- Bitcoin has reached a fork within the road- restoration, or an prolonged accumulation section.

- The long-term holders have been gradual in shopping for BTC regardless of the latest drops, a reticence that would spell hassle.

Bitcoin [BTC] continued to cling to the $61k help. Information of BTC miners transferring to Kaspa [KAS] would possibly set off extra worry out there, a latest AMBCrypto report revealed.

An analyst claimed that miners promoting their property to improve their {hardware} after the halving or for money wants may not affect the market as closely as anticipated.

So, are BTC holders prepared for costs to rally? Or will the promoting strain proceed from elsewhere?

Lack of demand mixed with long-term holder habits brought on worries

Supply: Farside Buyers

The ETF flows have been primarily unfavorable in two weeks, with solely the earlier two days bringing some reduction from the promoting strain.

This hinted at bearish sentiment for BTC from buyers, however it isn’t but clear whether or not that sentiment has begun to swing the opposite method or if this can be a momentary respite earlier than one other wave of promoting.

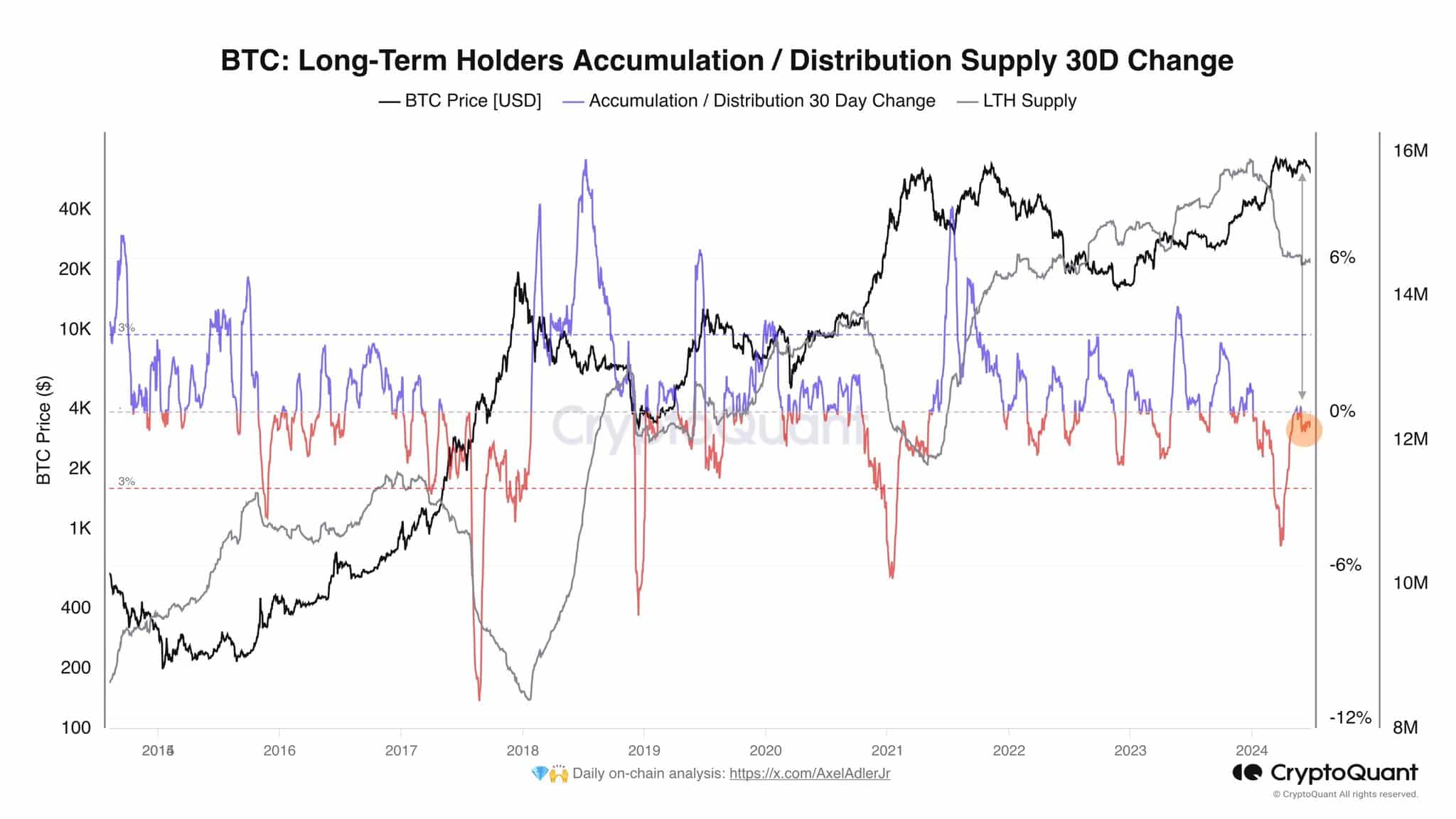

Supply: Axel Adler on X

Crypto analyst Axel Adler noticed on X (previously Twitter) that the long-term holders’ provide change was minimal in latest weeks. This lack of LTH development was an indication of pessimism throughout the market.

Provide in revenue turns again from overheated zone

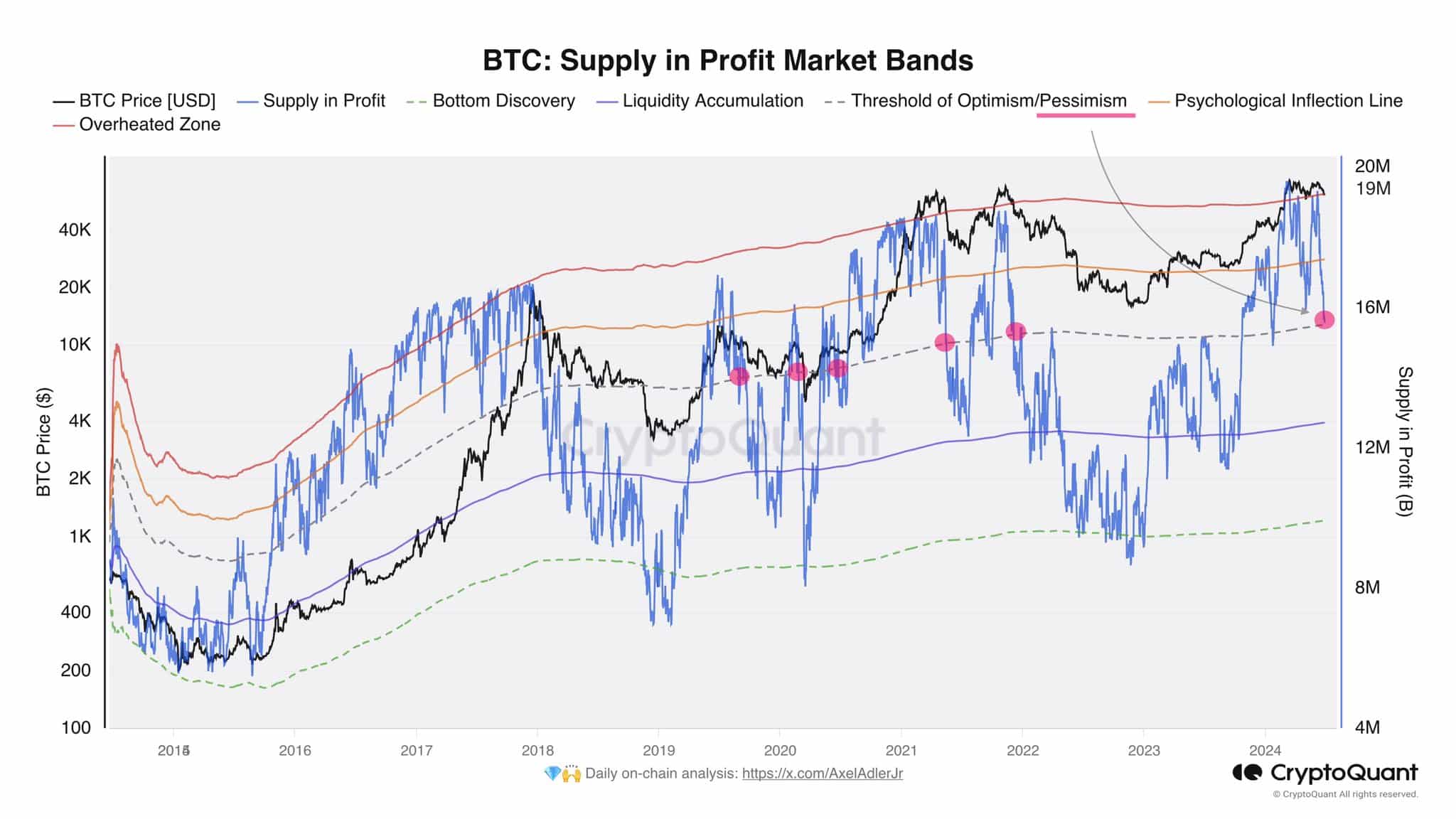

Supply: Axel Adler on X

The analyst additionally identified that the provision in revenue was at an inflection level. The brink of optimism/pessimism had been reached.

Up to now 4 years, every time the provision in revenue line crossed under this level, the market would possible go towards an prolonged accumulation section.

This may be accompanied by a value drop and will dampen the bullish expectations that the market has for BTC after the halving in Might.

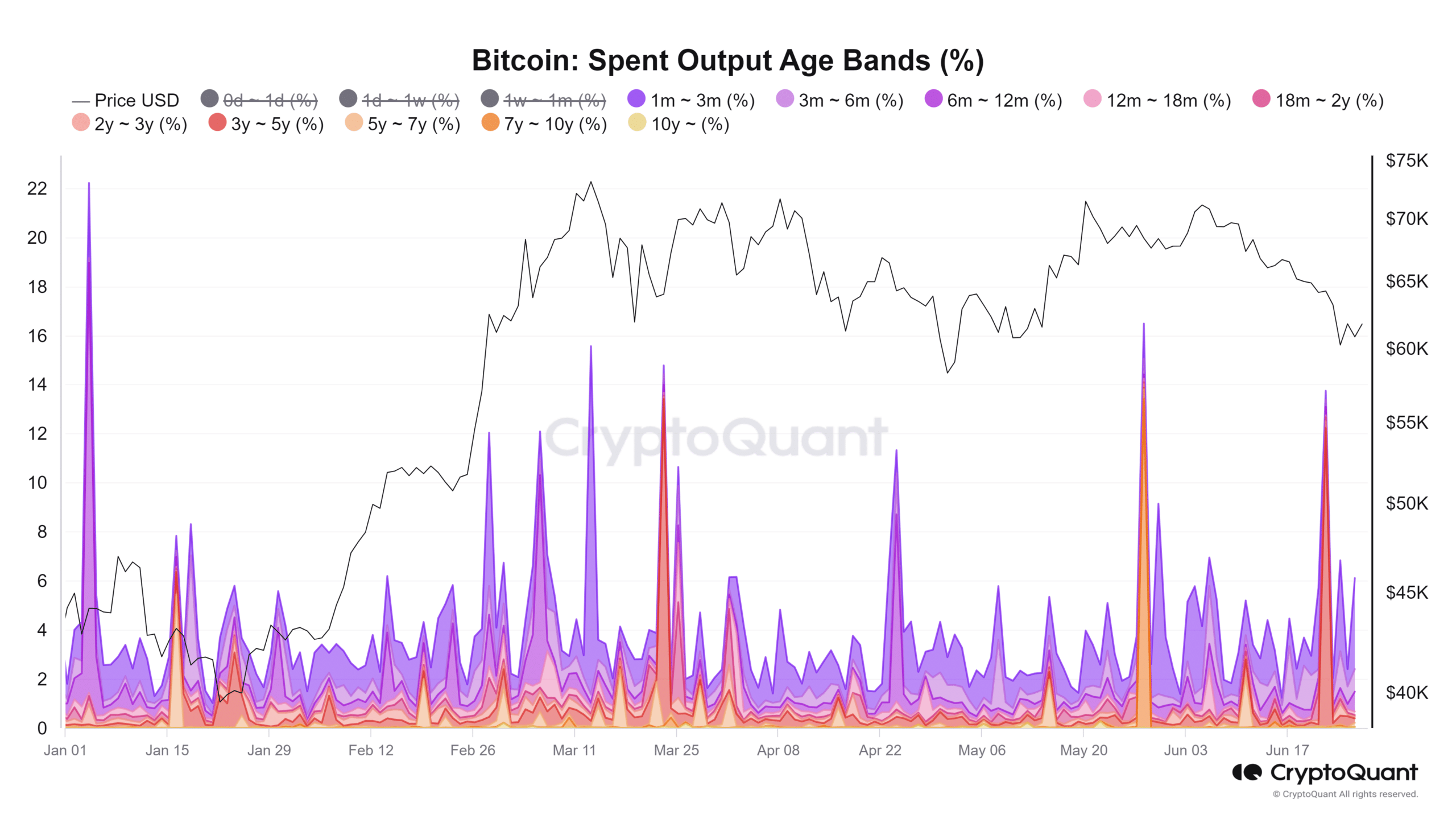

Supply: CryptoQuant

The spent output age bands confirmed that late Might and mid-June noticed massive coin actions from the 7-10-year holders and 3-5-year holders respectively.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This urged that long-term holders have been possible promoting and was an indication of an absence of conviction.

It doesn’t assure additional value downturns however it’s a signal that the promoting strain has not receded but.