- One skilled factors to historic developments as a powerful indicator of an impending BTC rally.

- A number of key metrics assist the potential for Bitcoin to climb greater, backed by a number of confluences within the knowledge.

Final week, Bitcoin [BTC] confronted appreciable downward stress, leading to a 1.67% worth drop. Nevertheless, the market has since proven indicators of restoration, with BTC gaining 1.30% within the final 24 hours.

Analysts anticipate these positive aspects to proceed, with historic knowledge and a number of metrics suggesting Bitcoin may surpass its current 15.27% rise and push greater within the coming weeks.

Historic knowledge exhibits a 7% drop adopted by an enormous worth surge

Based on crypto analyst Carl Runefelt in a current submit on X (previously Twitter), Bitcoin is at present at a historic crossroads much like October 2023.

He famous:

“Bitcoin dropped 7% at the beginning of October 2023, and now it’s dropped about the same!”

Supply: X

Based mostly on the chart he shared, if this historic sample repeats, BTC may rise by roughly 66.76%, doubtlessly reaching $100,000. Nevertheless, it’s value noting that in 2023, the rally earlier than consolidation solely gained 35.43%.

Whether or not BTC will see an analogous upward surge stays unsure. AMBCrypto has analyzed varied metrics to gauge market individuals’ actions and supply perception into what would possibly unfold within the upcoming buying and selling classes.

Merchants exit exchanges, growing demand for Bitcoin

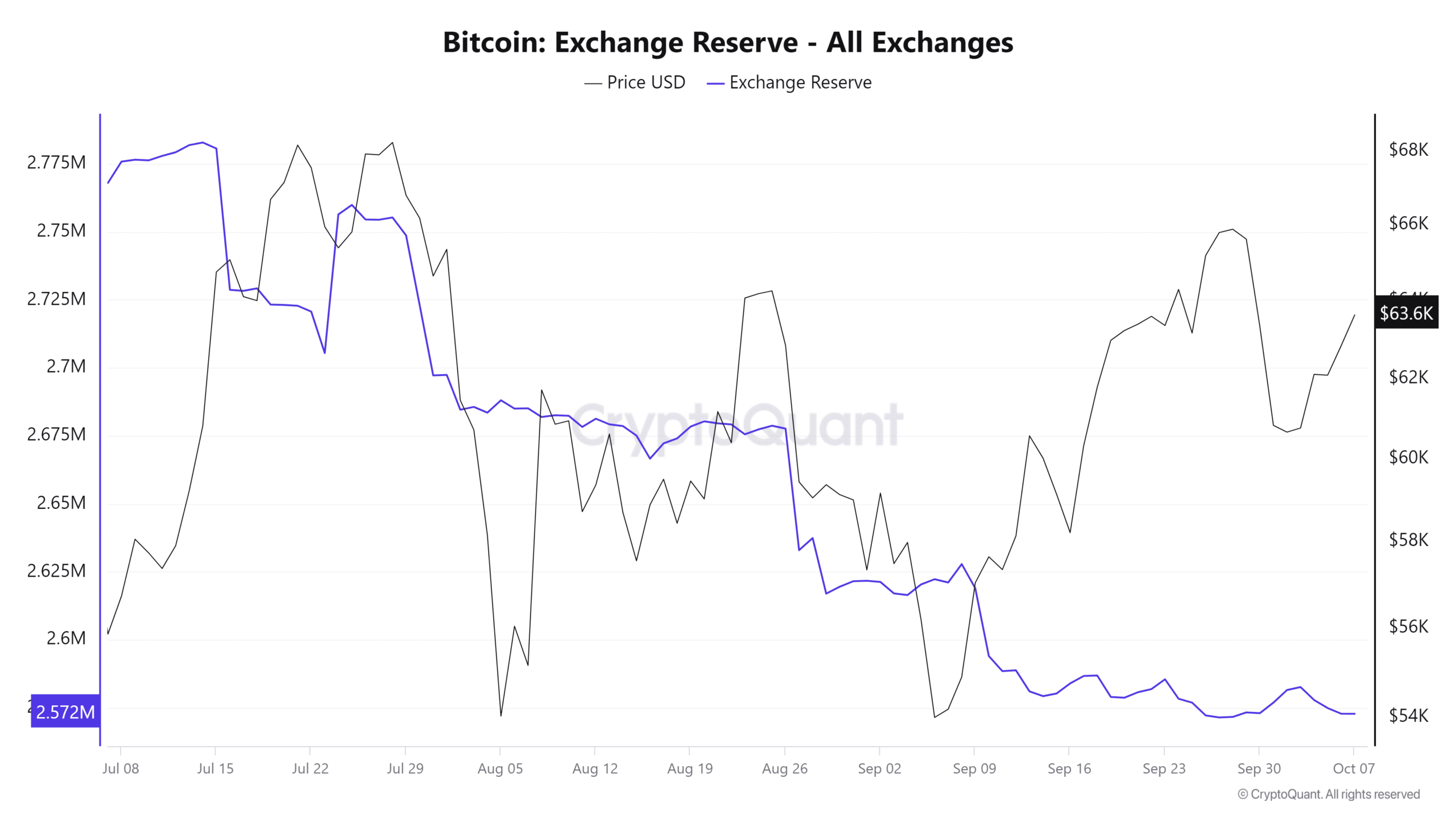

At press time, the full provide of BTC throughout a number of crypto exchanges, as measured by the Change Reserve, has been in regular decline since third October.

At present, solely 2.57 million BTC stay on exchanges, down from 2.58 million, indicating that merchants are more and more opting to retailer their Bitcoin off-exchange, signaling rising confidence within the asset. This shift can also be driving greater demand for BTC.

Supply: CryptoQuant

This shopping for stress is additional confirmed by CryptoQuant’s Change Stablecoin Ratio. When this metric is low, as it’s for BTC, it means that obtainable stablecoins are doubtless getting used to purchase Bitcoin, pushing its worth greater. The present studying of the ratio stands at 0.00009506 and is continuous to pattern downward.

If these metrics preserve their downward trajectory, it’s doubtless that BTC will proceed its upward momentum, as market sentiment more and more favors the bulls.

Whereas these are sturdy bullish indicators, AMBCrypto has additionally recognized further metrics pointing to the identical conclusion.

Quick merchants face losses as BTC rises

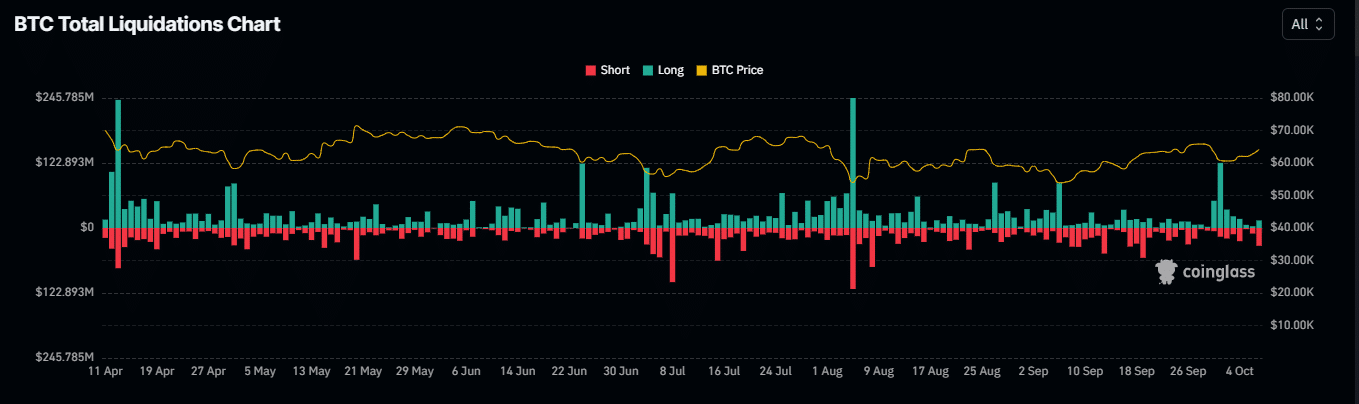

Prior to now 24 hours, quite a few quick merchants have been liquidated as Bitcoin’s worth moved in opposition to their bearish predictions.

Knowledge from Coinglass reveals that roughly $41.80 million value of quick contracts on BTC have been worn out, highlighting a powerful bullish shift available in the market.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Moreover, Open Curiosity, a key metric that measures dealer exercise, signifies a bullish pattern, with a 3.66% improve pushing the full to $34.08 billion.

If this pattern continues, BTC’s upward momentum is prone to persist, confirming the bullish sentiment amongst merchants.