- Bitcoin fell decrease after a softer June CPI information.

- Analysts claimed a bullish reversal was probably for BTC.

On the eleventh of June, Bitcoin [BTC] mirrored US inventory equities losses, particularly Large Tech, following a softer June CPI (Shopper Worth Index) print.

BTC did not reclaim the $60K degree and dropped under $58K after the inflation information.

The June CPI information was cooler at 3.0%, in comparison with 3.3% in Could, that means the general weighted shopper worth for a basket of products and providers eased barely.

Will a probable September Fed charge lower enhance Bitcoin?

The softer June inflation may verify the current disinflation development, boosting the chances of the Fed charge cuts later within the yr. This might be optimistic for threat property, together with the crypto market.

Nonetheless, after the CPI information, buyers reportedly rotated out of Large Tech shares, sending them decrease alongside BTC as they grabbed small-cap US shares.

Apparently, Quinn Thompson, founding father of crypto hedge fund Lekker Capital, claimed that “small-cap outperformance” may nonetheless strengthen Bitcoin’s restoration. He famous,

“Small cap outperformance tends to coincide with crypto strength. Let’s see if the macro can overpower the #Bitcoin supply overhang.”

Supply: X/Quinn Thompson

The above chart revealed a optimistic correlation between small-cap efficiency, tracked by iShares Russell 2000 ETF (IWM), and BTC.

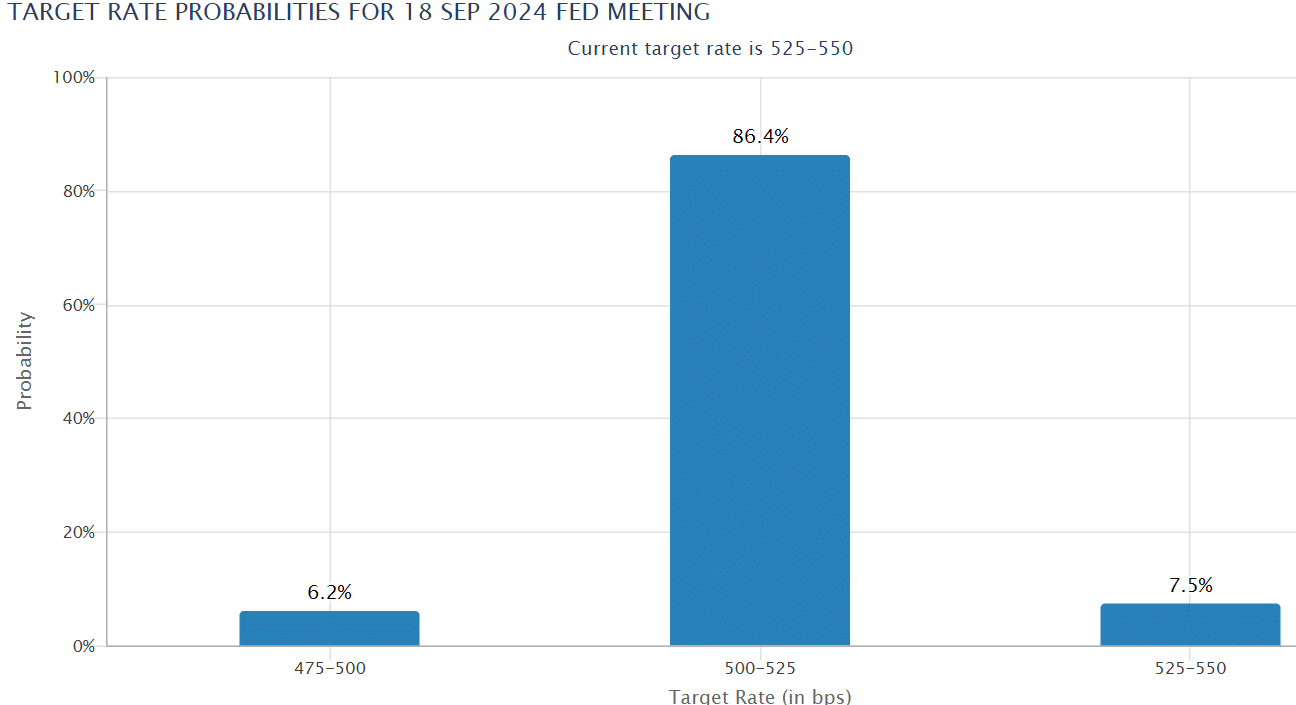

Within the meantime, the odds of Fed charge cuts in September surged above 80% as of press time, following the softer June inflation.

Supply: CME Fed Watch software

The enhancing macro prospects, nevertheless, might be dented by Bitcoin provide overhang, particularly from the German authorities sell-offs, as cautioned by Thompson.

However, as of the twelfth of July, German holdings have been lower than 10K BTC out of 50K BTC held in mid-June, which meant its provide stress may ease considerably by subsequent week.

So, what’s subsequent for BTC worth within the brief time period?

BTC’s subsequent worth goal

Primarily based on a probable easing provide stress, upcoming Ethereum [ETH] ETF, and softer CPI, QCP Capital analysts projected that BTC may break above its present sideways motion.

In response to famend BTC analyst Stockmoney Lizards, a retest of $50K-52K might be potential earlier than the $64K goal is reached.

Supply: X/Stockmoney Lizard