- Bitcoin has climbed to a 20-week excessive above $71,000 amid constructive market sentiment.

- With 98% of holders in earnings, FOMO might propel BTC to a brand new ATH earlier than the top of Uptober.

Bitcoin [BTC] has been trending up this month and not too long ago reached a 20-week excessive above $71,500. At press time, BTC traded at $70,900 and was solely 3.7% shy of its all-time highs.

A number of bullish indicators presently counsel that Bitcoin might kind a recent ATH earlier than the top of “Uptober” amid constructive market sentiment.

Bitcoin UTXO Realized Value

A have a look at the Bitcoin UTXO Realized Value for short-term holders means that costs might proceed to rise within the quick time period.

Per CryptoQuant, the UTXO Realized Value for wallets which have held BTC for beneath a month is near surpassing that of wallets which have held Bitcoin for between three to 6 months.

Previous crossovers have usually preceded vital value will increase. An analogous crossover is about to occur, which might strengthen the bullish narrative round BTC.

Supply: CryptoQuant

Quick-term holders normally decide the sustainability of a rally. Subsequently, if new transactions begin occurring at greater costs, it’ll enhance market sentiment and pave the way in which to an ATH.

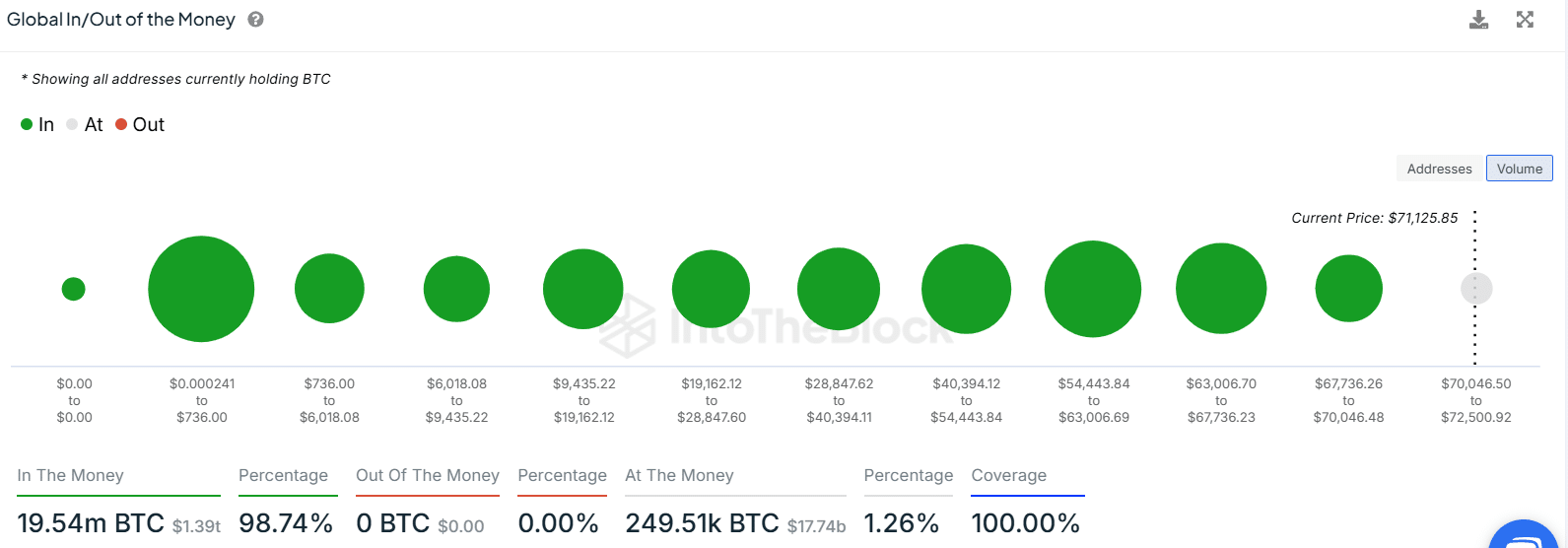

98% of holders are in earnings

Knowledge from IntoTheBlock exhibits that 98% of BTC holders are sitting in earnings whereas 1.26% are at a break-even level.

Supply: IntoTheBlock

When pockets profitability will increase, it boosts investor confidence as holders turn into extra prepared to carry their belongings reasonably than promote. This state of affairs may also stir the worry of lacking out (FOMO). Consequently, new patrons might enter the market, reinforcing the uptrend.

FOMO is already evident because the Concern and Greed Index sits at 72. This exhibits that the market is in a state of greed.

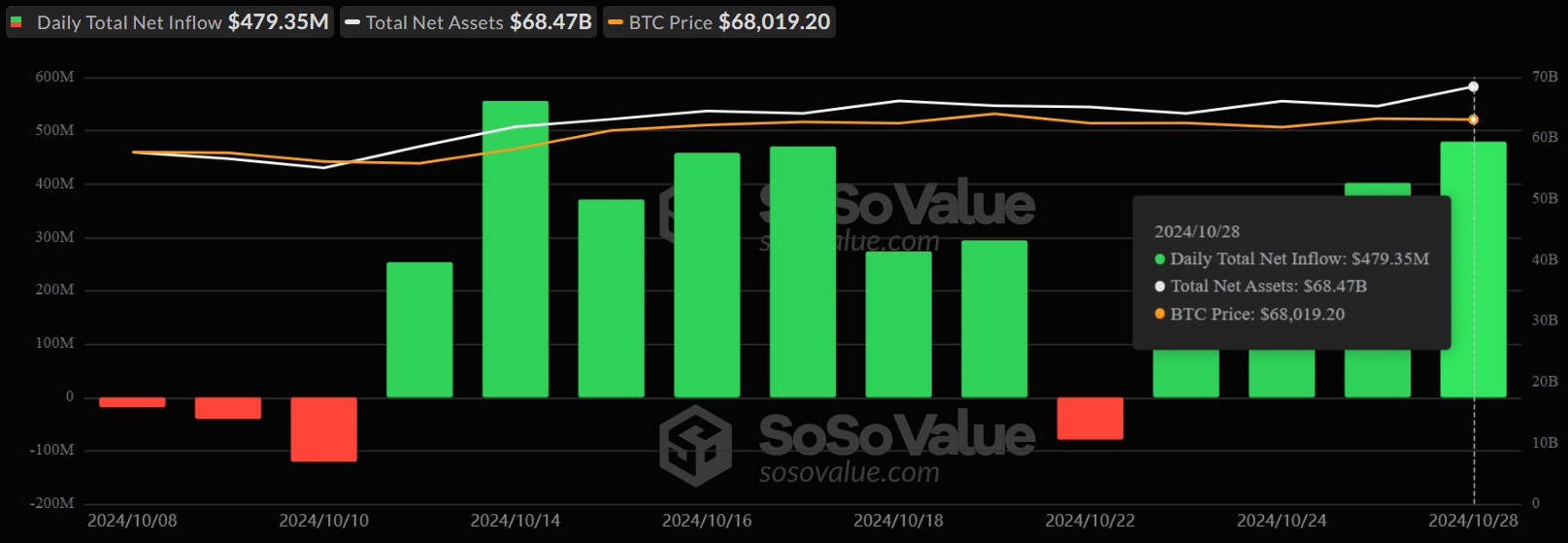

Rising demand for BTC ETFs

On twenty eighth October, US spot Bitcoin exchange-traded funds (ETFs) recorded their highest inflows in two weeks. Per SoSoValue, inflows throughout the day got here in at $479M, with Blackrock taking the most important share with $315M inflows.

Supply: SoSoValue

As AMBCrypto reported, BlackRock’s BTC holdings have surpassed 400,000 cash, with the asset supervisor being on monitor to flipping Satoshi and turning into the most important Bitcoin holder.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

US spot Bitcoin ETFs collectively maintain $68.47 billion value of belongings, which is 4.9% of Bitcoin’s provide. In simply two weeks, these ETFs have recorded $3 billion in netflows.

As Bitcoin attracts new curiosity from each retail and institutional traders, its market dominance over altcoins has continued to soar. At press time, Bitcoin’s dominance stood at 60% whereas the altcoin season index had dropped to 27.