- Bitcoin might stay bullish till it trades above $45k.

- If BTC falls to the $54,700 degree, practically $2 billion price of lengthy positions shall be liquidated.

After a large value crash on the fifth of August, the market is now recovering. High belongings akin to Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have skilled important value jumps within the final two days.

Amid this ongoing value restoration, Julio Moreno, CryptoQuant’s Head of Analysis, shared that Bitcoin was flashing a bear sign.

Bitcoin flashing bearish sign?

In a submit on X (beforehand Twitter), Julio shared that the bull-bear market cycle indicator has entered a bearish zone. That is for the primary time since January 2023 that this indicator has flashed a bearish sign.

In keeping with historic information, this identical indicator flashed bearish indicators through the market crash in March 2020 and Could 2021.

Whereas retweeting Julio’s submit, Ki Younger Ju, the founder and CEO of CryptoQuant, shared on X that Bitcoin might stay bullish till it trades above $45k. In a submit, he famous,

“Some indicators are showing bearish signals. However, they could still recover with a rebound, so we need to watch if it stays at this level for a week or two. If it lingers longer, the risk of a bear market grows, and recovery may be difficult if it lasts over a month.”

At press time, BTC was buying and selling above the $57,200 degree, and skilled a value surge of over 4% within the final 24 hours. Regardless of this spectacular value surge, buying and selling quantity has dropped by 38% throughout the identical interval.

This huge fall in buying and selling quantity signifies a concern amongst merchants and buyers.

Bitcoin technical evaluation

In keeping with skilled technical evaluation, BTC seems bullish and will soar to almost $60,000 within the coming days.

$60,000 would be the essential degree for BTC because it faces resistance from the trendline and the 200 Exponential Transferring Common (EMA).

Supply: TradingView

Nevertheless, if BTC manages to provide a breakout of this resistance degree, there’s a excessive probability we might even see a large upside rally to $70,000 within the coming days.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

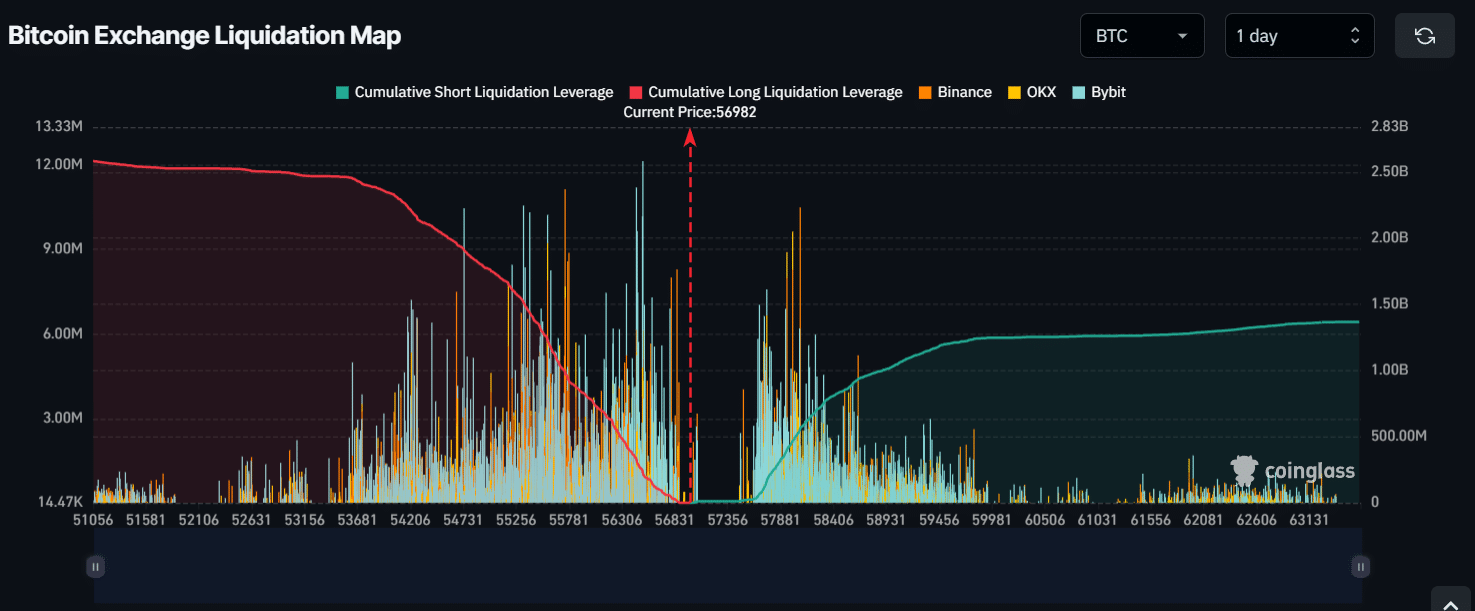

As of now, the main liquidation degree is close to $54,700 on the decrease aspect and if the sentiment modifications, and it falls to that degree, practically $2 billion price of lengthy positions shall be liquidated.

Supply: Coinglass

Whereas, on the higher aspect, the main liquidation degree is close to $58,000. If sentiment stays unchanged and BTC soars to that degree, practically $500 million of brief positions shall be liquidated.