- Bitcoin worth motion confirmed low orderbook depth.

- Market indicators say the best way is up.

Lately, Bitcoin [BTC] has skilled a major drop, very like different cryptocurrencies, following the market crash on fifth August.

Regardless of a quick restoration that pushed Bitcoin to $60K, it confronted sturdy resistance and rapidly fell to $54K.

On the 1-hour timeframe, BTC worth motion confirmed low orderbook depth at 0-1% and 1-5%. Traditionally, low orderbooks have typically signaled the underside of a rally, adopted by a bullish development.

Supply: Hyblock Capital

This means that watching the orderbooks intently for a possible reversal in This fall 2024 will likely be essential for predicting future worth actions.

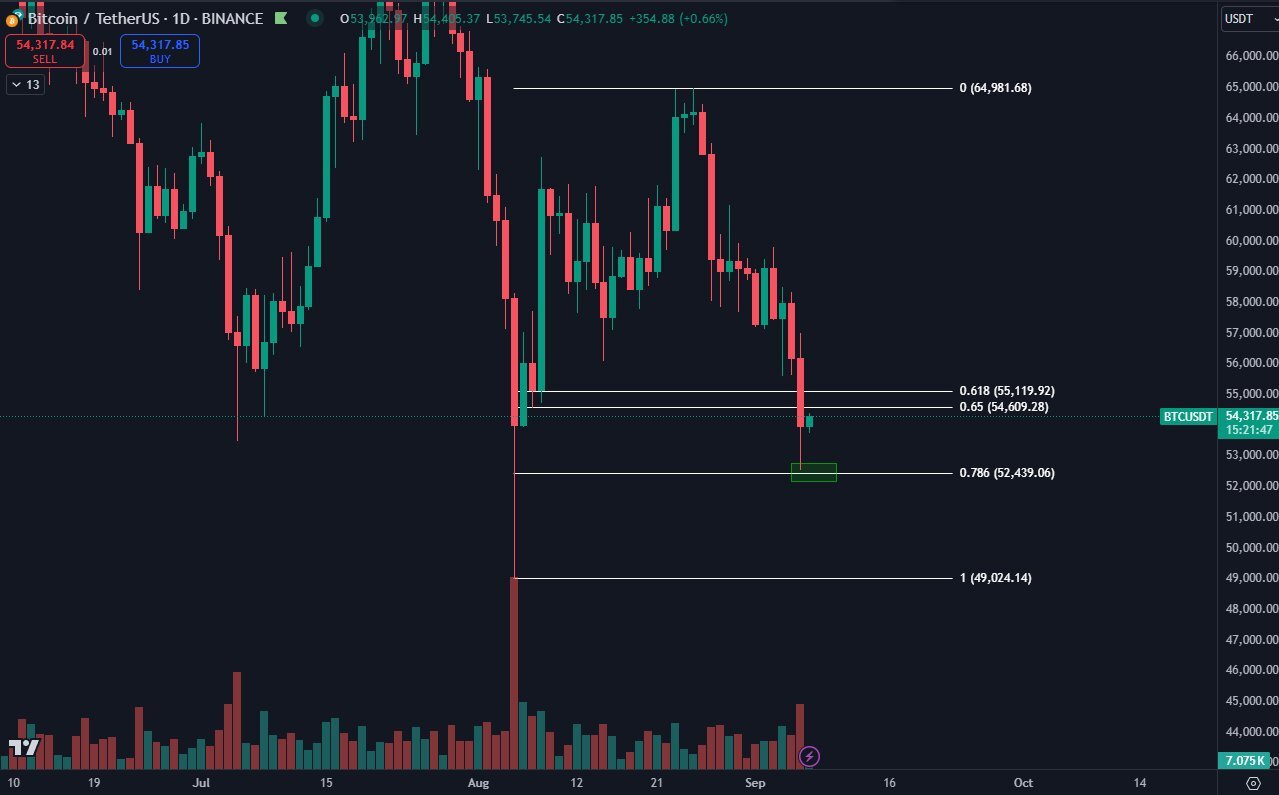

BTC Fibonacci ranges

Bitcoin’s worth motion, BTC did not respect the 0.618 Fibonacci degree however did bounce from the 0.786 degree, which has been essentially the most dependable Fibonacci retracement this 12 months.

This degree now represents the final likelihood for a better low, which might sign a possible bounce if mixed with low orderbook depth.

If Bitcoin follows previous patterns, filling the big wick attributable to the Japanese inventory market crash might result in a bounce, pushing the worth greater.

Supply: TradingView

Nevertheless, if the sample fails, BTC could decline additional earlier than seeing a rebound.

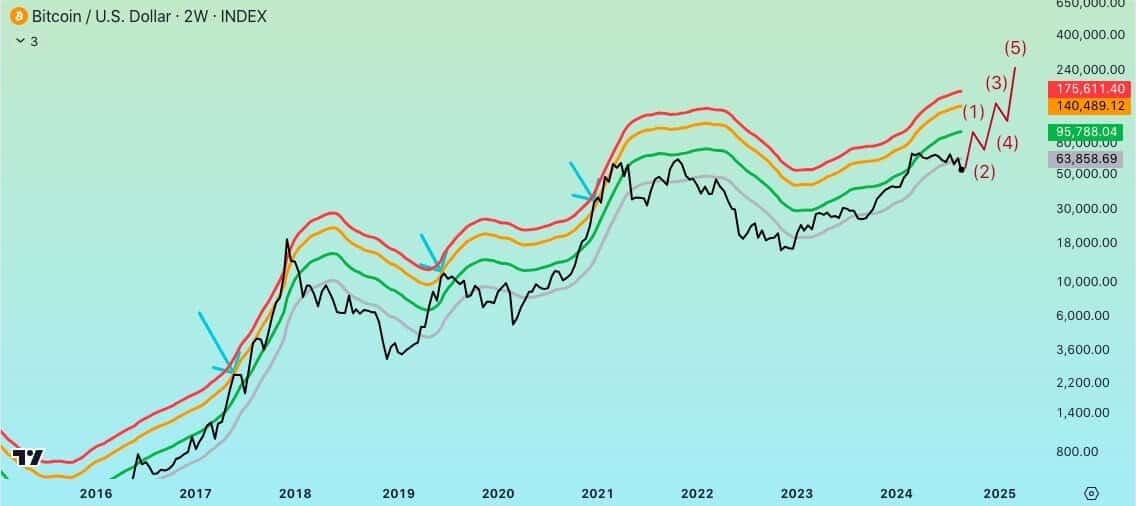

Bitcoin’s Mayers band

The Mayer’s Band gives further insights into this Bitcoin bull cycle. It means that the cycle just isn’t over but, with a possible goal of $95K, which might not sign the cycle’s finish.

An extended-term goal of $140K is feasible. For long-term merchants, staying away from short-term charts could also be smart till Bitcoin reaches a brand new all-time excessive.

The period and magnitude of this Bitcoin cycle seem like larger than earlier cycles, which might point out extra development forward.

Supply: TradingView

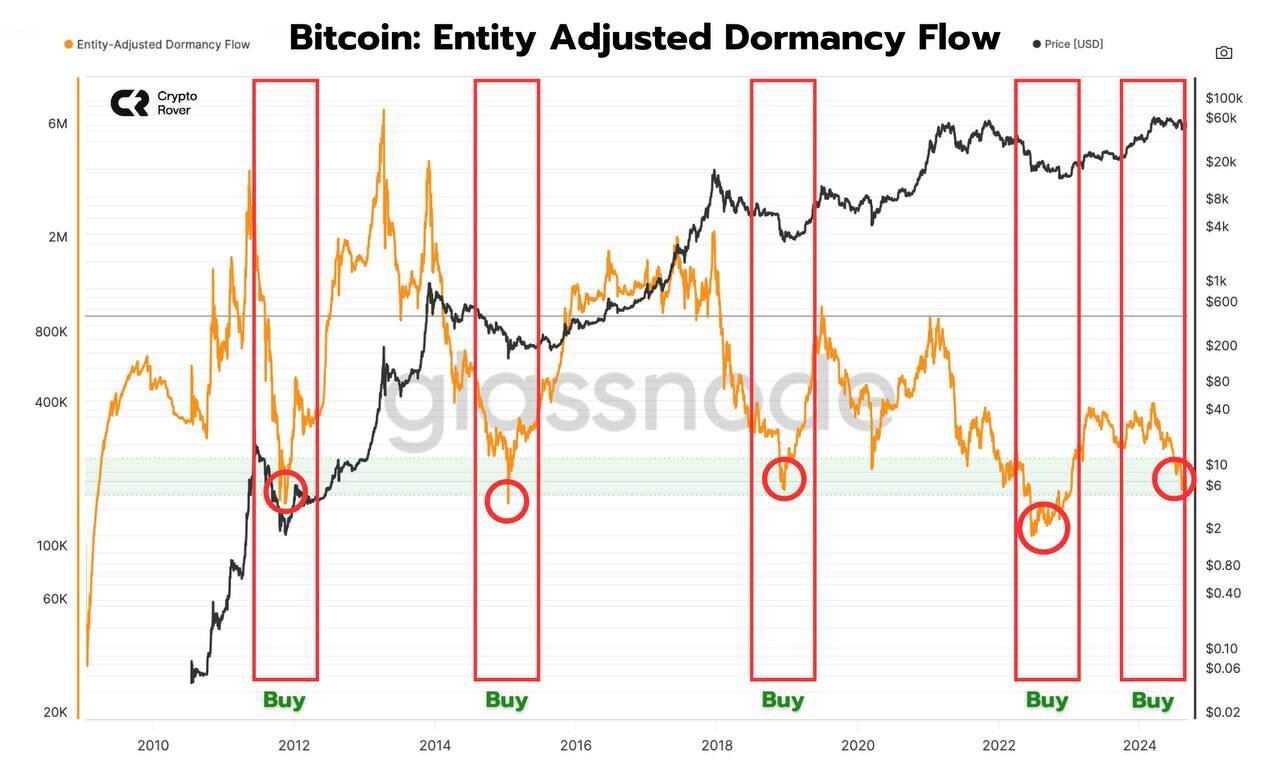

Bitcoin adjusted dormancy stream

One other key indicator is the Bitcoin adjusted dormancy stream, which presently reads round $10. Traditionally, BTC worth has all the time bounced from these ranges.

When mixed with the low orderbook depth, this provides additional confidence to the concept Bitcoin might see a worth rebound quickly.

There may be additionally the chance that BTC may briefly drop to $50K earlier than making a major upward transfer, doubtlessly displacing its all-time excessive.

Supply: Glassnode

Bitcoin whale exercise rising

Lastly, whale exercise is on the rise, with BTC whales rising their lengthy positions with low leverage, sometimes between 1.2x and 3x.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Not like retail merchants, whales use algorithms to Greenback Value Common (DCA) into low-leverage longs as the worth drops, avoiding emotional decision-making.

This calculated strategy from Bitcoin whales might assist propel BTC worth to new, greater ranges as they accumulate through the downturn, setting the stage for a doable main worth surge.

Supply: TradingView