- Bitcoin reputation is a small fraction of what it was in March 2024.

- The market capitalization charts gave bullish alerts for the long-term.

Bitcoin [BTC] market sentiment was beginning to flip bullish. The Crypto Worry and Greed Index stood at 63 to indicate greed was predominant available in the market after BTC raced previous the $64k resistance zone.

In a publish on X, person Alex Becker famous that regardless of the joy inside the crypto group, the curiosity from the broader market was minimal. It was solely a fraction of the frenzy seen in the course of the 2020 run.

Supply: Google Tendencies

A have a look at the recognition of the time period “Bitcoin” on Google Tendencies underlines this level. It reached the zenith of its reputation within the first half of 2021. The rally from final October to March 2024 noticed BTC reputation attain a rating of 58.

In distinction, the rating it set final week was 20. This meant that Bitcoin searches are solely a 3rd of what they had been earlier this yr, even because the king of crypto trades simply 11% beneath its all-time excessive.

AMBCrypto took a more in-depth have a look at different charts to grasp what this implies for the broader crypto market.

Bitcoin Dominance is vital for understanding capital circulation

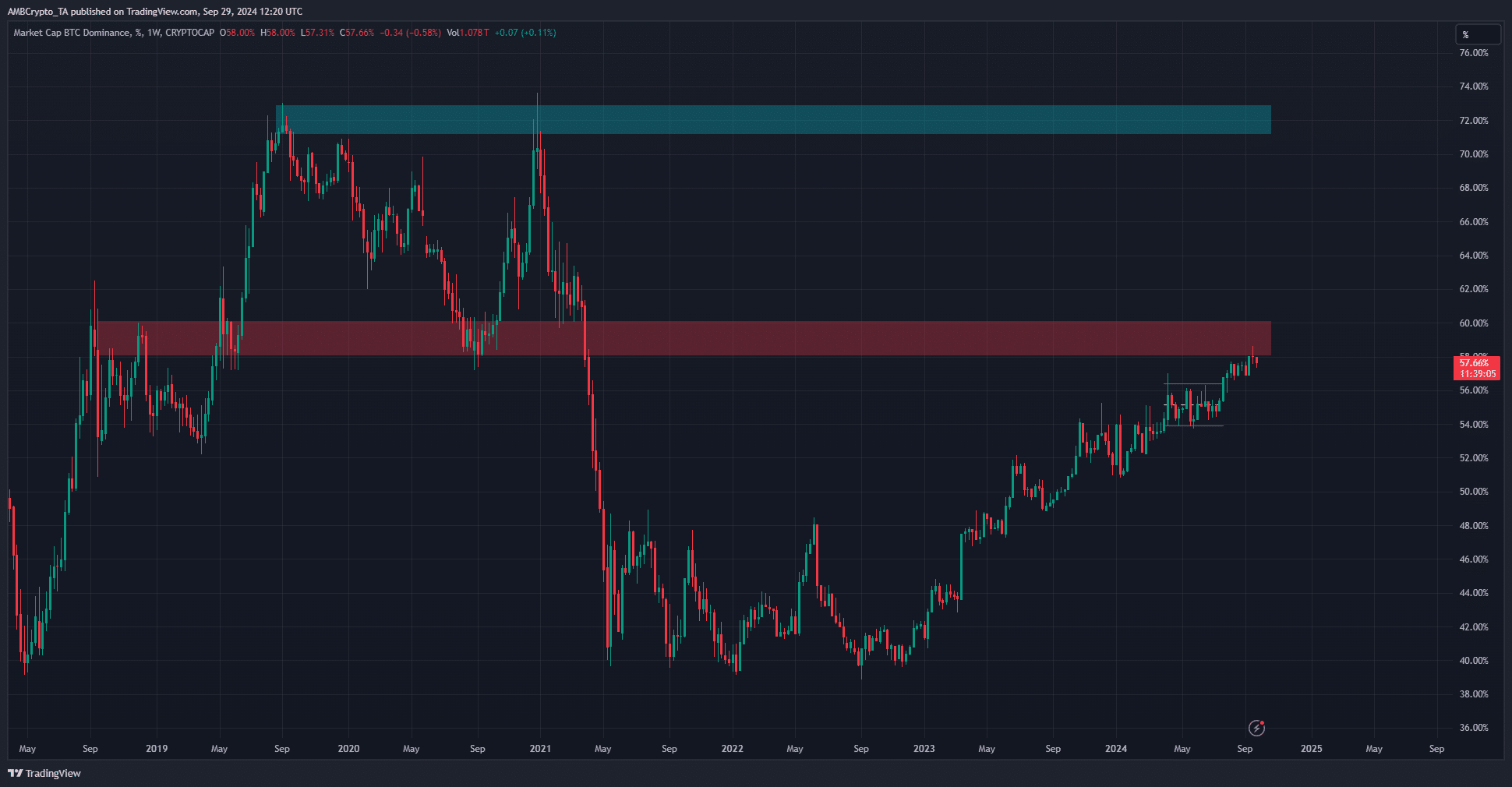

Supply: BTC.D on TradingView

At press time, the whole crypto market capitalization was $2.3 trillion. The Bitcoin Dominance, or BTC’s share of the whole market cap, stood at 57.66%. The weekly chart outlined the 60% space as a resistance zone.

The BTC.D chart usually has an inverse correlation with how properly alts carry out. A fall in BTC.D signifies that the altcoin market cap is rising sooner than BTC’s, which might be a constructive improvement for the alt market.

Nevertheless, evaluating with the 2020 cycle, we see that it might be excellent if Bitcoin can embark on a long-term uptrend to attract capital to the crypto market. As soon as it does, this capital can “rotate” into different altcoin sectors, which merchants and buyers can revenue from.

Lengthy-term buyers can use this dominance chart to grasp whether or not Bitcoin or the altcoins are the market’s focus at any given time.

One other constructive signal for alt season

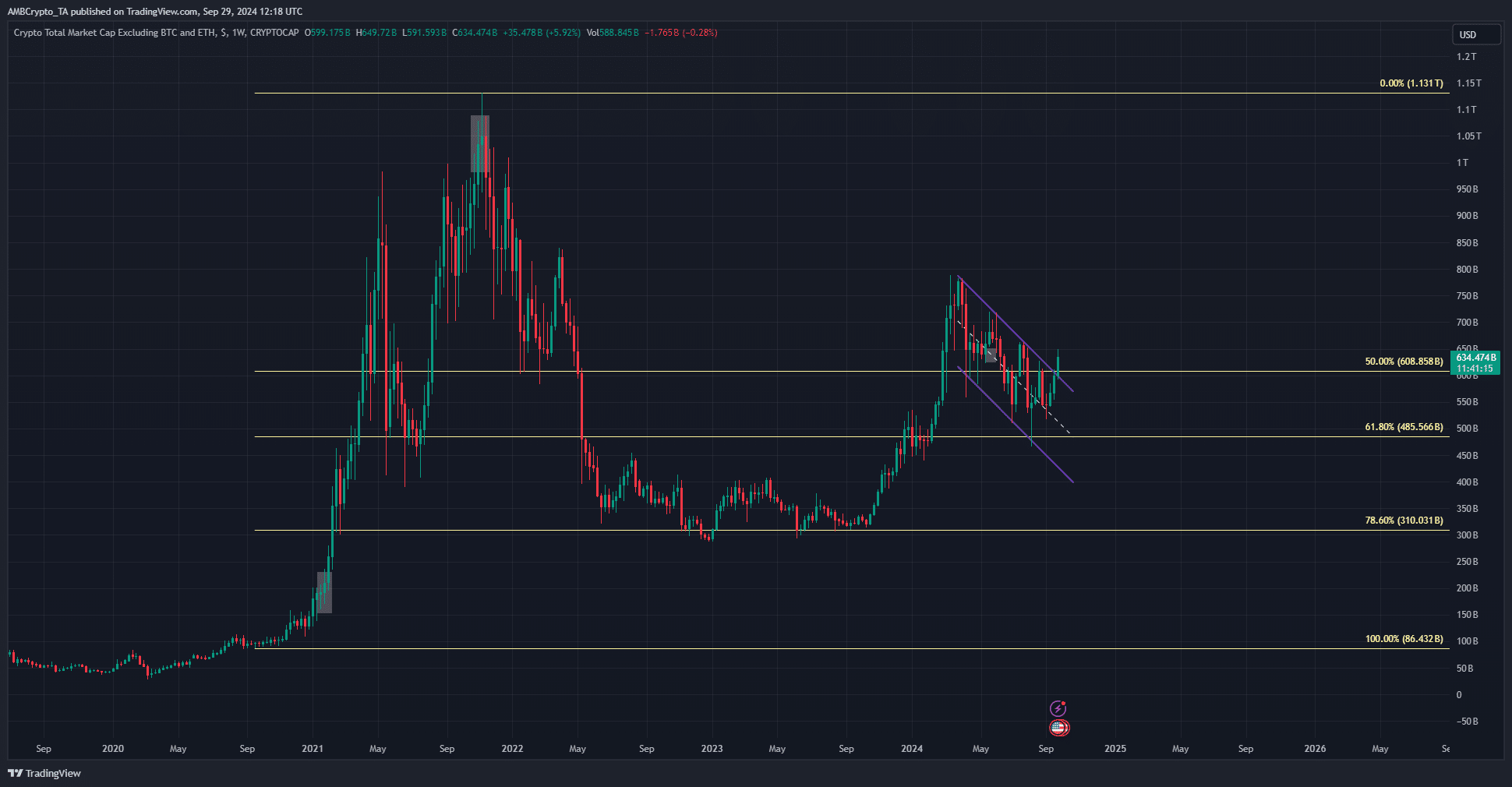

Supply: TOTAL3 on TradingView

The market capitalization of the highest crypto property excluding Bitcoin and Ethereum [ETH] are represented on the chart above. It broke out previous a descending channel formation.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In doing so, it additionally breached the 50% Fibonacci retracement stage from the 2020 bull run.

This set the stage up properly for a robust efficiency from the altcoins within the coming months. From a technical perspective and historic developments, the one approach for the crypto market to go is upward over the following 3-6 months.