- The Bitcoin Golden Cross might sign a possibility for a breakout to $65K.

- Nevertheless, a number of circumstances must align for this cross to materialize in the long run.

Bitcoin [BTC] bulls have edged previous bearish strain after every week of stable makes an attempt to interrupt above $64K, reaching a every day excessive of $64,825.

This stage has been examined a number of occasions since BTC hit its ATH of $73K in March. In August, bears reasserted their dominance, thwarting a possible breakout to $68K.

Now, with BTC buying and selling at $63,687 after one other failed try to carry the help, what is going to it take to interrupt the cycle?

Bitcoin Golden Cross wants long run assurance

Supply: TradingView

On the every day worth chart, Bitcoin’s 50-DMA has crossed above the 200-DMA, signaling a Golden Cross.

Traditionally, this sample has been a dependable sign for monitoring Bitcoin’s directional tendencies. When the short-term transferring common crosses above the long-term one, it typically signifies a powerful upward swing.

Apparently, over the last week of the August cycle, the quick MA practically closed in on the lengthy MA, hinting at a possible bull rally.

Nevertheless, a resurgence of quick positions stopped the crossover from materializing, resulting in a pointy rejection and a retracement to the $55K help.

If an analogous state of affairs unfolds, the pattern might reverse right into a Loss of life Cross, foreshadowing a bearish market – What wants to vary?

Turning down BTC quick management is essential

Sometimes, merchants interpret a Golden Cross as a sign to enter lengthy positions, anticipating future worth beneficial properties.

With this in thoughts, AMBCrypto analyzed the speculative market to evaluate whether or not merchants have been positioning themselves to capitalize on the cross.

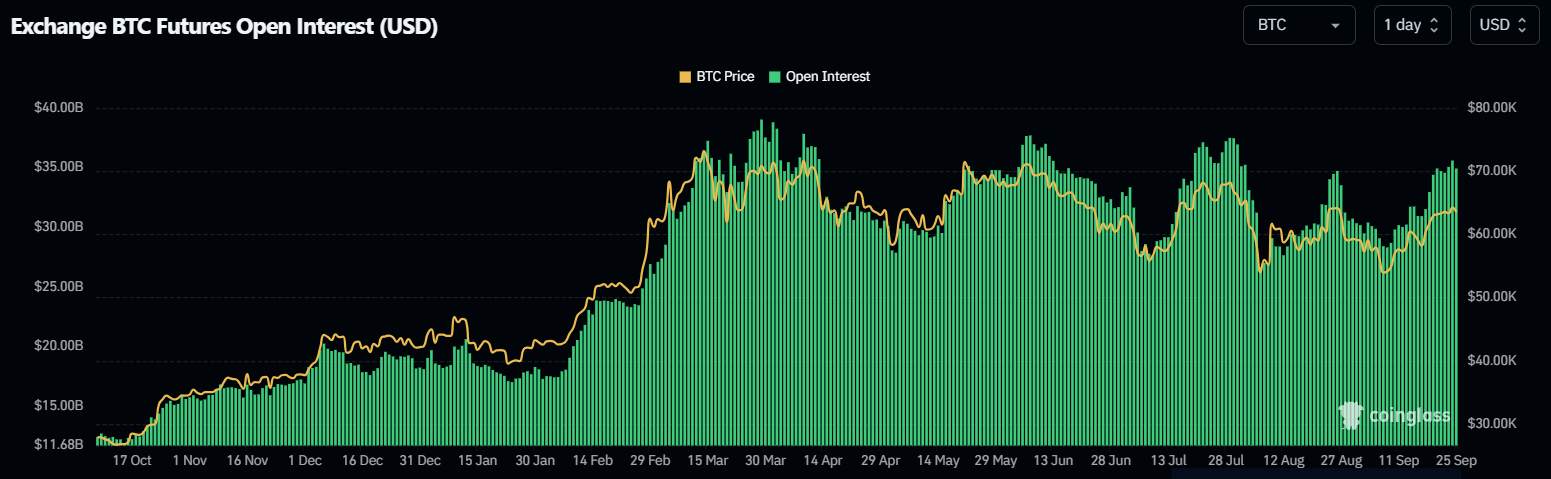

Supply: Coinglass

Usually, at any time when Open Curiosity (OI) surges, it usually coincides with Bitcoin testing crucial resistance ranges.

Put merely, every peak has been characterised by a notable rise in futures merchants going lengthy, however this surge usually ends with them closing their positions, leading to a pointy decline for BTC.

Surprisingly, whereas OI mirrors these market tops, BTC’s worth hasn’t adopted go well with, probably indicating a resurgence of quick management.

As Bitcoin bulls entered their fifth day of making an attempt to push BTC above $65K, a major inflow of lengthy positions has emerged.

Nevertheless, if quick management persists, lengthy liquidation might set off one other downturn, probably sending BTC again under $60K earlier than a breakout try can materialize.

THIS adjustment could make a distinction

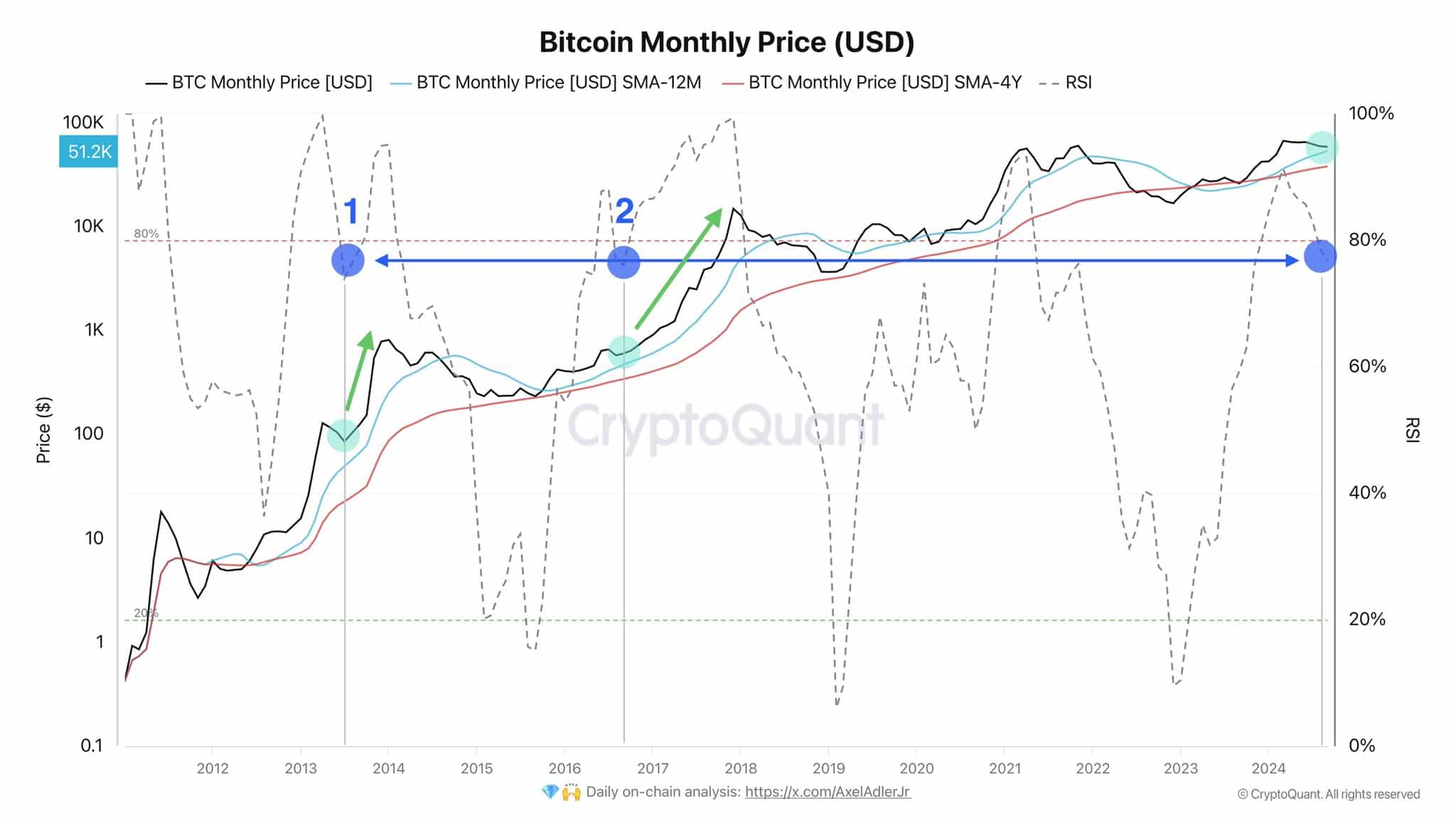

On the month-to-month timeframe, the RSI has dipped under 80%. AMBCrypto’s evaluation recommended that Bitcoin could also be gearing up for a short-term worth correction, as oversold circumstances typically spark renewed shopping for curiosity.

Supply : CryptoQuant

Traditionally, such RSI drops have heralded upward worth corrections throughout bullish cycles, prompting buyers to grab perceived bargains.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Whereas this might bolster the chance of the Golden Cross materializing quickly, for long-term stability, the market should cut back OI by a minimum of 10%. This discount would make Bitcoin much less vulnerable to quick management.

With out this adjustment, whereas BTC could stay above $64K within the quick time period, it’s unlikely to achieve $65K imminently.