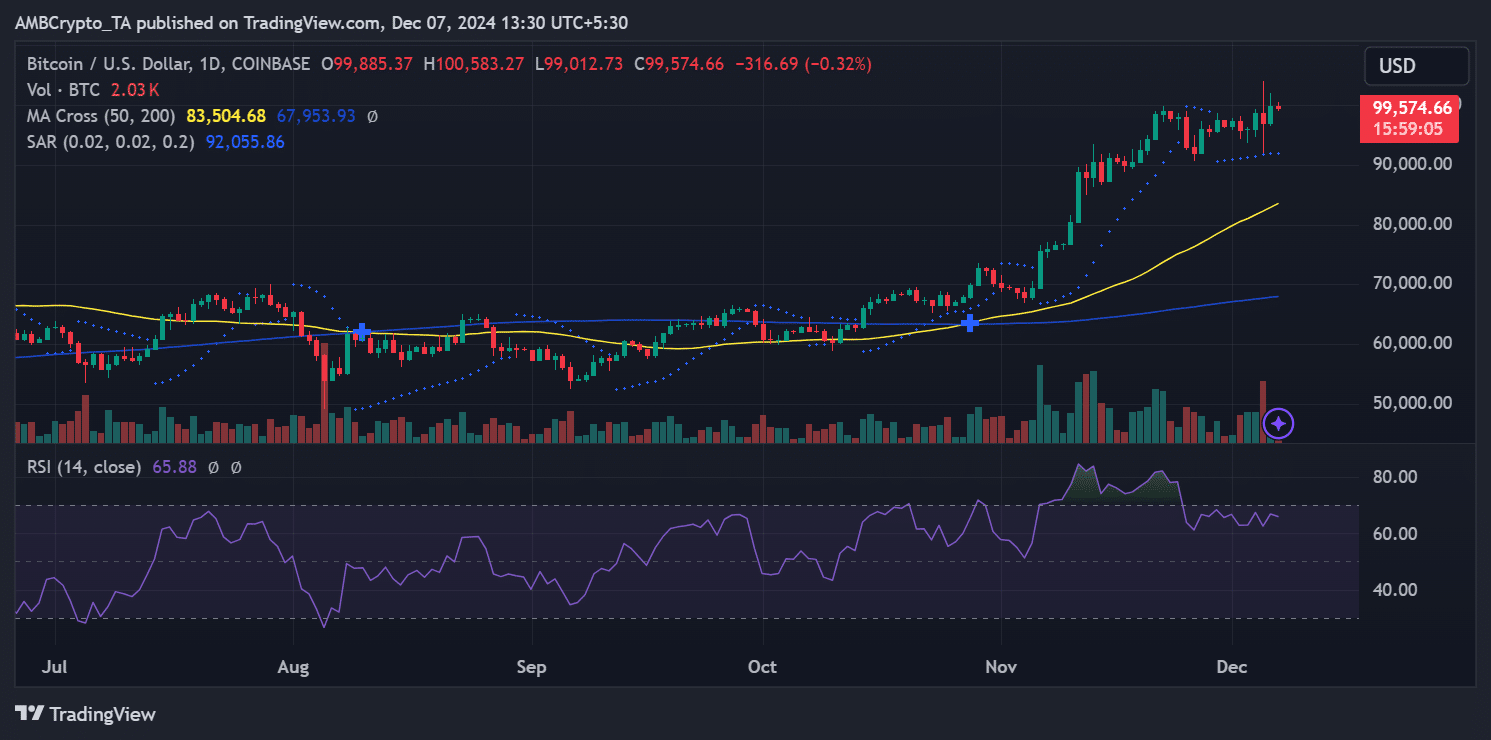

At press time, Bitcoin gave the impression to be consolidating close to its psychological resistance at $100,000. The Relative Energy Index (RSI) highlighted a worth of 65.88 – An indication that the asset stays in bullish territory, though overbought circumstances weren’t but evident.

The Parabolic SAR and transferring averages additional supported a bullish bias, with the worth buying and selling effectively above the 50-day and 200-day transferring averages at $83,504 and $67,953, respectively.

Supply: TradingView

Community metrics – Hashrate, problem, and income

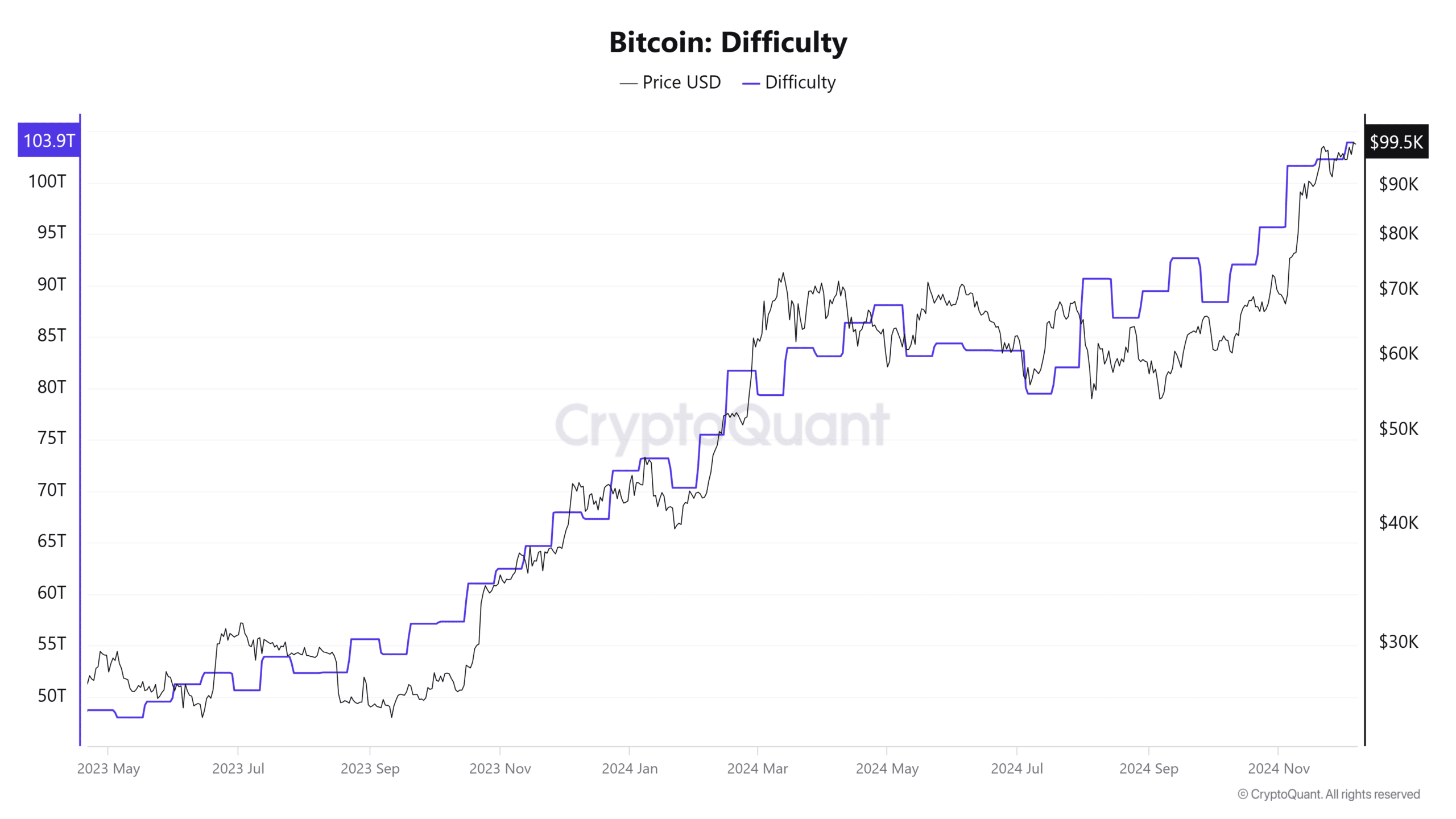

An evaluation of Bitcoin’s hashrate revealed that it hit an all-time excessive of over 900 EH/s. The sustained hike indicated robust competitors amongst miners.

Coupled with a document community problem of 103.9T, excessive mining exercise has continued regardless of the autumn in miner balances.

Supply: CryptoQuant

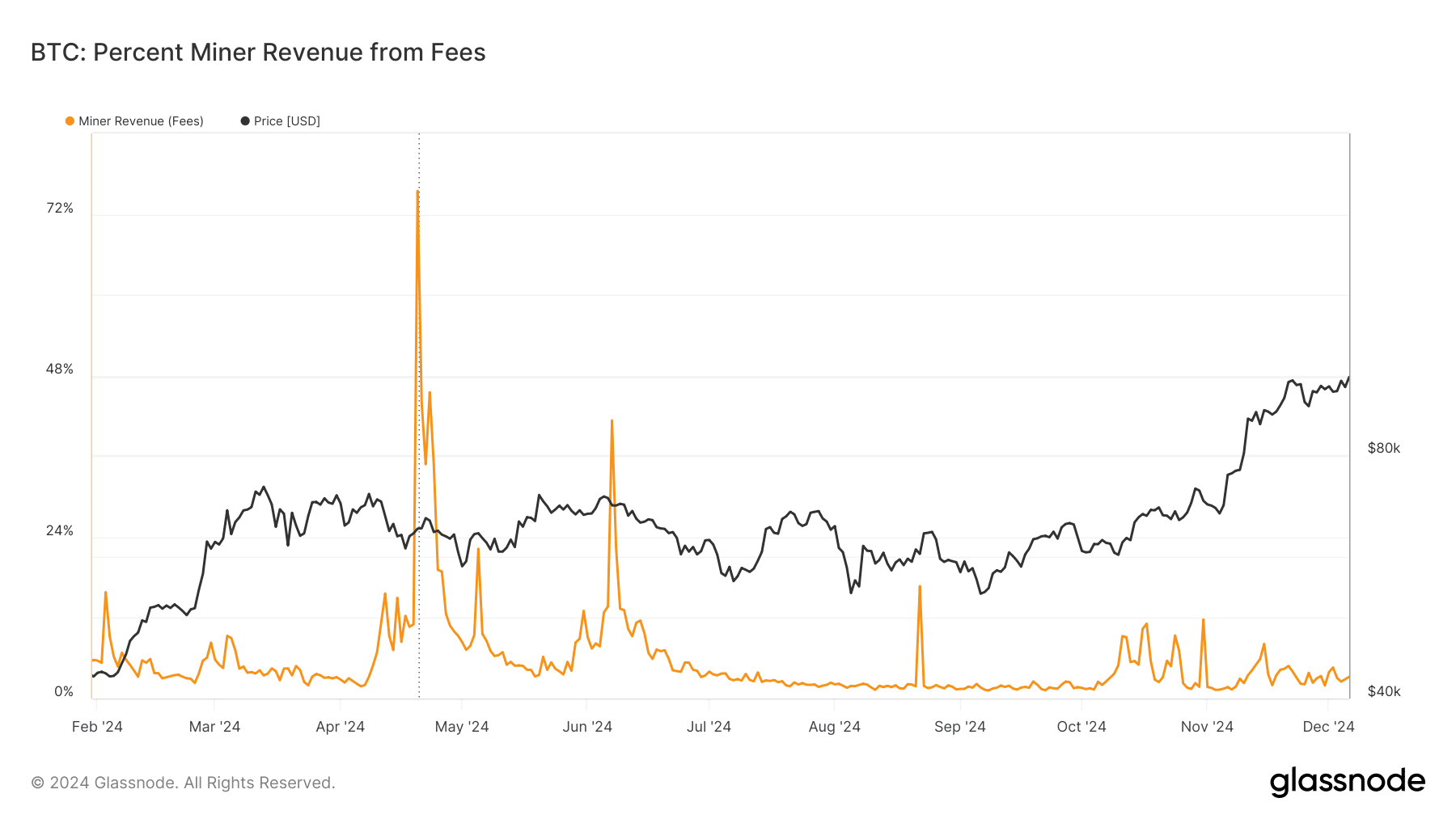

Moreover, miner income from charges stays subdued, with transaction charges contributing to solely about 10% of complete miner earnings.

That is considerably decrease than the peaks seen earlier in 2024, emphasizing miners’ dependence on block rewards.

Supply: Glassnode

Implications for Bitcoin’s worth

The divergence between miner exercise and worth developments underscored Bitcoin’s market maturity. Regardless of main sell-offs, Bitcoin’s worth has remained resilient, consolidating close to its all-time excessive as consumers stepped in to soak up the promoting stress. Nevertheless, sustained promoting from miners might result in heightened volatility, particularly if compounded by macroeconomic or liquidity issues.

Bitcoin’s means to keep up its worth close to $100,000 amid important miner promoting displays the rising affect of non-mining market individuals and the asset’s broader adoption.

Learn Bitcoin (BTC) Worth Prediction 2024-25

As miners modify their holdings, market individuals will intently watch Bitcoin’s means to interrupt previous its psychological resistance and maintain its rally. The approaching weeks can be crucial for figuring out whether or not the current miner sell-off means a possible turning level or merely displays short-term market changes.