- Bitcoin remained above a vital help degree at press time.

- Indicators revealed that BTC was buying and selling below its attainable market backside.

Bitcoin [BTC] bulls have taken a backseat over the previous few days because the king of cryptos’ volatility dropped. It was attention-grabbing to notice that whereas BTC consolidated, it managed to stay above a vital help degree.

This instructed that if issues fall in place, then the coin may start an upward rally within the coming days.

Bitcoin’s essential help degree

As per CoinMarketCap, Bitcoin’s weekly chart remained pink, and its worth solely moved up marginally within the final 24 hours.

On the time of writing, the king of cryptos was buying and selling at $59,443.16 with a market capitalization of over $1.17 trillion.

In the meantime, Titan of Crypto, a preferred crypto analyst, posted a tweet mentioning an attention-grabbing growth — BTC’s worth has been buying and selling simply above a crucial trendline (pink).

Supply: X

Notably, BTC hasn’t closed a candle beneath the pink line. Related episodes occurred again in 2021 and 2022. Throughout these occasions, Bitcoin registered promising bounce backs after touching the identical pink line.

If historical past repeats itself, then traders may quickly witness BTC gaining bullish momentum.

Will historical past repeat itself?

AMBCrypto then assessed the coin’s on-chain information to see what they instructed concerning a bounce again.

As per our evaluation of CryptoQuant’s information, BTC’s alternate reserve was dropping, indicating an increase in shopping for strain.

The king coin’s Miners’ Place Index (MPI) instructed that miners have been promoting fewer holdings in comparison with its one-year common.

This meant that miners have been assured in BTC and have been anticipating its worth to rise within the coming prime.

Supply: CryptoQuant

On prime of that, BTC’s Binary CDD was additionally inexperienced, that means that long-term holders’ motion within the final seven days was decrease than the typical. They’ve a motive to carry their cash.

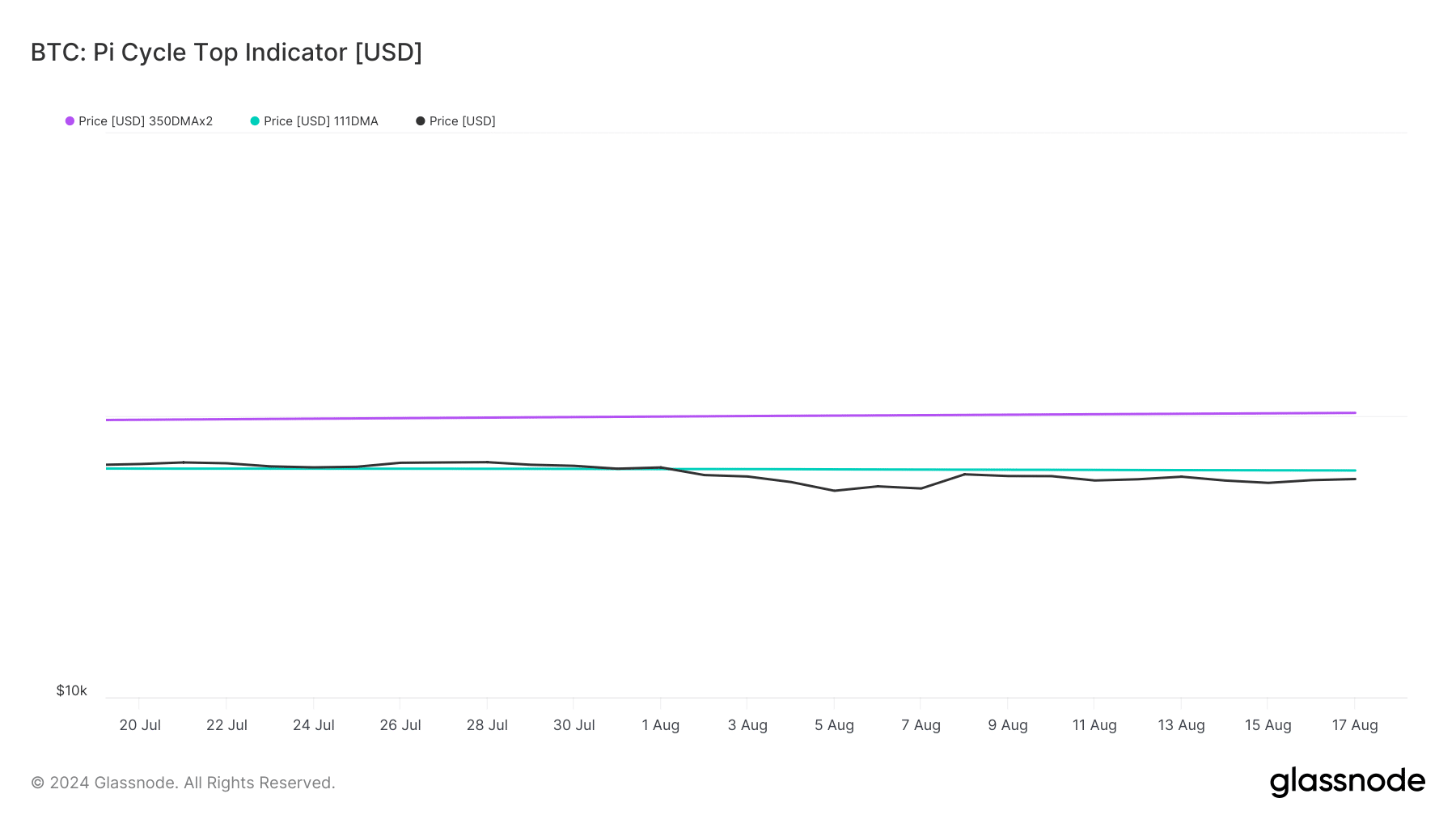

Our have a look at Glassnode’s information revealed yet one more bullish indicator. BTC’s Pi Cycle High indicator identified that BTC’s worth was resting below its attainable market backside of $63.7k.

This indicated that the probabilities of BTC reaching that mark have been excessive.

AMBCrypto reported earlier that BTC was additionally following one other historic pattern, which could end in a large bull rally in This fall 2024.

Supply: Glassnode

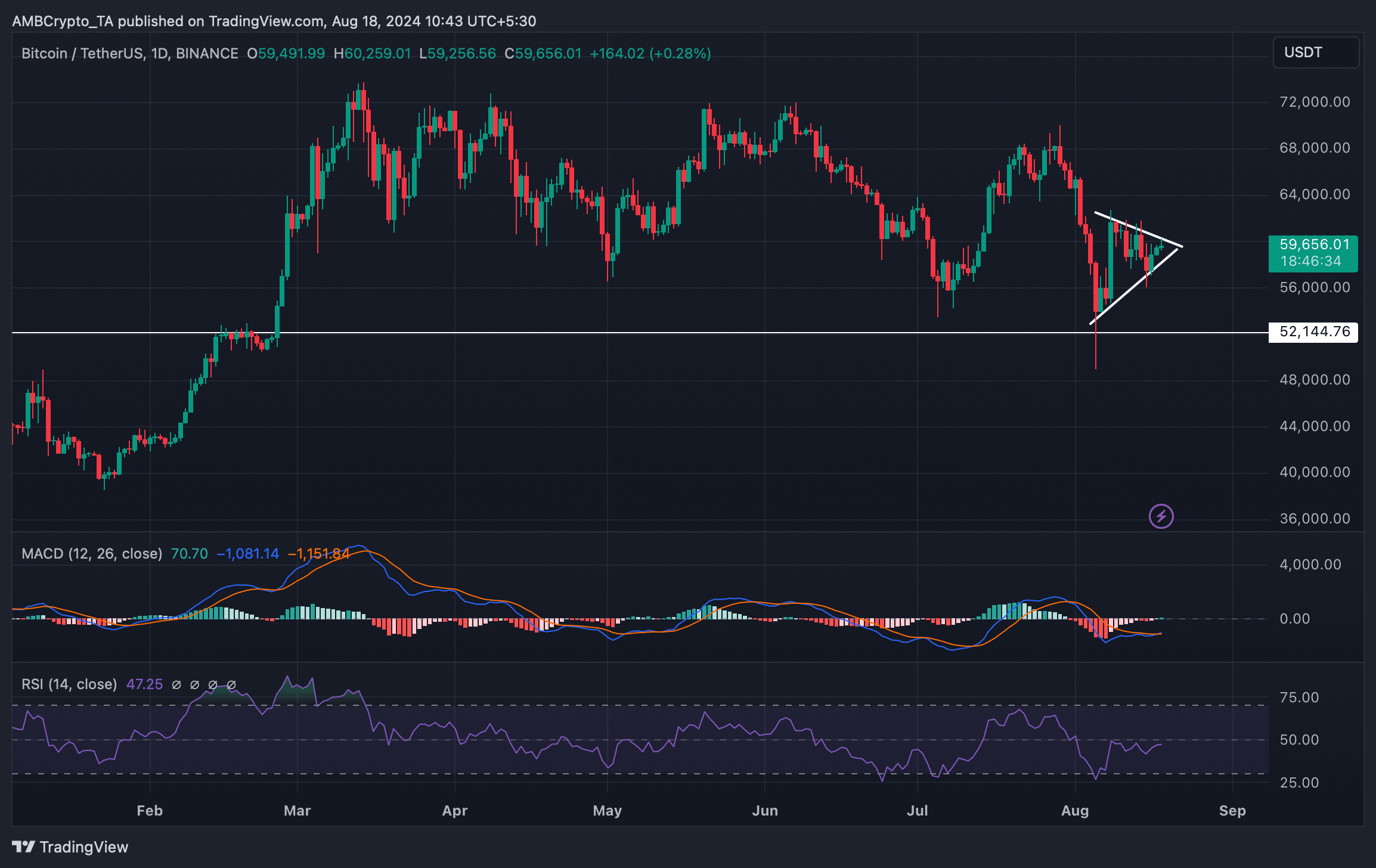

AMBCrypto then took a have a look at Bitcoin’s day by day chart to higher perceive what to anticipate within the short-term. Our evaluation revealed a bullish symmetrical triangle sample on BTC’s chart.

The technical indicator MACD displayed a bullish crossover.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

The Relative Power Index (RSI) additionally registered an uptick, suggesting a profitable breakout above the sample.

Nevertheless, if BTC fails to shut above the aforementioned pink line help, then it would plummet to $52k.

Supply: TradingView