- The web place change for long-term holders has switched to constructive.

- BTC has flipped its earlier instant resistance to assist.

Bitcoin [BTC] efficiently surpassed the $60,000 mark, buoyed by growing confidence amongst traders and a predominantly bullish sentiment available in the market.

Alongside new patrons, long-term holders are additionally re-engaging with the market, signaling a return to type for the king coin.

Purchase Bitcoin!

Information from Santiment signifies that Bitcoin merchants are regaining their confidence, as mirrored within the social quantity metrics, significantly in shopping for actions.

Particularly, the purchase social quantity skilled a major spike, illustrating heightened purchaser curiosity and exercise.

On fifteenth July, the purchase sentiment rating reached round 117, surpassing the promote social quantity, which stood at roughly 92 throughout the identical interval.

This disparity between purchase and promote volumes means that the market sentiment is presently skewed in the direction of shopping for, with extra contributors opting to amass BTC reasonably than promote.

This development signifies the present Concern of Lacking Out (FOMO) sweeping by way of the market as merchants and traders rush to capitalize on the perceived upward trajectory of Bitcoin’s worth.

Such dynamics usually contribute to sustaining and probably accelerating value will increase as demand outstrips provide.

Bitcoin welcomes again long-term holders

Latest knowledge from Glassnode on Bitcoin’s long-term holders’ internet place change metric gives insightful proof of the cryptocurrency’s present bullish development.

Beforehand, this metric was destructive, indicating that long-term holders have been lowering their positions — basically, they have been promoting greater than they have been shopping for.

This internet promoting development endured for the higher a part of the month, contributing to a bearish sentiment amongst established traders.

Supply: Glassnode

Nonetheless, there was a notable shift on this dynamic lately. The development has reversed, and the metric now exhibits a constructive worth.

As of the newest evaluation, the web place change is almost 13,000. This constructive shift signifies that long-term holders are accumulating Bitcoin as soon as once more.

The development alerts their renewed confidence in its potential for additional appreciation. This accumulation part by seasoned traders is often a robust bullish sign.

BTC breaks $60,000

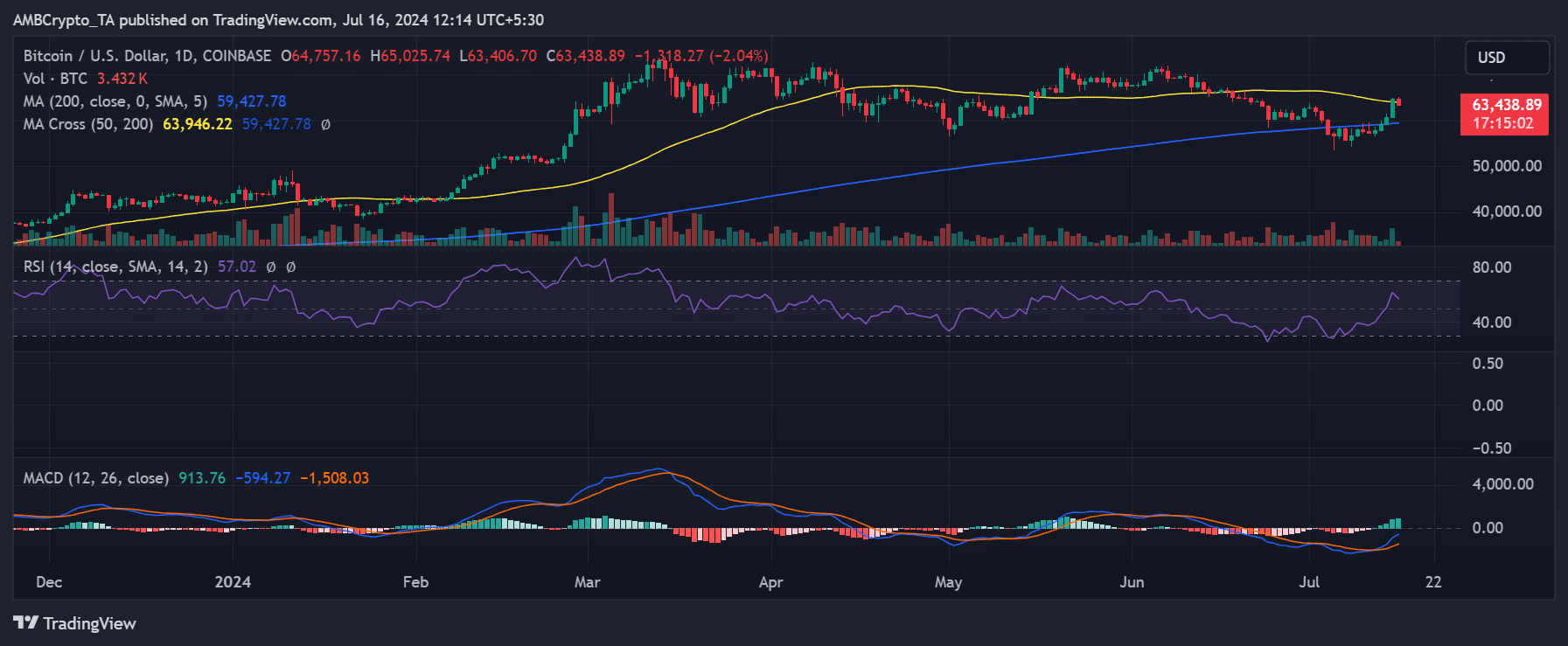

In accordance with AMBCrypto’s evaluation of the day by day time-frame chart for Bitcoin, it skilled a major uptrend on fifteenth July. BTC climbed by virtually 7% to commerce at round $64,757. Additionally, this marked the primary occasion throughout the month that it reached this value degree.

Moreover, it was the primary time in virtually a month that Bitcoin surpassed its brief transferring common (yellow line), which had beforehand acted as a resistance degree on this value vary.

Supply: TradingView

As of this writing, BTC was buying and selling at round $63,400, reflecting a decline of over 2% from its current excessive.

Learn Bitcoin (BTC) Value Prediction 2024-25

Regardless of this slight downturn, it has remained above the short-moving common, suggesting that the yellow line may now act as a assist degree.

This shift from resistance to assist might point out a possible stabilization or additional positive factors if Bitcoin maintains its place above this vital threshold.