- Metaplanet boosts BTC holdings amid worth restoration, reinforcing its “Asia’s MicroStrategy” popularity.

- Submit-announcement surge lifts Metaplanet’s inventory by 25.81%, marking a daring Bitcoin funding technique.

Metaplanet, a outstanding publicly-listed funding and consulting agency headquartered in Japan, has considerably boosted its Bitcoin [BTC] holdings.

Metaplanet’s BTC holdings

Just lately, the corporate acquired a further 21.88 BTC, valued at over $1.2 million (roughly 200 million Japanese yen).

Supply: Metaplanet Inc/X

This transfer aligns with Bitcoin’s current surge to round $65,000, marking a notable 4.5% enhance following weeks of steady decline.

In truth, on the time of writing, BTC confirmed bullish indicators on the every day chart, marking a 1.94% enhance prior to now 24 hours.

Metaplanet takes cues from MicroStrategy

Apparently, Metaplanet is usually dubbed “Asia’s MicroStrategy” as a result of its tendency to observe MicroStrategy’s funding methods.

For context, Metaplanet is financing its Bitcoin purchases by way of bond gross sales, just like MicroStrategy’s strategy. This highlights the rising institutional adoption of BTC.

That being stated, on sixteenth July, Metaplanet boosted its Bitcoin holdings to over 225 BTC, valued at about $14.55 million at present costs.

Moreover, Metaplanet’s current announcement of increasing its BTC holdings has triggered a outstanding surge in its share worth, hovering by a powerful 25.81% to achieve 117 JPY.

This surge displays investor confidence within the agency’s strategic adoption of Bitcoin, which has pushed its inventory by an astounding 631% for the reason that yr started.

Supply: Google Finance

What’s extra to it?

As of the most recent replace, Metaplanet’s present market capitalization stands at 17.5 billion JPY, with its BTC holdings valued at 2.25 billion JPY on its steadiness sheet.

As BTC’s proportion in its complete property continues to rise steadily, analysts speculate it may surpass 100% within the close to future. This reveals Metaplanet’s daring stance in embracing cryptocurrency as a core a part of its funding technique.

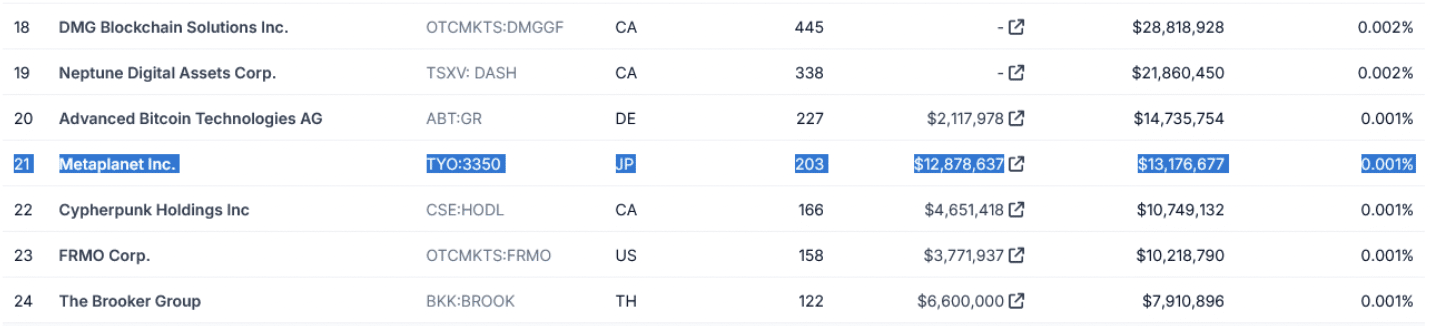

This was additional confirmed by CoinGecko’s information, displaying that Metaplanet presently ranks because the world’s Twenty first-largest company holder of Bitcoin.

Supply: CoinGecko

This underscores Metaplanet’s proactive stance in hedging towards Japan’s escalating debt disaster and the depreciating Japanese yen.

With the yen plummeting practically 54% towards the US greenback since January 2021, BTC has emerged as a sturdy various, appreciating by over 145% towards the yen prior to now yr alone.

In conclusion, Metaplanet’s technique displays a rising pattern the place establishments are utilizing Bitcoin alongside conventional property for hedging and diversification.