- Bitcoin Lengthy liquidations result in formation of native backside.

- Brief-term worth enhance for Bitcoin appears to be imminent.

Bitcoin [BTC] has proven resilience after a pointy decline following geopolitical tensions between Israel and Iran. Buying and selling at round $62K at press time, Bitcoin was displaying indicators of reclaiming the $63K stage.

The current liquidation of lengthy positions might have established an area backside, indicating that BTC could possibly be set for an additional upward transfer, with this backside serving because the month’s low.

Throughout vital declines, lengthy contracts usually drop sharply as a result of liquidations, decreasing promoting strain.

Key liquidity ranges remained agency between $68,900 and $69,300 above the press time worth, and $56,800 to $57,400 beneath.

A brand new liquidity cluster was additionally rising within the $66,500 to $66,800 zone, suggesting that the value might goal this space quickly.

Supply: CryptoQuant

Whereas BTC’s worth motion has oscillated between $55K and $75K for over 200 days, Bitcoin remained in a strong place.

It was buying and selling above the 100-week shifting common (100MA) on the weekly chart, sustaining energy on the macro stage.

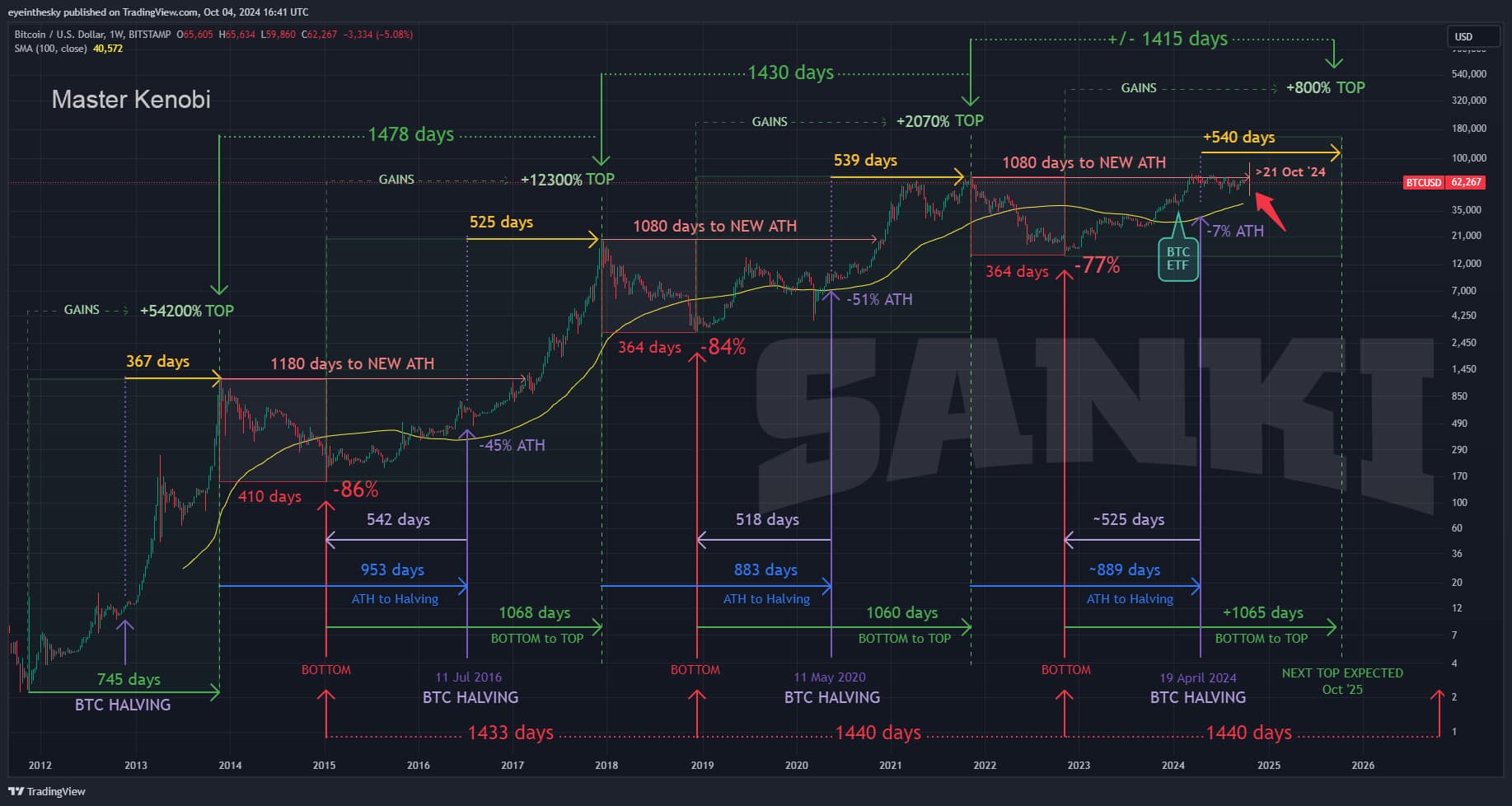

Notably, BTC is now 170 days previous the newest Bitcoin halving, and historic patterns present that new all-time highs (ATHs) are inclined to type roughly 1,080 days after the earlier cycle’s peak.

This implies that, if historical past proves to be proper, Bitcoin might more likely to pattern increased from its present stage.

Supply: Sanki/X

Coinbase Premium indicator

Including to this bullish outlook is the Coinbase Premium software on CryptoQuant, which highlights a short-term BTC enhance.

When a golden cross is fashioned, as proven in earlier worth actions, Bitcoin usually experiences a short-term increase. This indicator provides additional proof that BTC might rise from its present native backside.

Supply: CryptoQuant

US Bitcoin spot ETFs demand

Demand for Bitcoin from U.S. spot ETFs has additionally been rising. In early September, spot ETFs have been internet sellers, however by the top of the month, they’d bought 7K BTC, the best stage since July 2021.

Within the first quarter of 2024, spot ETFs purchased almost 9K BTC day by day, pushing costs to new highs. If this shopping for pattern continues, Bitcoin’s worth might rise even additional within the last quarter of 2024.

Supply: CryptoQuant

Whales holding regular

Moreover, giant Bitcoin holders, or “whales,” have proven traditionally low ranges of profit-taking, indicating confidence in future worth development.

Whales have been distributing their BTC throughout completely different addresses, with only one,975 addresses now holding between 1,000 and 10,000 BTC.

Regardless of some current promoting, whales have taken minimal earnings in comparison with earlier cycles, additional supporting the notion that BTC’s worth will rise from right here as they search to maximise their positive factors.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

A mix of liquidations, rising demand from ETFs, and robust whale exercise means that Bitcoin is poised for additional positive factors from its present native backside.

All these elements level in direction of a possible upward pattern for BTC within the close to time period.