- BTC mid-term holders are shopping for extra cash.

- Nonetheless, worth might development inside a slim vary earlier than witnessing any vital rally.

The Bitcoin [BTC] market is witnessing a development of accumulation by the coin’s medium-term holders, as famous by the pseudonymous CryptoQuant analyst SignalQuant in a current report.

Medium-term holders are those that have held their belongings for a interval between six months and 7 years.

Based on the analyst, this shift in conduct amongst this cohort of BTC holders, as its worth continues to face resistance on the $70,000 worth stage, suggests a rising confidence. It indicators that they like to carry onto their belongings slightly than promote them.

BTC to development in a decent vary?

Assessing the coin’s historic efficiency, SignalQuant discovered that within the third quarter of 2019, when an identical accumulation sample was noticed amongst BTC’s mid-term holders, its worth moved sideways for over six months earlier than finally experiencing a rally.

One might argue that this historic context offers a possible parallel for the present market situations.

It hints at the opportunity of an identical extended sideways motion earlier than a big uptrend is witnessed.

An evaluation of BTC’s key technical indicators on a 1-day chart confirmed that the worth consolidation was already underway.

For instance, the main cryptocurrency traded near its 20-day exponential shifting common (EMA) at press time and has traded on this method since 23 Could.

Supply: BTC/USDT on TradingView

This shifting common represents the coin’s common worth over the previous 20 days. When BTC trades above it, the coin exchanges fingers above its common worth up to now 20 days.

Conversely, when BTC trades below this shifting common, its present worth is decrease than its common up to now 20 days.

When the BTC worth trades near its 20-day EMA, it suggests a interval of consolidation, with neither bullish nor bearish forces dominating.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

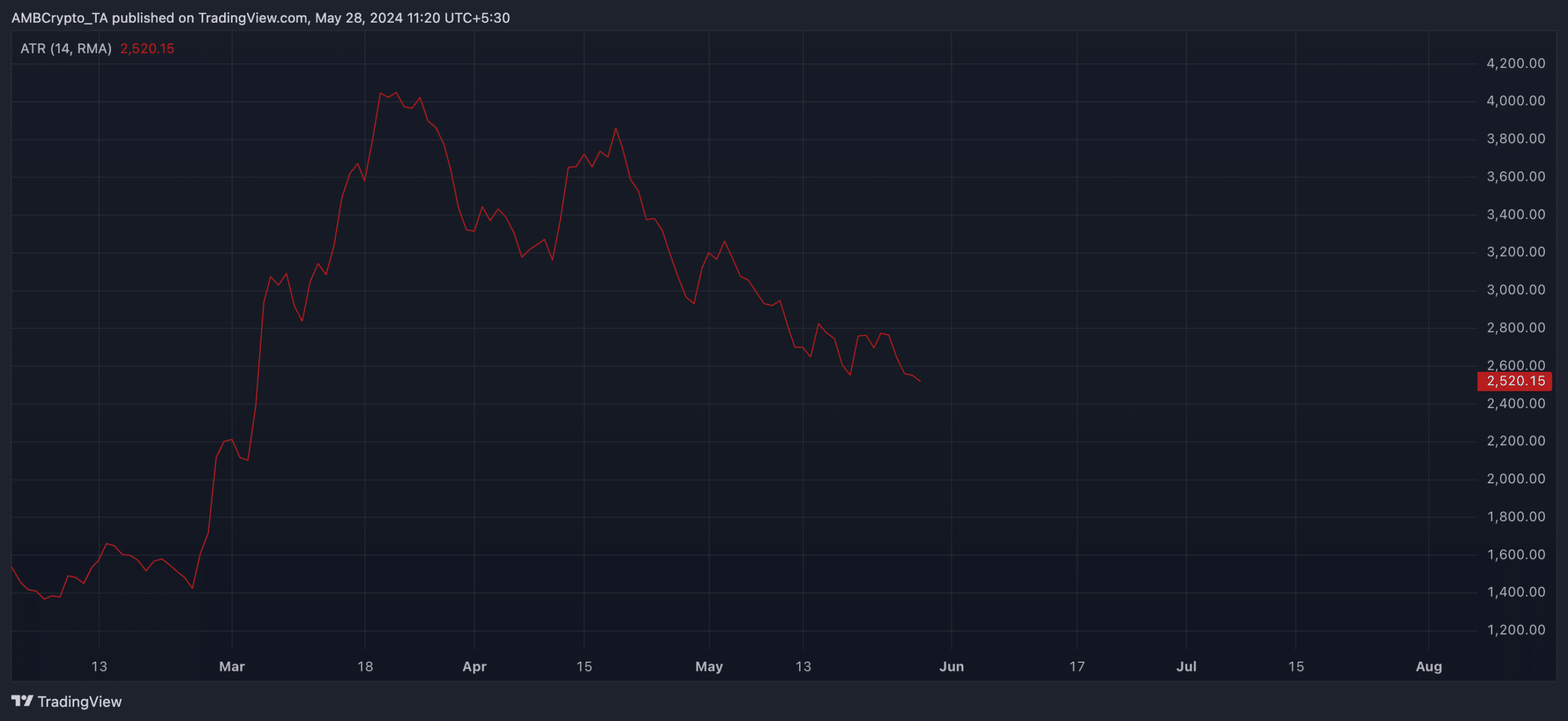

Additional, BTC’s declining Common True Vary (ATR) lent credence to the place above. At press time, the indicator was 2520, having declined by 21% for the reason that starting of Could.

Supply: BTC/USDT on TradingView

This indicator measures an asset’s worth volatility. When its worth drops, it means that the asset’s current worth actions have moved inside a narrower vary than the earlier interval.