- Mt. Gox transferred 42,830 BTC, valued round $2.9 billion, to new addresses on the twenty eighth of Could.

- Rising Bitcoin provide and potential large-scale sell-offs by Mt. Gox collectors may stress costs.

The Tokyo-based Mt. Gox, as soon as the behemoth of Bitcoin [BTC] exchanges, dealing with 70% of all transactions by 2013, has re-entered the cryptocurrency narrative after a big interval of dormancy.

The platform, which ceased operations and entered chapter following a large safety breach in 2014 that led to the lack of 800,000 bitcoins, is now making headlines once more.

Latest actions counsel a big motion of funds, which has piqued the curiosity of traders and analysts throughout the globe.

Mt. Gox resurfaces, makes historic Bitcoin transfers

As a part of the continued chapter decision, Mt. Gox’s trustees have begun transferring substantial bitcoin holdings.

Knowledge from Arkham Intelligence indicated that 42,830 BTC, valued round $2.9 billion, have been moved to new addresses within the early hours of the twenty eighth of Could.

This marks the primary such exercise in 5 years and is a precursor to a possible distribution of those belongings to collectors earlier than the top of October 2024.

The looming query is the affect of those strikes on the Bitcoin market, significantly whether or not this can result in a promoting spree among the many recipients.

Following the switch, Bitcoin skilled a slight dip, roughly 2%, which introduced its buying and selling value all the way down to about $67,830.

This shift occurred amidst a broader context of Bitcoin’s latest 24-high of over $70,000.

Observers are keenly watching the potential ripple results of Mt. Gox’s large-scale asset actions, given the historic precedents set by related giant disbursements within the cryptocurrency house.

In-depth evaluation by AMBCrypto has explored numerous metrics that might affect Bitcoin’s resilience to potential market shocks stemming from these releases.

Provide dynamics and investor sentiment

Complicating the market outlook is the conduct of Bitcoin’s circulating provide and investor demand.

Knowledge from Glassnode signifies a rise in circulating provide, which, if not matched by demand, may exert downward stress on Bitcoin costs.

It is a basic financial state of affairs the place an oversupply, with out corresponding demand, results in value depreciation.

Supply: Glassnode

This pattern may change into significantly impactful if Mt. Gox collectors select to promote throughout a time of accelerating provide like this.

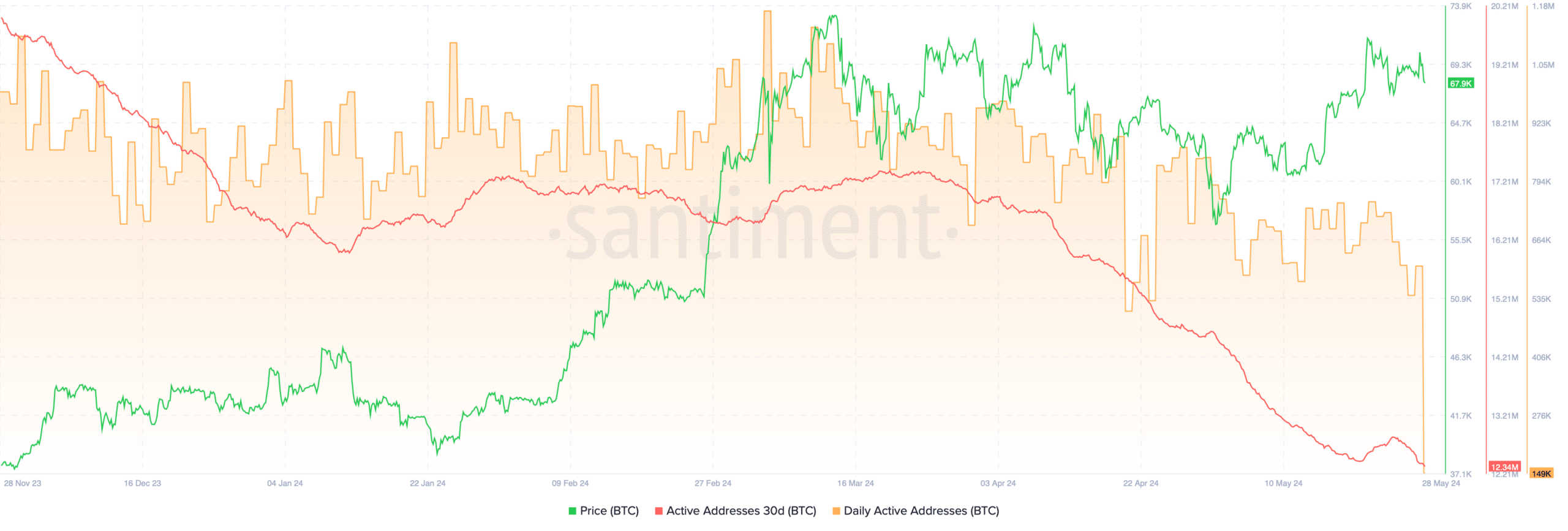

Conversely, based on Santiment knowledge, Bitcoin’s every day energetic addresses and 30-day energetic addresses are additionally declining, suggesting a discount in demand.

In such a market situation, a sell-off by Mt. Gox collectors may additionally result in a pointy value correction in BTC.

Supply: Santiment

Nonetheless, there are counterbalancing forces at play.

The approval and operation of Bitcoin ETFs, that are constantly buying important quantities of Bitcoin every day—now holding 855,619 Bitcoin and shopping for a median of 6,200 BTC per day—would possibly mitigate potential market shocks.

These ETFs may take in among the elevated provide if Mt. Gox collectors start to promote, doubtlessly stabilizing costs.

Additional buoying investor sentiment, AMBCrypto lately reported that the Bitcoin Rainbow Chart—an indicator used to gauge long-term worth traits—exhibits Bitcoin at the moment positioned within the ‘Buy’ zone.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Traditionally, getting into this zone has preceded substantial value will increase.

The present positioning means that this could possibly be an opportune second for traders to accumulate Bitcoin at a lower cost earlier than it ascends into the ‘Accumulate’ and ‘HODL’ zones.