- BTC’s Funding Charge reached a multi-month excessive.

- BTC traders have been accumulating the coin, hinting at a doable upcoming value rise.

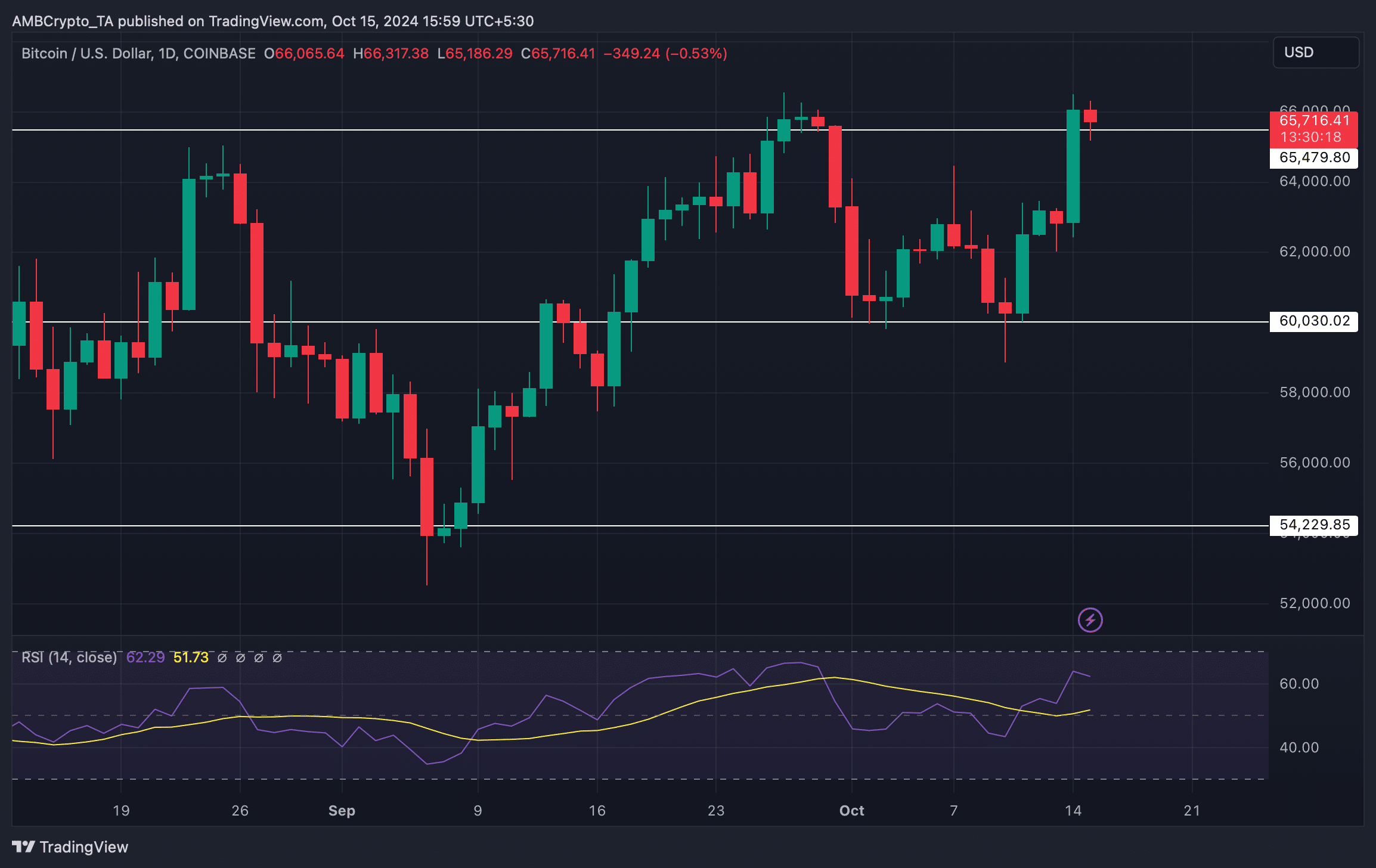

Bitcoin [BTC] has once more managed to cross the $65k resistance stage after plummeting below that just a few days in the past. This latest value uptick should have stirred up bullish sentiment out there.

The higher information was {that a} key metric reached a multi-month excessive, additional suggesting an enormous rise in constructive sentiment across the king coin.

Bitcoin reaches new highs

BTC’s value motion has witnessed inexperienced over the previous few days as its value elevated by greater than 4% within the final seven days.

On the time of writing, the king coin was buying and selling at $65,561.08 with a market capitalization of over $1.3 trillion.

The king coin’s buying and selling quantity additionally elevated whereas its value surged, which typically acts as a basis for a bull rally.

Whereas all this occurred, BTC’s Futures reached new highs. To start with, BTC’s Funding Charge touched a multi-year excessive.

When the Funding Charge rises, it signifies that more cash is flowing right into a community, which hints at an increase in bullish sentiment.

Supply: Coinglass

Other than that, Ali, a preferred crypto analyst, lately posted a tweet revealing one more achievement within the futures house.

As per the tweet, BTC’s Open Curiosity throughout all exchanges simply hit a brand new all-time excessive of $19.75 billion! A spike like this typically indicators huge value strikes forward, with extra capital on the road.

Subsequently, AMBCrypto deliberate to examine the king coin’s on-chain knowledge to search out out whether or not this newfound curiosity in BTC would lead to a continued value hike.

What’s subsequent for BTC?

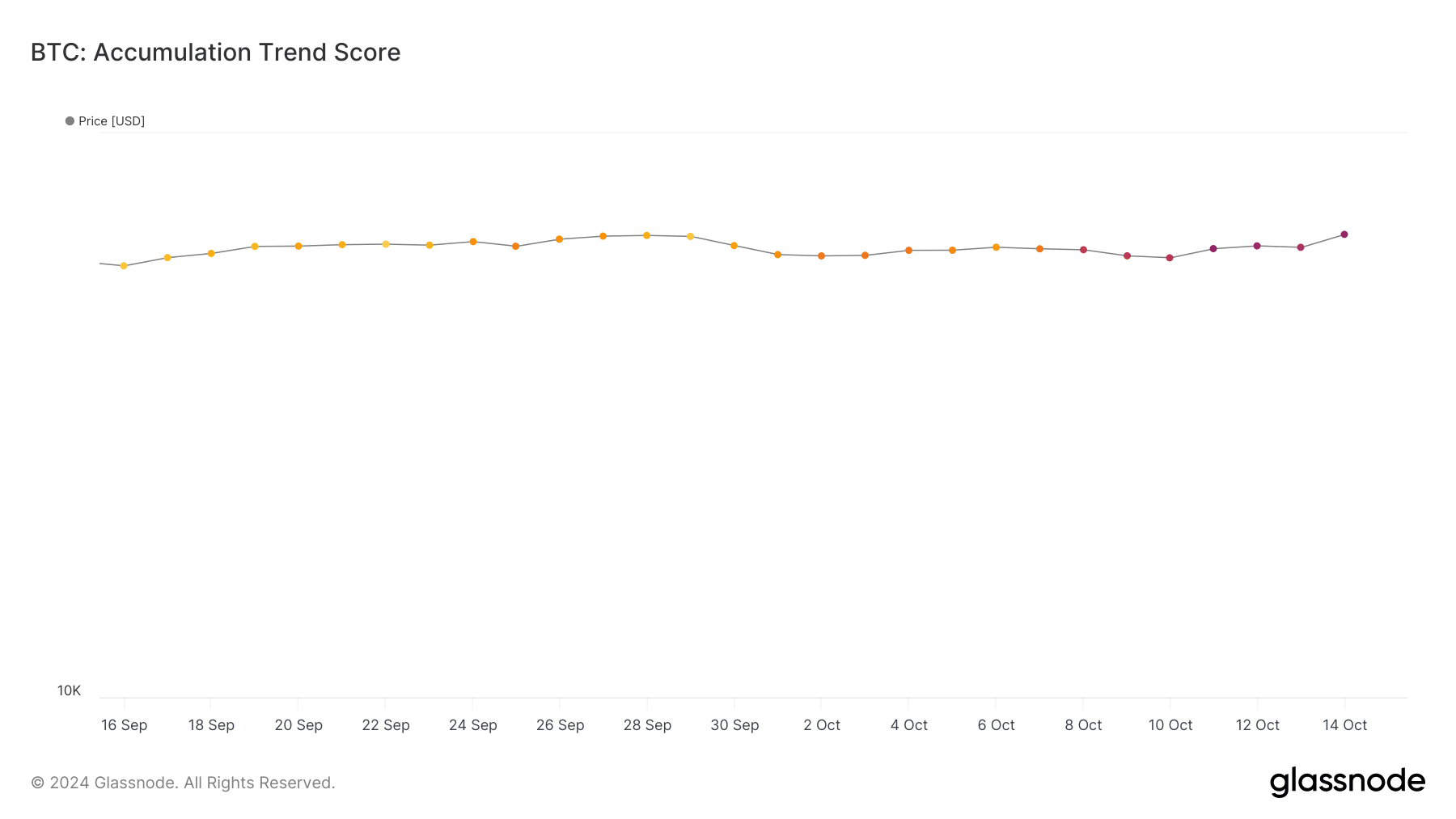

As per our evaluation of Glassnode’s knowledge, traders’ curiosity in BTC additionally mirrored in accumulation. We discovered that BTC’s accumulation development rating elevated from 0.2 in late September to 0.6 in October.

For starters, the buildup development rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain when it comes to their BTC holdings.

A quantity nearer to 1 signifies that shopping for stress is rising.

Supply: Glassnode

Nevertheless, not every part was in Bitcoin’s favor.

AMBCrypto’s have a look at CryptoQuant’s knowledge revealed that BTC’s internet deposit on exchanges was excessive in comparison with the final seven-day common, suggesting that promoting stress elevated in the previous few days.

Each time promoting stress rises, it hints at a value correction.

Life like or not, right here’s PEPE’s market cap in BTC’s phrases

Subsequently, AMBCrypto assessed BTC’s every day chart to higher perceive what to anticipate. We discovered that after breaking a resistance, BTC turned the identical stage into its assist.

Nevertheless, the Relative Energy Index (RSI) registered a downtick. This steered that BTC may not maintain its assist.

Supply: TradingView