- BTC’s ‘basis trade’ exploded following the restoration in September.

- The rising foundation premium was being pushed by hedge funds.

Bitcoin [BTC] foundation commerce, the place traders purchase spot BTC ETF and promote CME (Chicago Mercantile Change) futures contracts at larger costs to lock the revenue from the worth distinction, is again in an enormous method.

Usually most popular by hedge funds and asset managers, the idea commerce premium doubled in October. This occurred as BTC crossed $70K, proven by the Futures Annualized Rolling Foundation metric.

In mid-September, the premium dropped to six.2%; nonetheless, it stood at 12% as of the thirty first of October. That’s a few 2x surge in just a few weeks.

Supply: Glassnode

The Fed charge cuts and implications

Based on James Van Straten, a BTC analyst, the rising BTC foundation commerce might be linked to ongoing Fed charge cuts.

He said that the decrease rates of interest made BTC foundation commerce a greater possibility with larger returns than conventional alternatives.

“This is over double the current Fed Funds effective rate of 5%, in addition to the Fed cutting further in the next 3 months. I would assume the use of the “basis trade” will solely improve.”

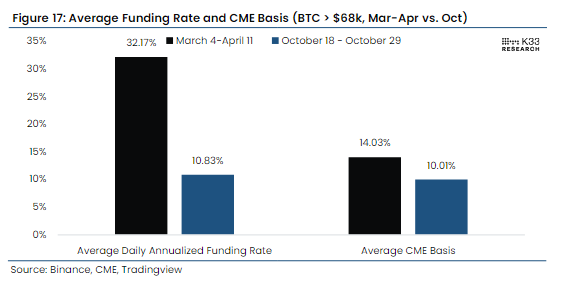

In the course of the peak of market froth in March, when BTC printed its all-time excessive (ATH) of $73.7K, the premium topped 14%. This was adopted by funding charges peaking above 30%.

In comparison with the present readings, the euphoria has not crept into the market to sign an overheated state of affairs, famous Mathew Sigel, VanEck’s head of digital property analysis. He mentioned,

“Past BTC peaks have coincided with surging perp premiums, hardly the environment today. Also, current spot volumes are half of March/April, indicative of substantially less panic buying from retail participants – a welcome observation for continued strength.”

Supply: K33 Analysis

That mentioned, the general BTC Open Curiosity (OI) charge surged to an ATH of $43 billion, dominated by CME futures at $12.69 billion. This indicated big curiosity from establishments.

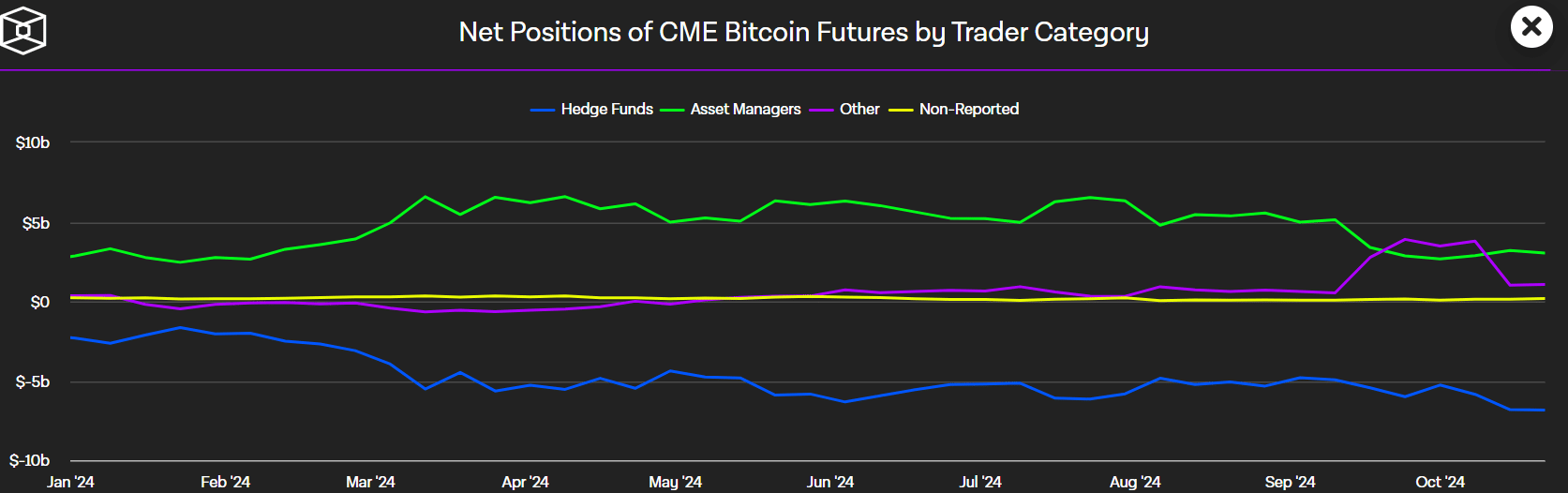

Nevertheless, the CME Futures market positioning confirmed that hedge funds drove the widening foundation commerce premium.

Based on The Block information, hedge funds (blue line) had a web brief place of $6.84 billion, indicating large hedging towards the BTC value decline.

Supply: The Block

By extension, this additionally widens the idea between spot BTC and futures costs and will entice much more gamers.

Nevertheless, a pointy drop within the premium may sign bearish sentiment and a possible BTC pullback. At press time, BTC was valued at $72.2K, up 13% in October.