- Bitcoin’s fall beneath $59,000 has triggered important market liquidations, notably impacting altcoins.

- Analysts advise warning, suggesting a pause in accumulating altcoins because of present market uncertainties and weak indicators.

In a dramatic 24-hour interval, the worldwide cryptocurrency market witnessed a pointy 4.7% drop, pushed by a big downturn in Bitcoin’s [BTC] value, which fell beneath the essential $59,000 mark.

This decline has rippled by means of the market, impacting altcoins severely.

As Bitcoin struggles to keep up its footing, the altcoin sector skilled a considerable discount in market cap from $1.03 trillion initially of this month to simply $953 billion at press time.

Bitcoin’s latest slip beneath $59,000 marks a essential juncture within the cryptocurrency market, reflecting broader uncertainty and triggering widespread sell-offs.

The downward pattern has solid doubts in regards to the sustained well being of the bull market, with Bitcoin testing help ranges a number of instances—an indicator of potential market weak point.

On Crypto Banter’s “The Ran Show,” analysts highlighted the precarious place of Bitcoin on the decrease finish of its buying and selling vary, suggesting that repeated testing of those ranges could sign an imminent market shift.

Steer clear from altcoins

Throughout these tumultuous market circumstances, specialists are advising merchants to train warning, notably with altcoins.

Current patterns and market knowledge recommend a cooling interval for altcoins, which have been considerably affected by Bitcoin’s extended value changes.

The analyst from Crypto Banter famous that whereas altcoins sometimes have durations of restoration, the present market circumstances usually are not favorable for quick rebounds.

Utilizing Pendle [PENDLE] for instance, the analyst revealed that the altcoin has skilled a notable decline not because of protocol points however due to exterior market pressures, illustrating the unstable nature of altcoin investments throughout unsure instances.

The recommendation from the analyst is to deal with sturdy on-chain knowledge and keep away from being swayed by fleeting social media traits.

The Crypto Banter analyst additionally made point out of FTX’s latest transfer, which might probably return extra funds to customers than initially misplaced, hinting at a optimistic flip in market liquidity that may help restoration.

Evaluating Bitcoin’s market cap development to main monetary establishments and conventional belongings like gold, the analyst strengthened the long-term worth proposition of Bitcoin regardless of short-term volatilities.

Solana: A case research in volatility

Whereas the analyst really useful warning with altcoins, it is sensible to look at Solana [SOL], the third-largest altcoin available on the market, as a selected case of the influence of the market’s downturn on altcoins.

Solana has been closely impacted; over the past 24 hours alone, SOL’s value has decreased by 7.3%, buying and selling at $134.83 at press time. This downturn adopted a quick surge tied to pleasure over potential ETFs.

This lower in Solana’s worth has had a big impact on merchants. In accordance with Coinglass, over the previous day, 106,449 merchants have confronted liquidations totaling $289.26 million.

Of this, Solana-related liquidations amounted to roughly $12.55 million, predominantly from lengthy positions. Particularly, Solana lengthy liquidations totaled $10.76 million, in comparison with $1.80 million from quick positions.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

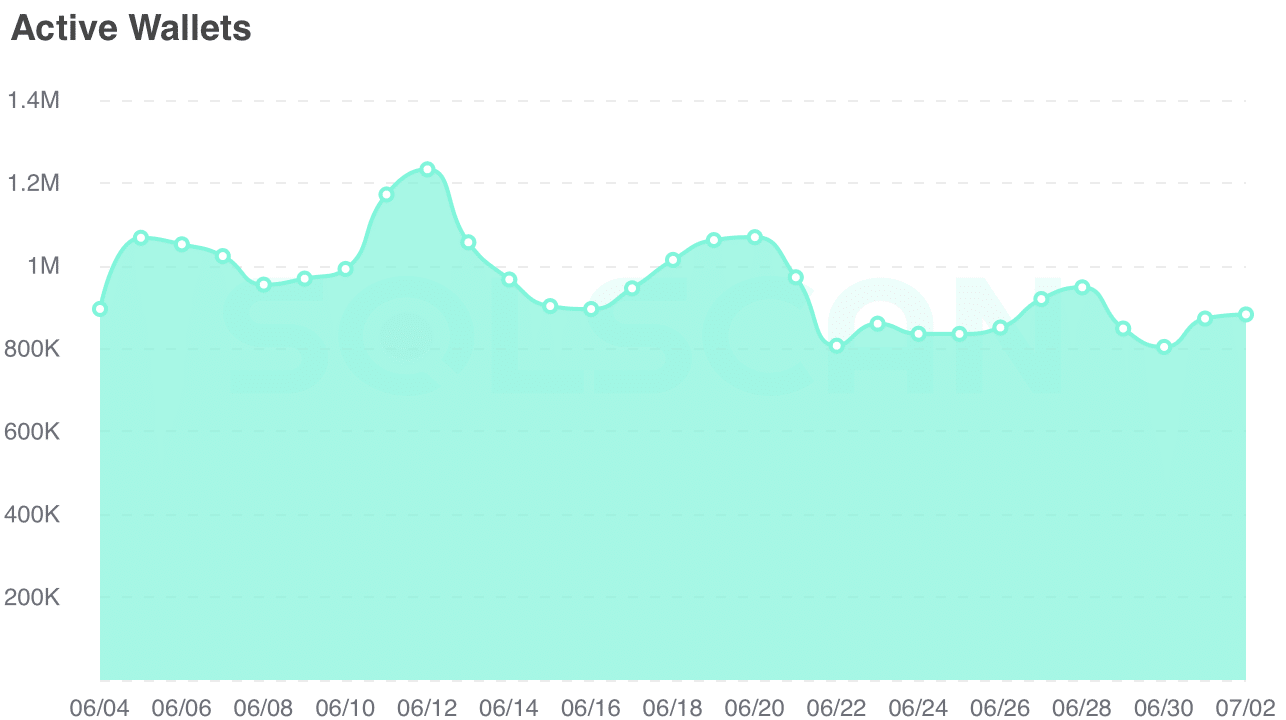

The downturn seems to be affecting Solana’s on-chain exercise. AMBCrypto’s have a look at Solscan indicated a marked decline within the variety of lively addresses.

From over 1.2 million addresses final month, the quantity has dropped to 882,000 at press time, highlighting a waning person engagement amid present market circumstances.

Supply: Solscan