- Schiff warned that hedge funds promoting Bitcoin to cowl MSTR shorts might crash Bitcoin’s worth.

- Bitcoin confronted bearish developments, displaying pink candles in day by day and weekly charts.

Bitcoin [BTC] bulls are struggling to show the bearish sentiment because the cryptocurrency confirmed pink candles on day by day and weekly charts.

Buying and selling at $65,177.67 at press time, the king coin’s volatility has drawn a variety of criticism these days, particularly from Peter Schiff.

In an X (previously Twitter) submit dated the seventeenth of June, Schiff famous,

Supply: Peter Schiff/X

Schiff on Bitcoin and MicroStrategy

Right here, Schiff underscored the interconnected dangers between Bitcoin and Microstrategy [MSTR], highlighting potential cascading results on each property.

Furthermore, when requested by an X consumer—Jim—”Why would Bitcoin crash?,” Schiff replied,

“Hedge funds selling as they buy MSTR. They would be unwinding both sides of the spread.”

Schiff’s assertion suggests Bitcoin worth might crash if hedge funds promote their Bitcoin holdings whereas shopping for MSTR to shut their brief positions.

Nevertheless, there stays some confusion concerning the the reason why hedge funds will promote their Bitcoin holdings even when their MSTR brief positions yield earnings.

Schiff’s remarks lack substantial help

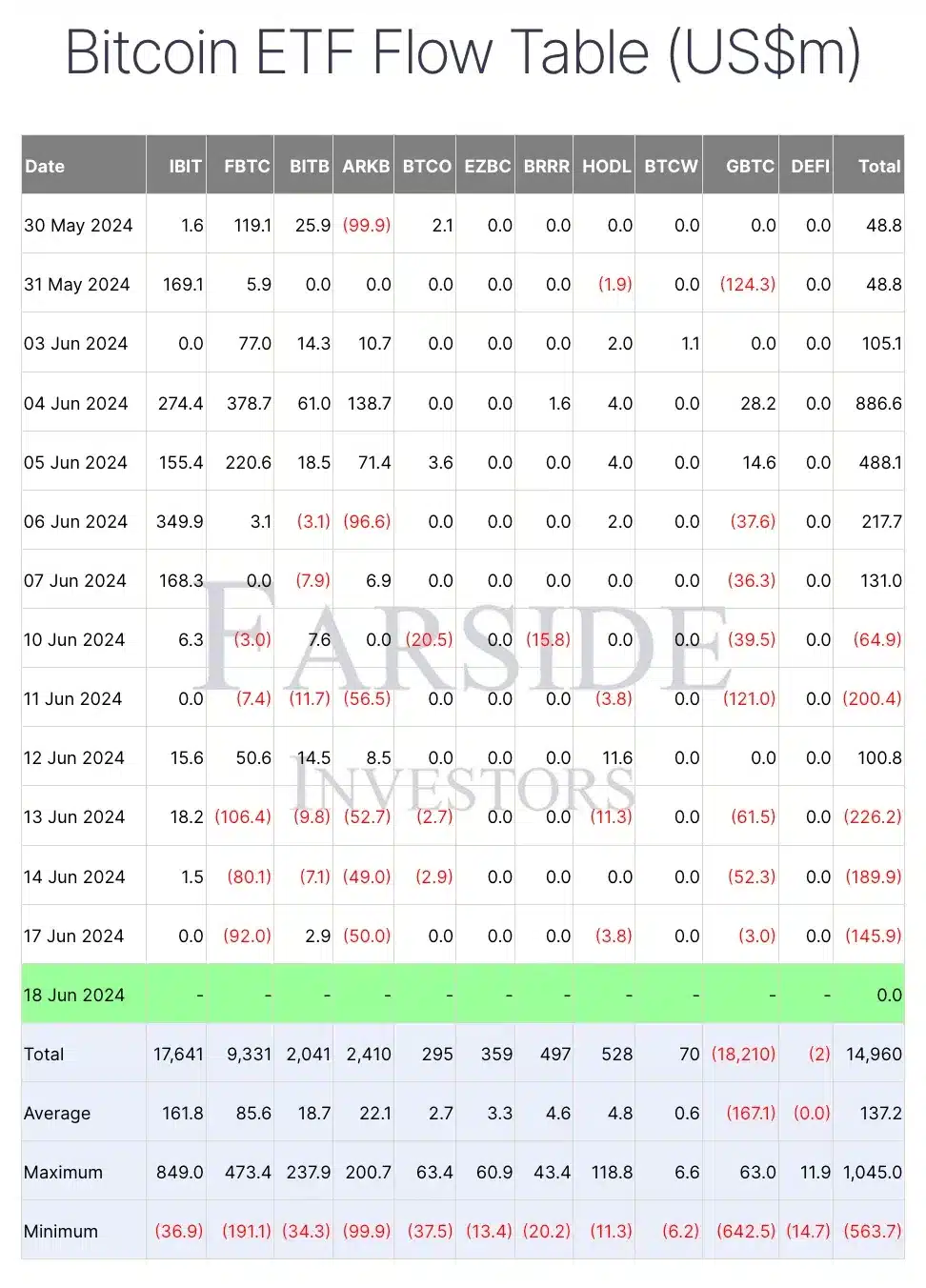

Amid Bitcoin’s ongoing worth struggles, BTC ETFs too are going through comparable challenges. From the thirteenth to the seventeenth of June (excluding weekends), BTC ETFs noticed consecutive outflows.

Supply: Farside Traders

Furthermore, MicroStrategy’s inventory,MSTR, additionally dropped by 3.13% previously 24 hours.

Nevertheless, with the Relative Power Index (RSI) close to the impartial zone, it’s unsure the place MSTR will go within the close to future. If it manages to surpass the resistance stage at $1607.8, bullish momentum might probably comply with.

Supply: TradingVIew

This underscored the sturdy interconnection between the 2 markets, suggesting that MicroStrategy’s (MSTR) worth motion follows Bitcoin’s motion.

Bitcoin stands sturdy

AMBCrypto’s evaluation of social quantity and 24-hour lively addresses revealed a major enhance, indicating that regardless of current worth declines, investor sentiment in the direction of Bitcoin stays optimistic.

Echoing comparable sentiment, YouTuber Crypto Rover, analyzed,

“Once this falling wedge on #Bitcoin breaks out, the price target is $72k.”

Supply: Crypto Rover/X