- BTC has declined by 10% over the previous 30 days, but it was in declining bullish consolidation.

- An analyst eyed a brand new ATH, based mostly on earlier consolidation cycles.

Bitcoin [BTC], the biggest cryptocurrency, has skilled a pointy decline over the past weeks. In reality, at press time, the king coin was buying and selling at $57736 after recording a 9.58% decline previously week.

The month of August noticed the crypto expertise a particularly unstable market. The interval noticed the crypto drop to a neighborhood low of $49k earlier than making a average restoration.

Regardless of the latest decline, BTC remains to be 16.6% above its latest native low, consolidating in a declining but bullish development. Equally, it was 59.94% above the yearly low of $38505 recorded earlier this 12 months.

These indicators and market habits have left analysts predicting a repeat of a bull run 2.0 to a brand new report excessive. For example, common crypto analysts Mags eyes a brand new report excessive, citing historic cycles.

Market sentiment

In his evaluation, Mags cited the earlier two cycles with month-to-month consolidation, leading to one other bull run.

Based mostly on the cycle analogy, after BTC hits a backside after which a neighborhood high, a interval of consolidation follows, which is later preceded by a powerful bull run.

He shared his evaluation by X (previously Twitter), noting that,

“Bitcoin – Bull run 2.0 Incoming. The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.”

Supply: X

This argument factors to the earlier bull run, which resulted from months of consolidation.

Notably, consolidation performs a vital position in stabilizing the markets. This era permits the market to soak up latest worth motion, thus stopping excessive volatility.

Additionally, it helps within the discount of speculative strain since short-term merchants have a tendency to shut their positions.

With the entrants of long-term merchants, buyers begin accumulating which regularly builds demand thus leading to elevated shopping for exercise.

What Bitcoin’s charts counsel

Mags believed that one other bull run was imminent for the king coin. The query is, what do different indicators present?

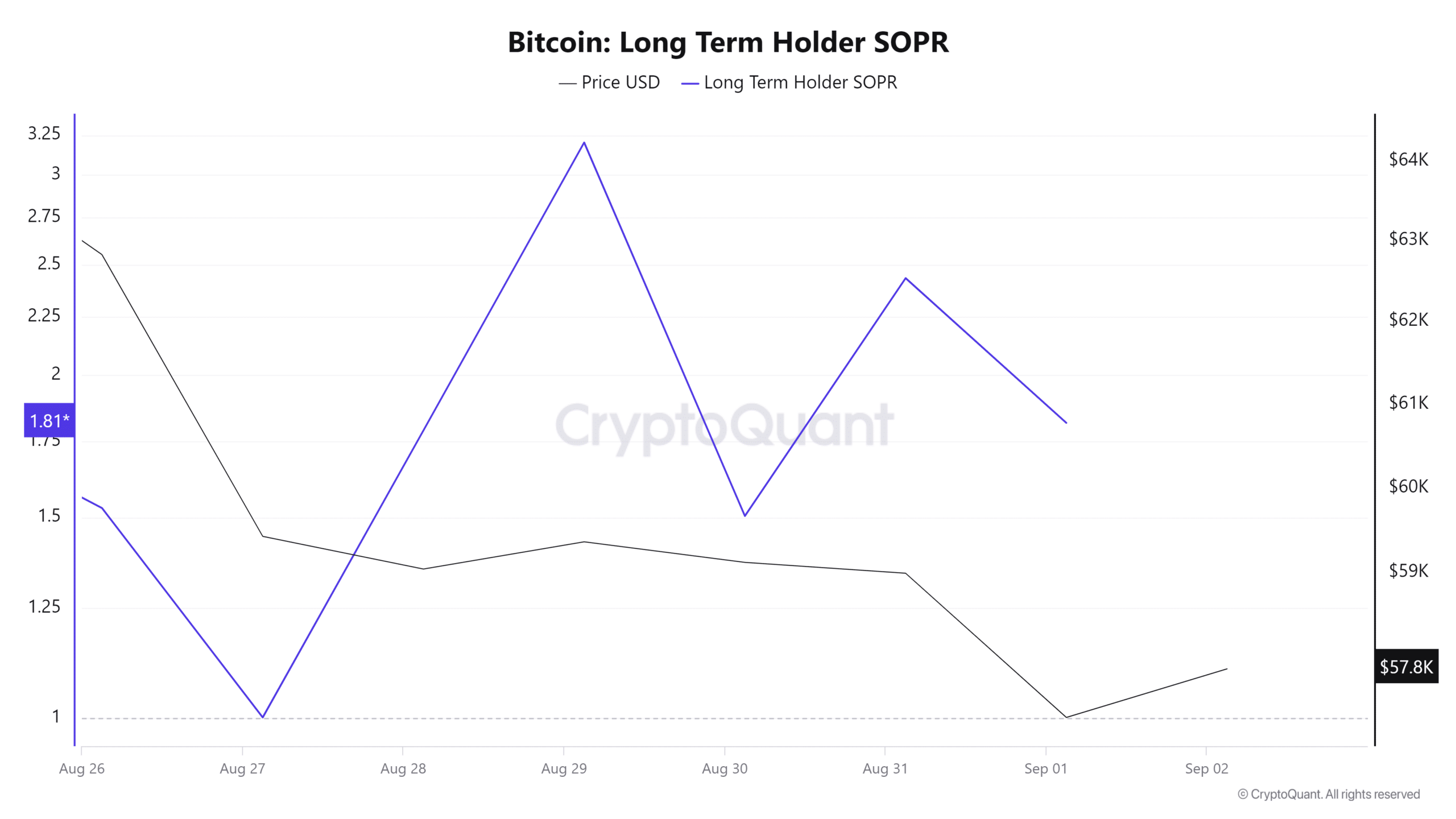

Supply: CryptoQuant

For starters, Bitcoin’s long-term holder’s SOPR has averaged round one over the previous seven days. When long-term holders’ spent output revenue ratio stays round one, it suggests crypto is bought at a price foundation.

This reveals market consolidation, with long-term holders neither in revenue nor losses. Such a state of affairs makes long-term holders proceed holding to attend for worthwhile gross sales sooner or later.

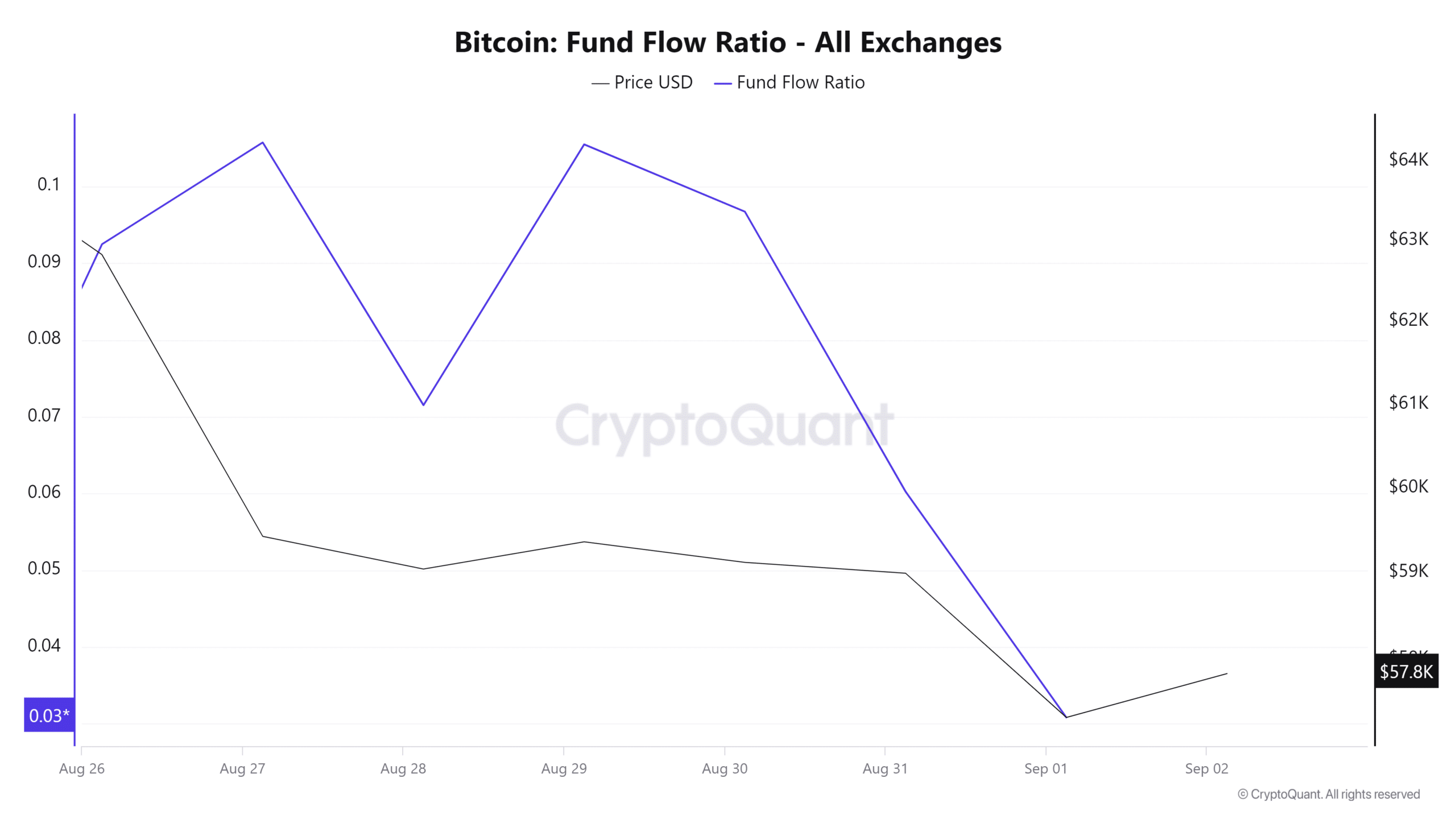

Supply: CryptoQuant

Moreover, the fund move ratio has been constantly beneath 1 over the previous seven days. Which means extra BTC has been withdrawn from exchanges, slightly than being deposited.

It is a bullish sign, indicating buyers are shifting their crypto off exchanges for long-term holding, thus lowering provide out there for fast promote.

Such strikes scale back promoting strain and enhance demand, which in flip helps in development reversal.

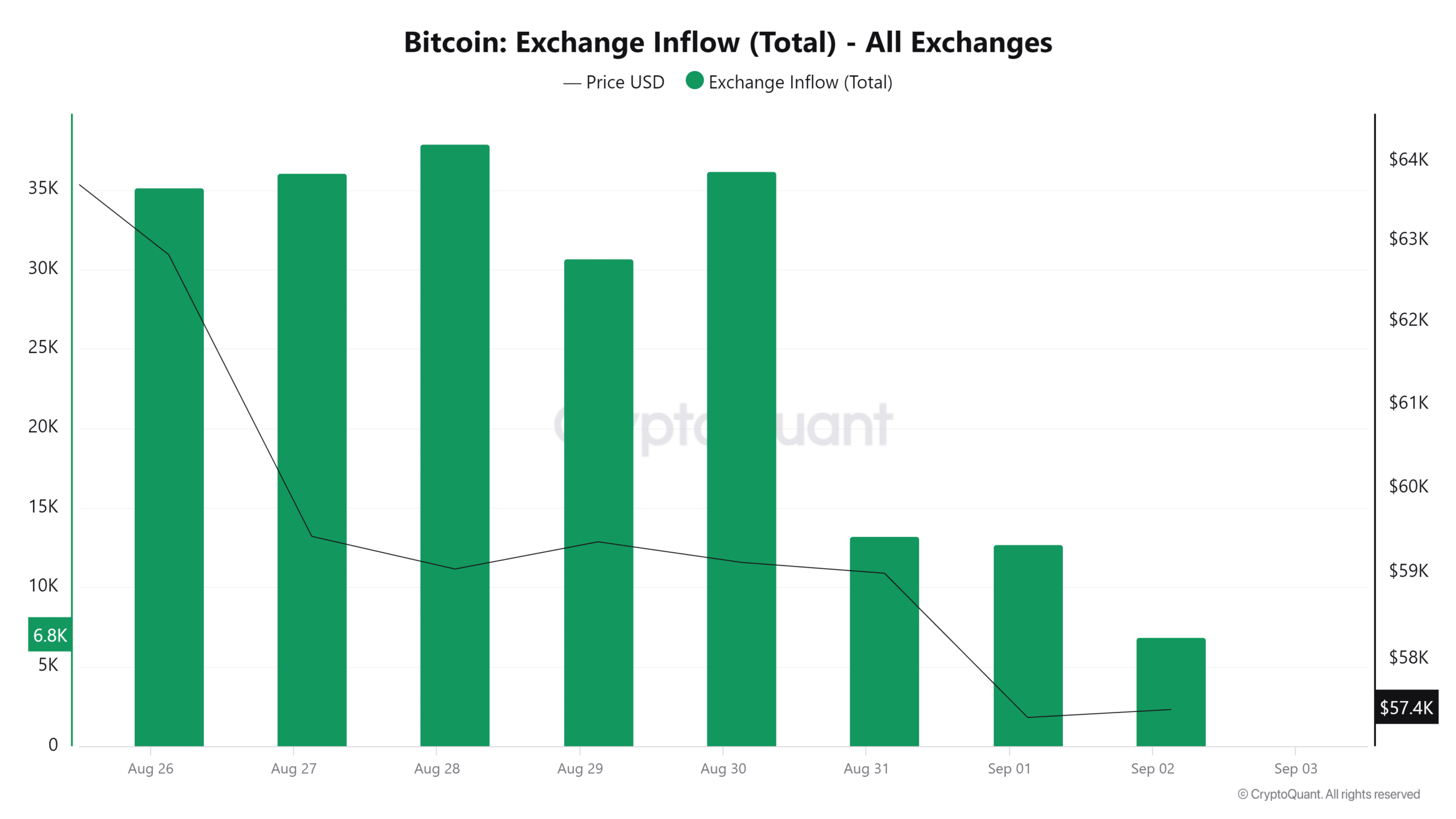

Supply: Cryptoquant

Lastly, BTC trade influx has lowered over the previous three days, from a weekly excessive of 37899.7 to a low of 6869. Such a decline in trade influx signifies holding habits, as buyers anticipate greater costs.

This market sentiment reduces promoting exercise, which is bullish as fewer cash are available for commerce.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Though BTC has declined over the previous 30 days, it’s in declining however a bullish consolidation. With elevated market indecision, buyers are turning to carry, thus lowering provide.

Such accumulation habits results in lowered provide and a rise in demand, which permits bulls to reclaim the markets. This can result in BTC breaking out above the $61159 resistance stage, doubtlessly in the direction of $70k.