- Regardless of the current worth decline, BTC’s variety of long-term holders elevated.

- In case of a bullish takeover, then BTC would possibly first reclaim $68k.

Bitcoin [BTC] registered a significant drop within the final 24 hours because it didn’t retest its all-time excessive, which a number of anticipated. Nevertheless, previously few hours, BTC has considerably consolidated close to $66.

Let’s take a look at Bitcoin liquidation heatmap to seek out out its upcoming targets.

Bitcoin’s current downfall

CoinMarketCap’s information revealed that BTC’s worth dropped by over 4% within the final 24 hours. On the time of writing, the king coin was getting snug close to $66k with a market capitalization of over $1.31 trillion.

AMBCrypto’s have a look at IntoTheBlock’s information revealed that regardless of the current setback, BTC’s variety of long-term holders (addresses holding BTC for greater than 1 yr) was growing.

Supply: IntoTheBlock

AMBCrypto’s have a look at CryptoQuant’s information revealed that its binary CDD was inexperienced. This meant that long-term holders’ motion within the final seven days was decrease than the common. They’ve a motive to carry their cash.

One other bullish metric was the funding fee, which elevated. Nevertheless, not every little thing was in BTC’s favor.

For example, as per Coinglass’ information, BTC’s lengthy/brief ratio registered a large dip. A drop out there instructed that there are extra brief positions out there than lengthy positions.

This indicated that bearish sentiment across the king of cryptos has elevated.

Supply: Coinglass

Upcoming targets for BTC

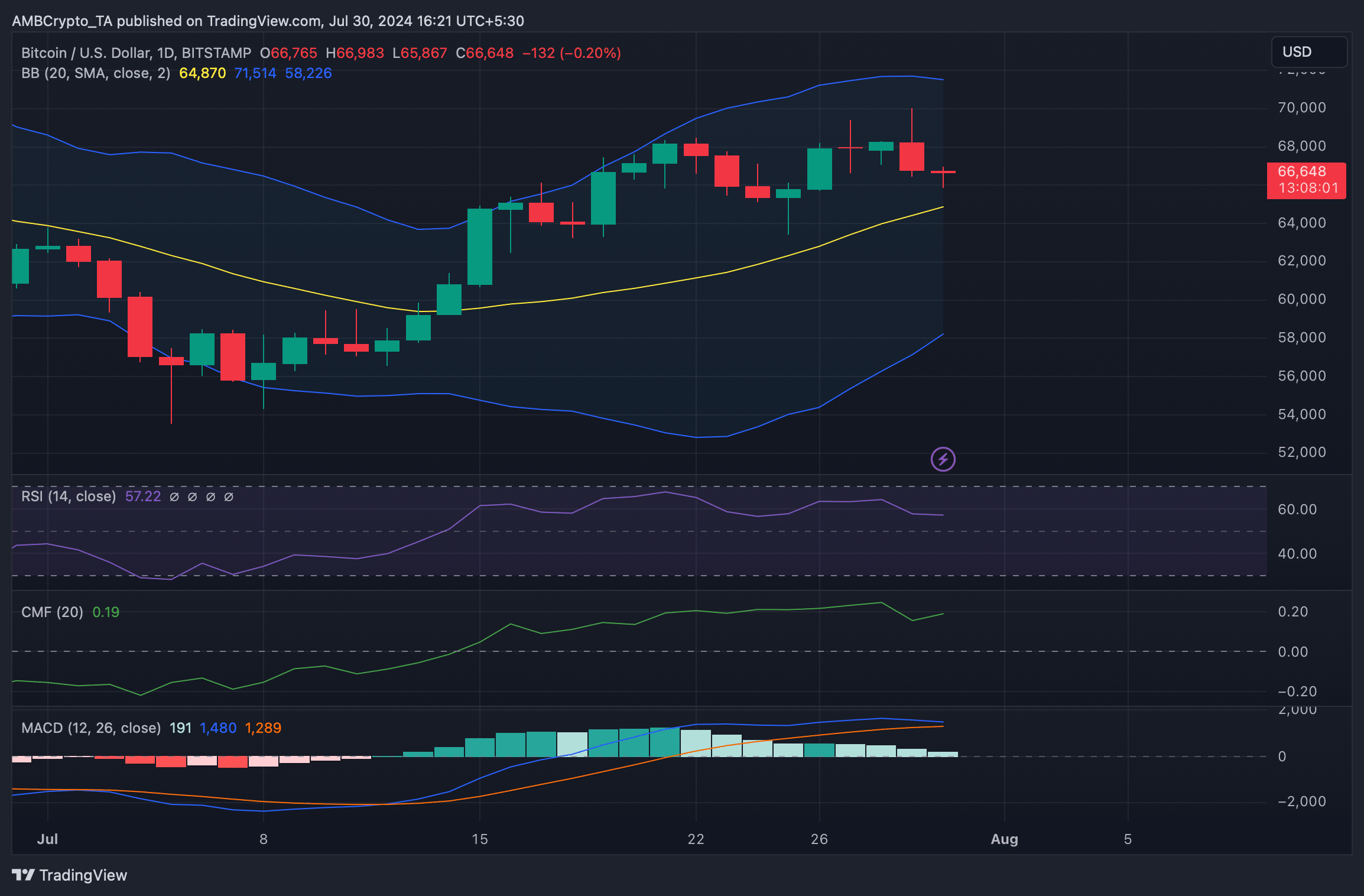

AMBCrypto then checked BTC’s day by day chart to see which approach BTC was headed within the coming days. The Relative Power Index (RSI) took a sideways path, hinting at a couple of extra days of consolidation.

The technical indicator MACD additionally had the same studying because it displayed the opportunity of a bearish crossover.

Nonetheless, the Bollinger Bands revealed that BTC was about to check its 20-day Easy Transferring Common (SMA). Bitcoin would possibly as properly handle to efficiently check the assist because the Chaikin Cash Circulate (CMF) registered an uptick.

Supply: TradingView

We then took a have a look at Bitcoin liquidation heatmap to seek out out its upcoming targets. If the bear rally continues, then it received’t be stunning for BTC to drop to $65k first as liquidation would rise.

An additional plummet below which may push BTC down to close the $60k vary.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, in case of a development reversal, BTC would possibly reclaim $68k earlier than it eyes at retesting its ATH.

If BTC manages to retest its ATH, then it will be fascinating to see whether or not it will probably go above that.

Supply: Hyblock Capital