- Bitcoin was secure above $60K, however struggled to interrupt the $70K resistance degree.

- An analyst highlighted unrealized earnings and whale exercise as indicators of a possible shopping for alternative.

Bitcoin [BTC] continues to indicate resilience by holding above the $60,000 mark, though it has but to make vital progress towards breaking the $70,000 resistance.

After briefly rising to $64,000, the cryptocurrency confronted a correction, falling to $62,340, down by 1.8% during the last 24 hours.

Regardless of the worth fluctuation, many analysts remained optimistic about Bitcoin’s present standing, highlighting potential shopping for alternatives amid the continued consolidation.

Bitcoin: Shopping for alternative forward?

CryptoQuant analyst “Darkfost” has offered insights into Bitcoin’s present market place, emphasizing the Non-Realized Revenue metric.

The analyst defined that prime ranges of unrealized earnings usually sign potential promoting stress, as merchants could also be tempted to take earnings when they’re sitting on vital positive aspects.

Conversely, destructive Non-Realized Earnings point out that merchants are holding positions at or beneath their entry costs, which may signify the market nearing a backside and current a great shopping for alternative.

Darkfost identified that Bitcoin’s present destructive Non-Realized Revenue zone signifies that many merchants are holding positions with little to no revenue, suggesting a market backside could also be forming.

The analyst famous,

“Currently, we are in the negative zone most of the time, which could indicate potential opportunities.”

Supply: CryptoQuant

Moreover, Darkfost highlighted that unrealized earnings have reached unprecedented ranges, in contrast to earlier market cycles, suggesting that the continued cycle might carry distinctive dangers and alternatives for buyers.

Backing up the information

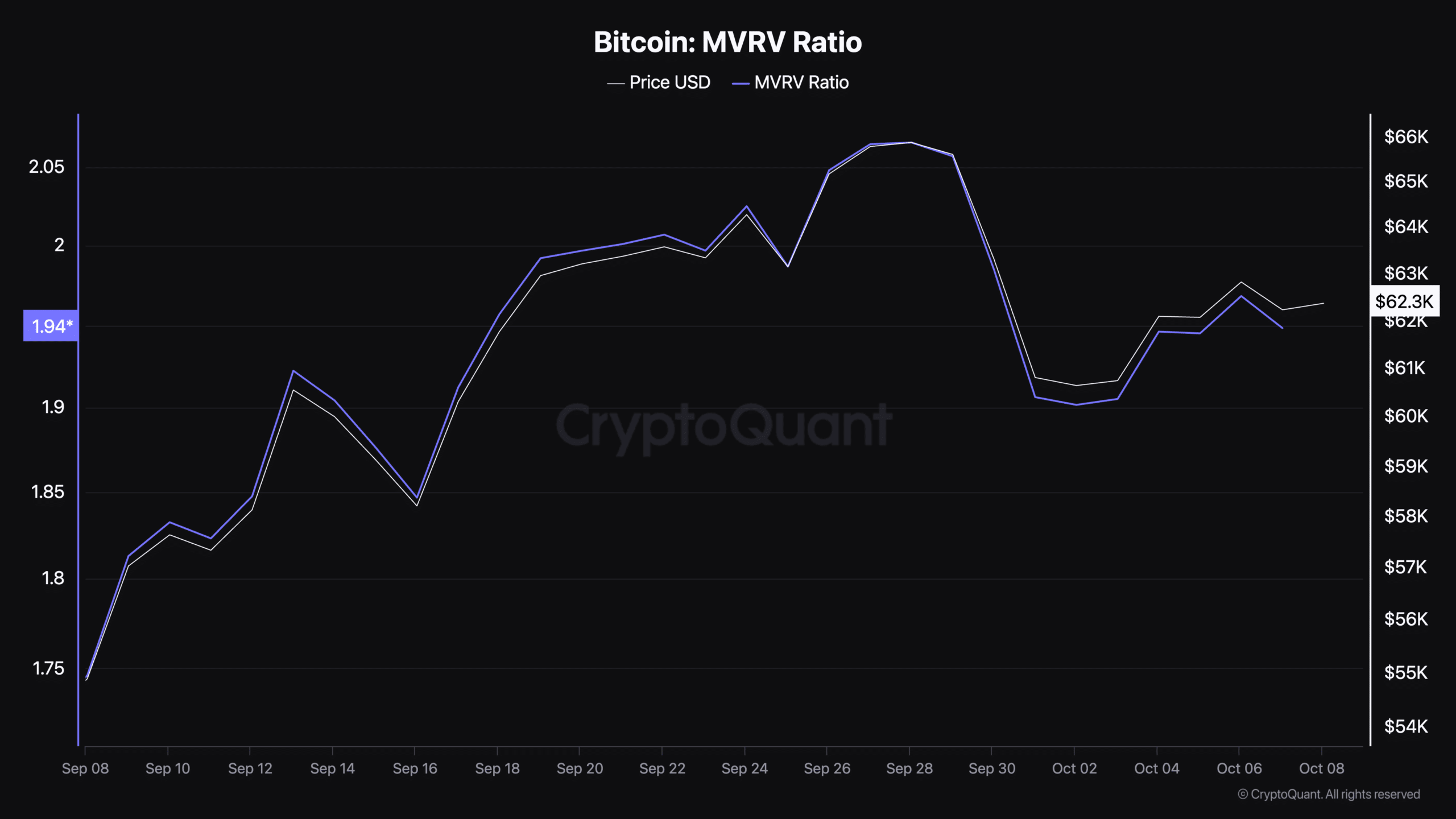

To additional assess Bitcoin’s market stance, it’s price contemplating different key indicators, such because the Market Worth to Realized Worth (MVRV) ratio.

The MVRV ratio compares the present market worth of Bitcoin to its realized worth (the worth at which all cash have been final traded).

When this ratio is excessive, it will probably point out overvaluation and potential market corrections, whereas a low ratio suggests undervaluation and shopping for alternatives.

As of immediately, Bitcoin’s MVRV ratio has elevated from 1.74 final month to 1.94, indicating that the market is nearing a extra balanced degree, however nonetheless has room for progress.

A rising MVRV ratio means that Bitcoin is gaining worth relative to its historic efficiency, which can sign optimistic sentiment out there.

Supply: CryptoQuant

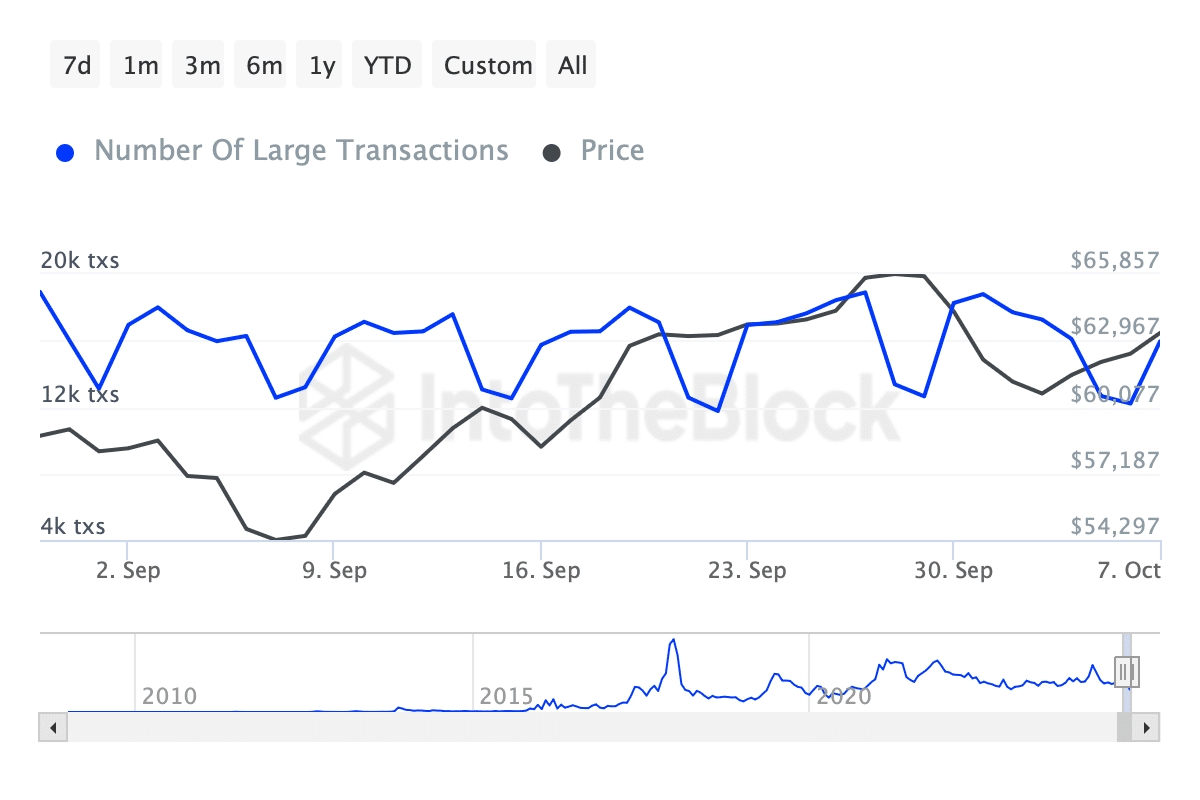

Whereas worth motion and profitability metrics present invaluable insights, Bitcoin’s whale exercise is one other key issue price monitoring.

Knowledge from IntoTheBlock revealed that transactions exceeding $100,000 have risen considerably in latest days.

The variety of such giant transactions has elevated from beneath 13,000 to greater than 15,000, indicating rising curiosity from institutional buyers and high-net-worth people.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This improve in whale transactions usually advised that giant buyers have been accumulating Bitcoin, which might additional help the worth and point out confidence within the king coin’s future progress.

The involvement of whales usually precedes vital market strikes, as their trades can closely affect the general provide and demand dynamics.