- Bitcoin’s hashprice has hit a report low, stroking fears of one other spherical of miner disaster.

- Community Issue was up 10%, and every day miner income has tanked by 50%.

Bitcoin’s [BTC] hashprice, which tracks miner income, has dropped to a report low, elevating fears that BTC miners may face one other profitability disaster.

In response to the Hashrate Index knowledge, the hashprice dropped to $40 per computing energy unit per day on the eighth of August.

This was under even the 2022 crypto winter, which bottomed out at $60 per unit amidst an enormous BTC miner disaster.

Supply: Hashrate Index

With the falling hashprice, the BTC Miner Income Per Day additionally declined from $40 million on the twenty ninth of July to round $24 million on the seventh of August, per YCharts knowledge.

Bitcoin community problem will increase

Miners’ woes have been compounded by rising BTC community problem, which has hit a report excessive of 90 trillion in August, up from 80 trillion in mid-July.

Which means the computing energy wanted to mine BTC or discover a block has elevated by practically 10%.

This might put subscale miners below a lot strain and tip them to promote their BTC holdings to cowl operational prices or shut down.

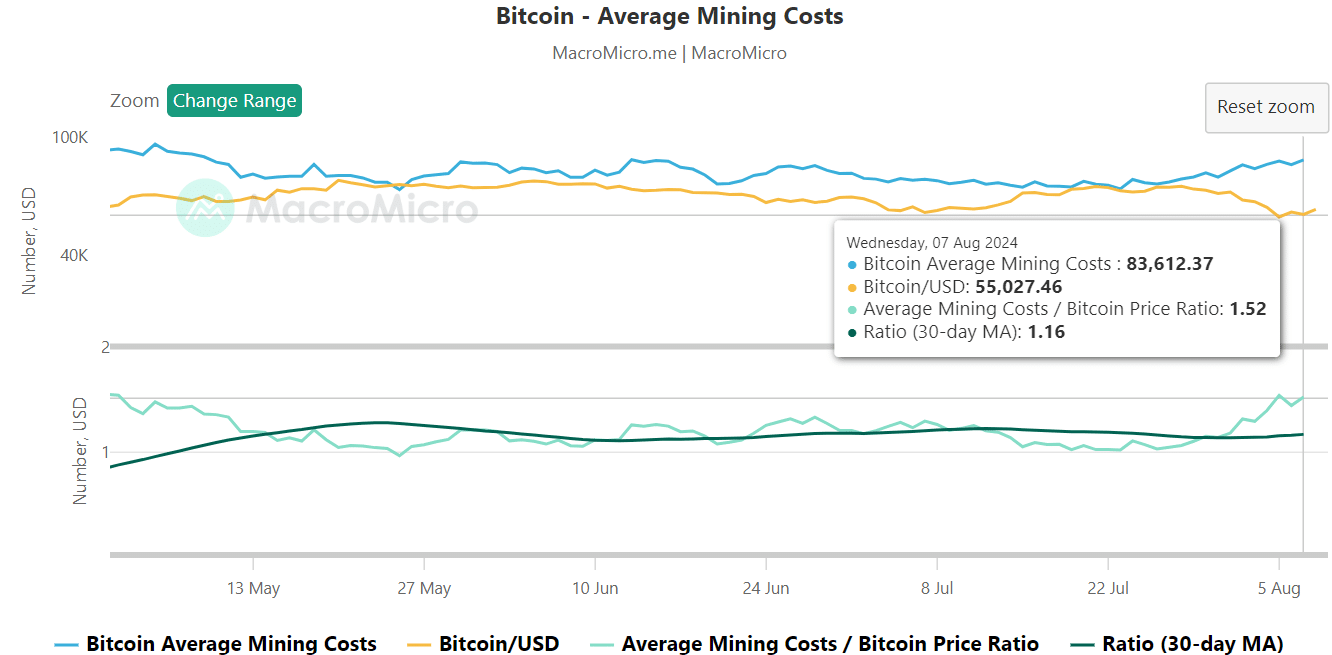

On the seventh of August, the typical mining value was $83.6K towards the BTC worth of $55K, per MacroMicro knowledge. That’s a whopping +$23K shortfall.

Supply: MacroMicro

Nonetheless, well-scaled and optimized miners, like Marathon {Digital}, have a median mining value of $43K.

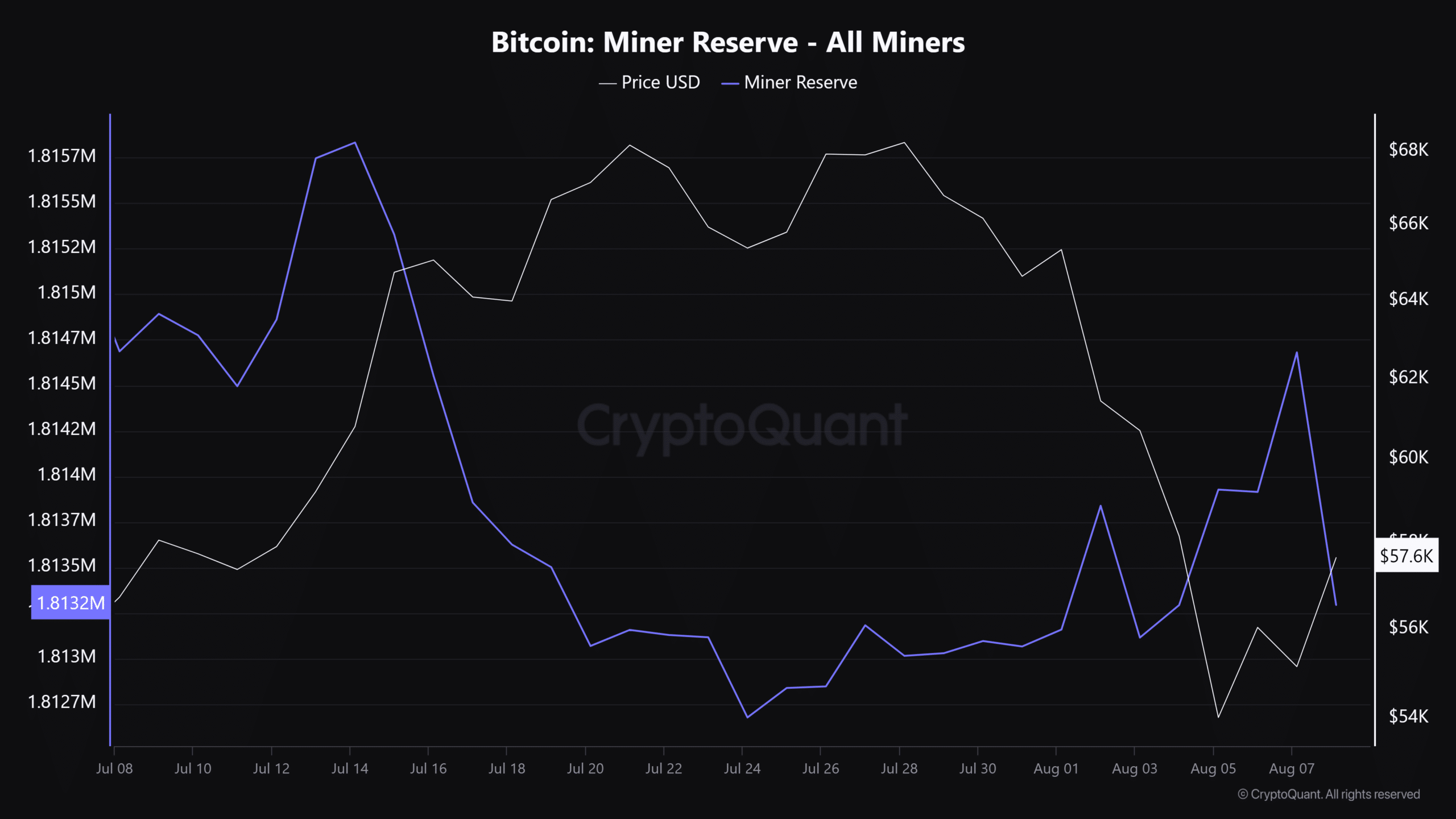

In response to CryptoQuant founder Ki Younger Ju, it meant that they may solely be apprehensive if BTC dropped under the worth for method too lengthy.

Supply: CryptoQuant

In the meantime, BTC Miner Reserve dropped by over 1,100 BTC on the seventh of August, denoting that some miners offered off a part of their holdings.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

The metric tracks whole BTC miner holdings, which have risen since late July. It denotes that they had been holding even throughout final week’s dump.

Nonetheless, miner sell-offs may additionally put strain on BTC costs. As of press time, BTC traded above $58K and will eye the earlier range-low at $60K. Nonetheless, a sustained miner dump may derail the restoration.