- BTC maintained the $67,000 value vary regardless of declines.

- The sentiment has additionally remained constructive.

Bitcoin’s [BTC] value has skilled a downturn during the last 24 hours, but the general constructive pattern stays strong. This resilience is additional underscored by the crypto worry and greed index, which presently displays a constructive sentiment available in the market.

Bitcoin sees month-to-month excessive in weighted sentiment

The weighted sentiment for Bitcoin, as analyzed utilizing Santiment information, has just lately surged to its highest level in a number of months, presently standing at over 4.9. This marks a major shift, because the sentiment had predominantly been damaging since round Might.

Evaluation revealed a quick constructive uptick round fifteenth July, however this was rapidly adopted by a return to damaging values.

Nonetheless, ranging from roughly twenty third July, the sentiment started a constant upward trajectory, culminating within the present excessive.

Supply: Santiment

That is the best degree of weighted sentiment Bitcoin has skilled since March 2023, indicating a sturdy turnaround in market attitudes towards Bitcoin.

The rise additionally displays elevated investor confidence and constructive market expectations.

Bitcoin exhibits grasping sentiment

The Bitcoin worry and greed index, as reported by Coinglass, presently stands at round 71, indicating a state of “greed.” This degree displays a major diploma of confidence amongst merchants relating to the longer term trajectory of Bitcoin’s value.

Such confidence persists regardless of the cryptocurrency going through a value decline during the last 48 hours.

This index, which gauges the feelings and sentiments driving Bitcoin traders’ habits, means that many merchants stay optimistic about BTC’s potential for restoration and progress.

Additionally, they’re doubtless shopping for into the market with the expectation that costs will rise. This optimistic sentiment aligns with the latest spike within the weighted sentiment indicator, each pointing to a typically bullish outlook available in the market.

Bitcoin stays in a bull pattern

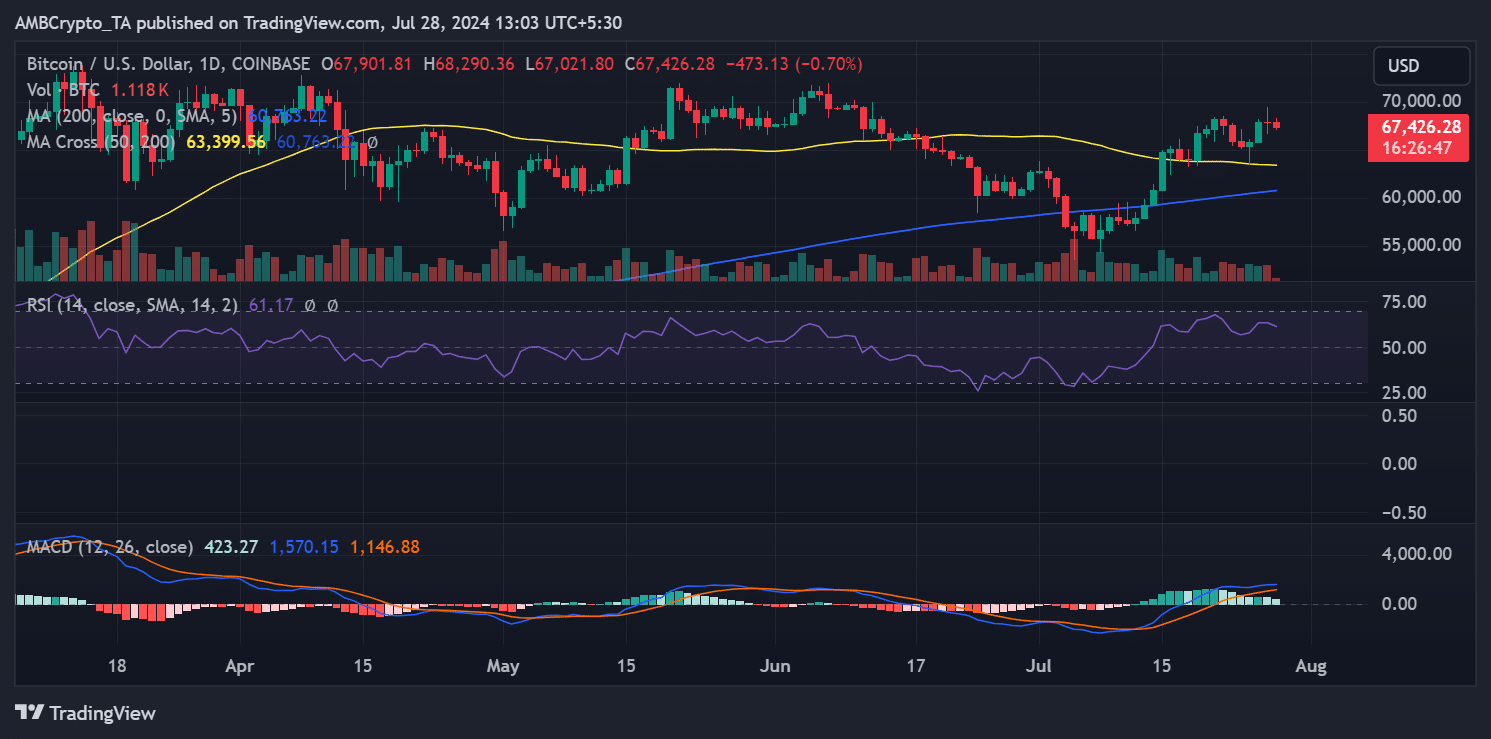

The Bitcoin value pattern just lately skilled a slight downturn however has managed to remain throughout the $67,000 vary.

As of the most recent updates, the value has continued to say no, though the lower remained lower than 1%, with BTC presently buying and selling at round $67,425.

Regardless of these minor declines, it was nonetheless in a bullish pattern. That is supported by its Relative Energy Index (RSI), which is presently at round 60, indicating a powerful bullish momentum.

Supply: TradingView

Learn Bitcoin (BTC) Worth Prediction 2024-25

Moreover, it was buying and selling above its short-term transferring common (depicted because the yellow line), which is performing as a help degree across the $63,000 mark.

This alignment above the transferring common additional confirms the continuing bullish pattern, suggesting that Bitcoin nonetheless has robust market help at these ranges.