- Bitcoin’s lively addresses confirmed robust FOMO because the digital asset hit new highs.

- Promote stress intensified as mid-term HODLers engaged in profit-taking.

Plentiful Bitcoin [BTC] predictions have been made to date this 12 months, with many analysts expressing optimism in BTC hovering nicely above $100,000.

Its newest rally appeared to have triggered a wave of FOMO, which was evident by the surge in addresses holding BTC.

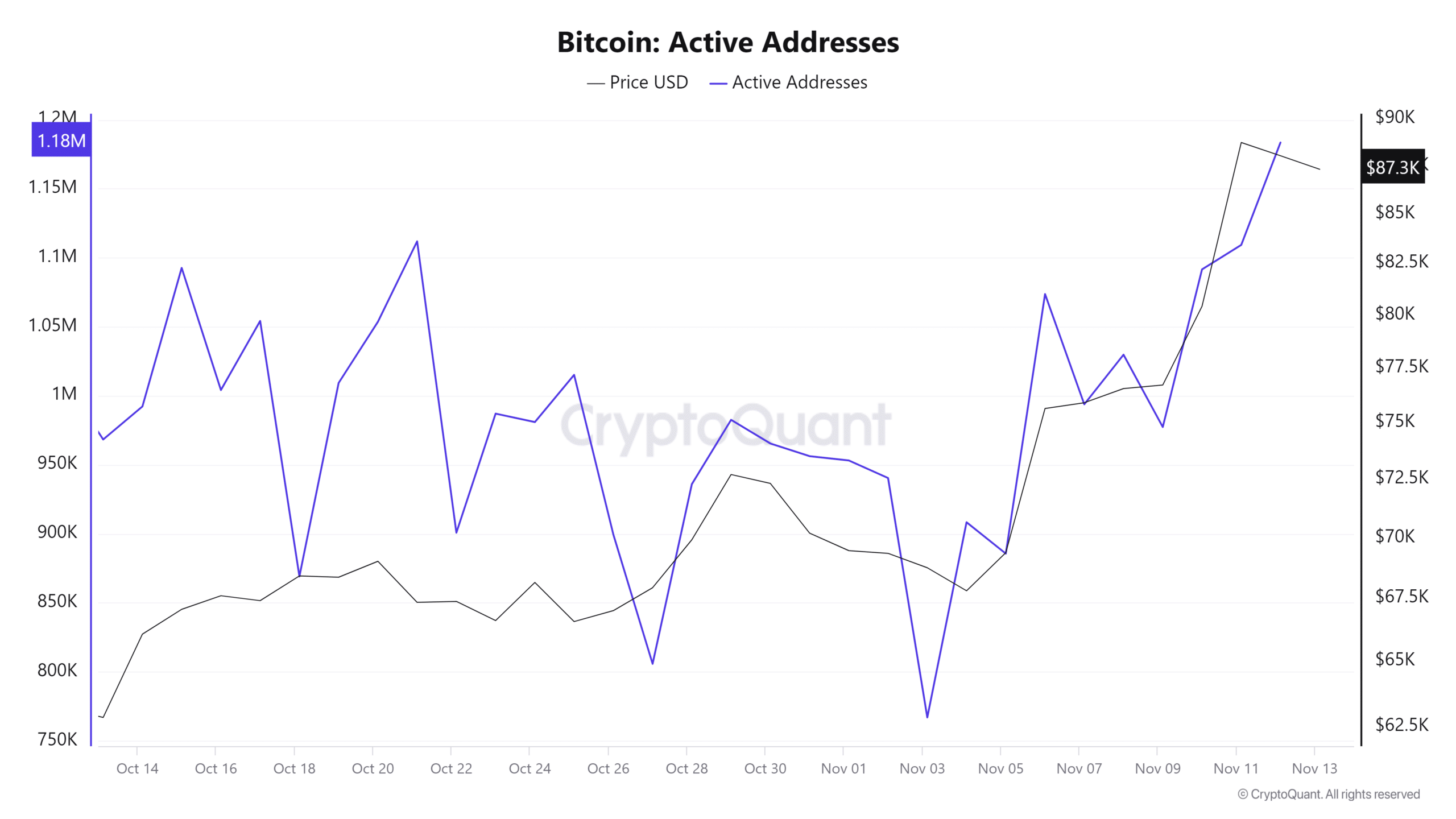

Based on CryptoQuant, the newest Bitcoin rally was characterised by a surge in lively addresses.

This was not solely an indication of confidence within the present state of the market, but additionally a sign that they don’t need to miss out on the rally.

The variety of lively addresses was as little as 766,947 on the third of November, nevertheless it has rallied to over 1.18 million addresses as of the twelfth of November.

This consequence highlighted a immediately proportional consequence with worth.

Supply: CryptoQuant

The surge in lively addresses holding Bitcoin additionally reflectedthe heavy ETF inflows noticed throughout the identical interval.

Is Bitcoin shopping for stress reducing?

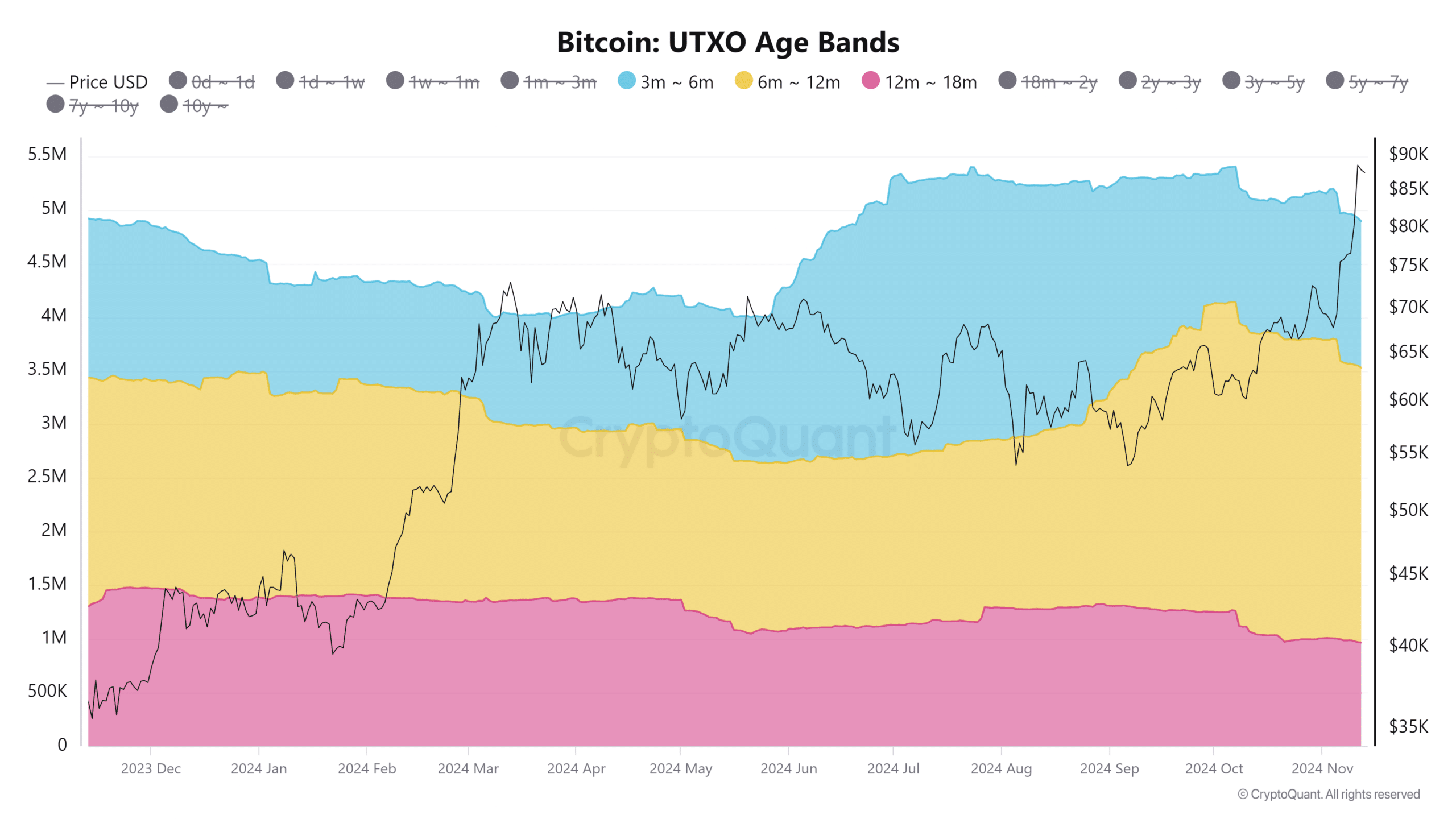

Whereas lively addresses have been contributing to bullish momentum, latest knowledge additionally indicated that profit-taking was beginning to intensify.

This was very true a couple of explicit cohort of HODLers which were holding BTC for six to 18 months, particularly within the spot market.

Supply: CryptoQuant

Knowledge indicated that patrons promoting not too long ago began accumulating way back to Could 2023. People who held up till not too long ago have loved over 200% positive aspects throughout these 18 months.

Based on CryptoQuant, these are mid-term holders whose common entry level was throughout the 28,000 worth vary.

Roughly 230,000 BTC moved from addresses holding for six to 12 months from the third to the twelfth of November. About 41,500 BTC moved from addresses that held for 12 to 18 months.

Is that this the tip of the newest bullish wave?

A surge in promote stress from mid-term hodlers might point out that Bitcoin is prepared for a large pullback.

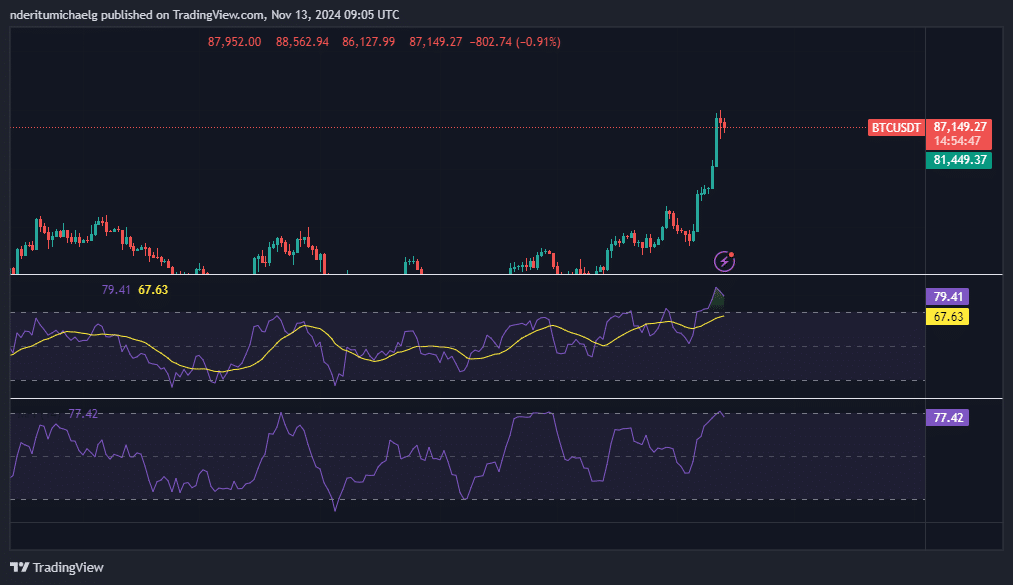

It not too long ago peaked at $89,940 in the course of the buying and selling session on the twelfth of November and has since demonstrated some bullish exhaustion and a few promote stress.

Supply: TradingView

Bearish expectations have been rising primarily based on the truth that the value was deeply overbought.

Promote stress from mid-term holders not solely affirm a surge in profit-taking, but additionally that long run holders could also be anticipating some pullbacks after BTC’s newest rally.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Though a pullback is affordable at present ranges, bullish expectations are nonetheless excessive, particularly as 2025 attracts close to.

The surge in lively addresses urged that FOMO might possible keep the next worth flooring and encourage extra shopping for, as buyers proceed to think about Bitcoin as a horny possibility beneath $100,000.