- Bitcoin mining hashprice has stabilized at $48 regardless of rising problem and falling transaction charges.

- A projected 4.3% problem drop could present short-term margin aid.

Bitcoin’s [BTC] mining hashprice has stabilized at $48 per petahash per second (PH/s), following a 1.4% rise in problem to 113.76 trillion at block 889,081 on the twenty third of March.

Supply: Hashrate Index

The rise got here because the community hashrate dropped under 800 EH/s, reversing a short rise to 840 EH/s earlier this month.

That’s not the one metric tightening miner profitability.

A restoration in worth, however not in stress

Bitcoin’s worth dipped to $80,000 on the tenth of March, recovering to $85,172 by the twenty fourth of March. However the hashprice stays underneath the $50 threshold many miners depend on for sustainable operations.

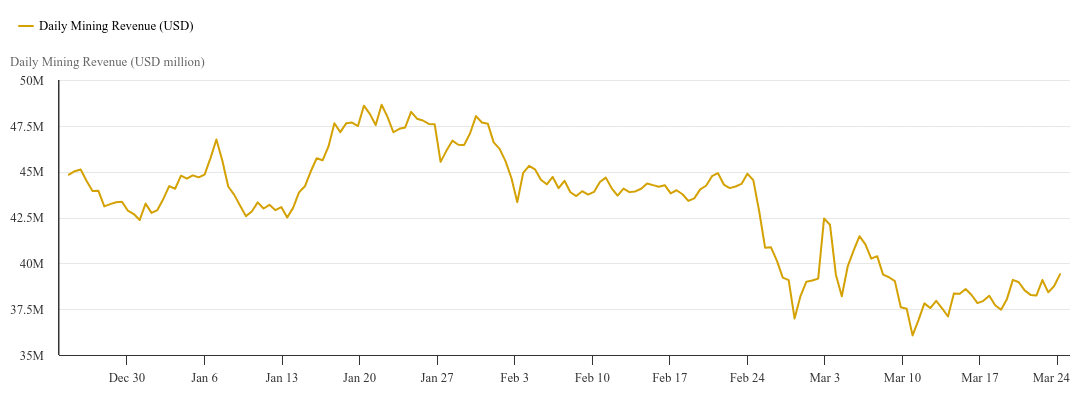

Each day mining income reached $39.23 million, a slight rebound from the $36.27 million low earlier within the month.

Supply: Braiins

Nonetheless, income has declined 17% since December, when miners earned over $47 million day by day.

Charges vanish, margins vanish sooner

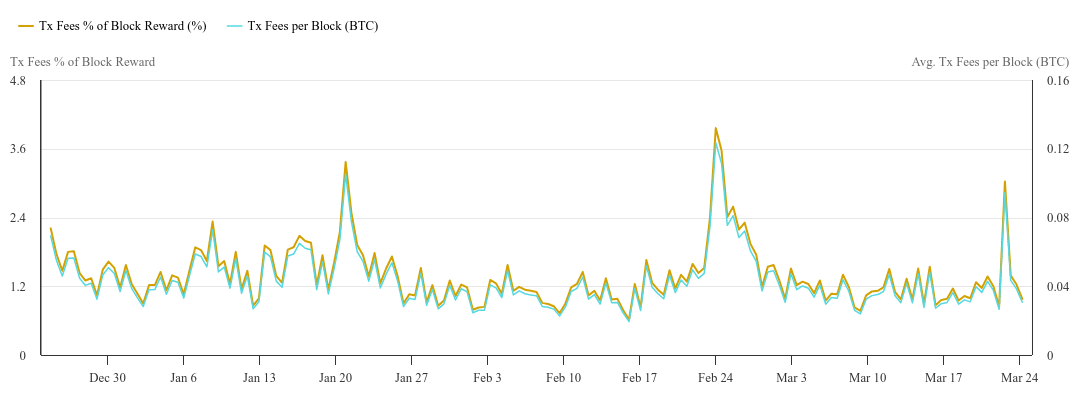

Transaction price revenue has additionally dried up.

As of the twenty fourth of March, charges made up simply 1.12% of block rewards, the bottom share since January 2022. Per-block price revenue now averages 0.04 BTC, eradicating a key income stream for miners throughout worth weak spot.

Supply: Braiins.

The stress has pushed many operators towards effectivity upgrades.

Older-generation machines just like the Antminer S19 XP and S19 Professional now yield $0.088 and $0.067 per kilowatt-hour, which falls under typical electrical energy charges in lots of areas.

That places 1000’s of items susceptible to changing into unprofitable. In the meantime, newer fashions proceed to carry out.

Based on Braiins, rigs just like the Antminer S21 Hyd nonetheless ship over $4.50 in day by day earnings, providing higher margin safety underneath present hashprice circumstances. However the problem rise complicates issues.

Problem climbs, however timing betrays the miners

Bitcoin’s protocol recalibrates problem each 2,016 blocks. The newest enhance displays previous community exercise, not the present slowdown.

This timing hole has left miners going through rising problem simply as hashrate falls.

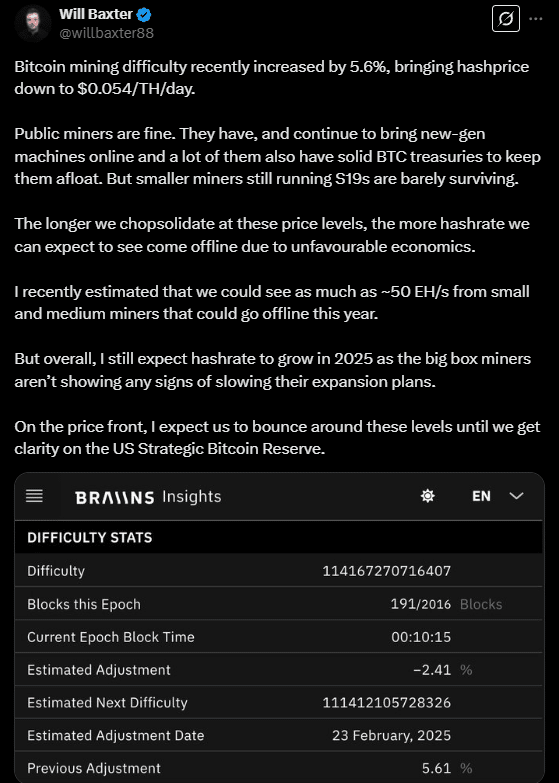

Will Baxter, EVP at Braiins, confirmed that problem just lately rose 5.6%, driving hashprice all the way down to $0.054/TH/day.

Supply: X

He famous that public miners stay insulated by newer {hardware} and treasury holdings, whereas smaller miners nonetheless utilizing S19s are “barely surviving.”

“The longer we chop sideways at these price levels, the more hashrate we can expect to see come offline.”

Baxter estimated ~50 EH/s of small and medium-sized mining capability may shut down this yr.

Nonetheless, he expects hashrate development in 2025 as “big box miners” proceed increasing.

Aid on the horizon?

The following adjustment, projected for the seventh of April, could drop problem by 4.3% to 108.86 trillion.

That forecast aligns with the present 10.45-minute common block time, which exceeds the goal and indicators a downward recalibration.

Nonetheless, miners stay divided.

Institutional gamers with trendy rigs and low cost energy proceed working. Others with older {hardware} and better prices are scaling again, as proven within the falling hashrate.

And not using a worth rebound or a spike in transaction charges, hashprice could stay underneath stress.

The upcoming problem adjustment will likely be important in shaping short-term margins—particularly with the subsequent halving anticipated inside a yr, which can additional cut back block rewards.