- BTC’s rally comes as its trade reserve continues to say no.

- Sentiment suggests BTC may drop additional till it finds a vital level for a rebound.

Bitcoin [BTC] market efficiency isn’t what you’d anticipate after a big upswing final month, which introduced it to a brand new all-time excessive with a 33.14% improve.

At present, the 24-hour acquire is minimal at 0.78%. Whereas this means extra shopping for exercise than promoting, the upward transfer is much from assured, as AMBCrypto experiences.

BTC provide on exchanges drops additional

Information from CryptoQuant experiences a continued decline in Bitcoin availability on cryptocurrency exchanges. The Trade Reserve has fallen by 0.61% prior to now 24 hours and 1.53% during the last week.

Supply: Cryptoquant

A drop in Trade Reserve usually signifies a decreased circulating provide of BTC on exchanges, an element that always helps value will increase because of shortage.

This decline has performed a job in BTC’s current features on the each day chart. Nevertheless, the sustainability of this rally stays unsure, with AMBCrypto outlining key components to look at.

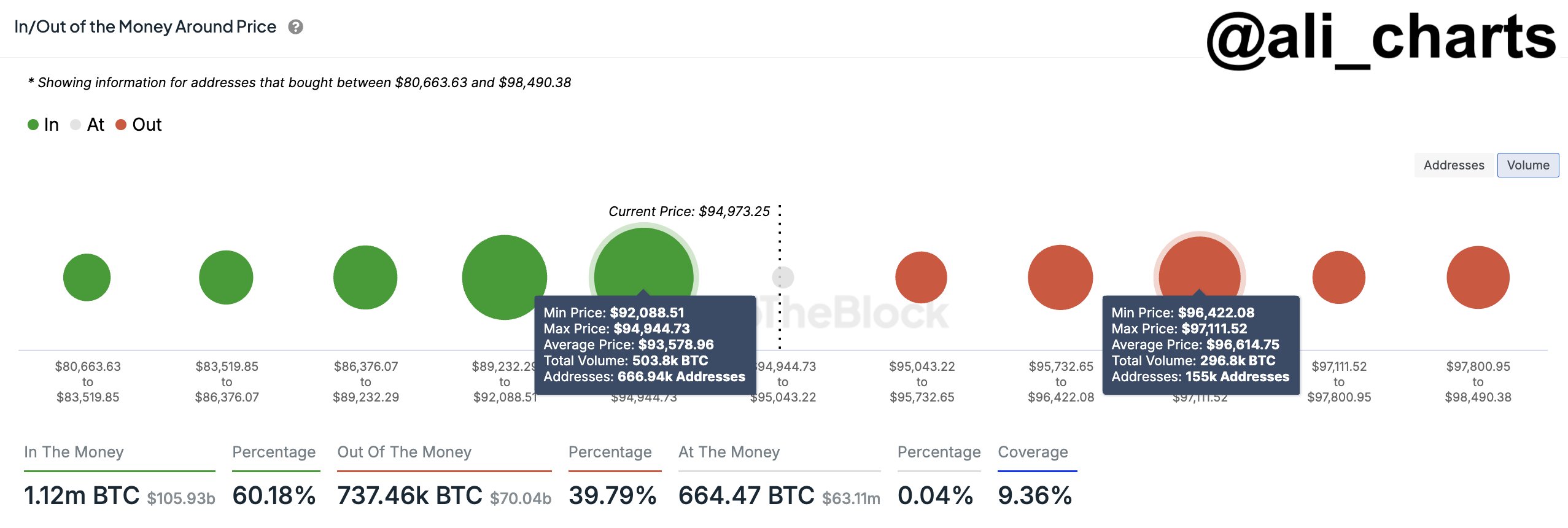

Promoting stress builds as BTC hits provide zone

In accordance with analyst Ali, BTC is at a vital juncture, having entered a provide zone at $96,614.75. Right here, important promoting stress exists, with promote orders totaling 296.8K BTC.

If BTC faces a drop, Ali highlighted the significance of the subsequent key demand zone at $93,578.96, the place purchase orders for 503.8K BTC from 666.94 addresses are concentrated.

He said:

“Staying above this support level is a must to prevent these holders from selling.”

Whereas the stronger purchase orders at this degree recommend it might maintain, the result is determined by the depth of promoting stress.

Supply: X

AMBCrypto additionally famous a warning signal, with a pointy rise in BTC inflows to exchanges—2,678 BTC moved within the final 24 hours—including weight to the potential for a value decline.

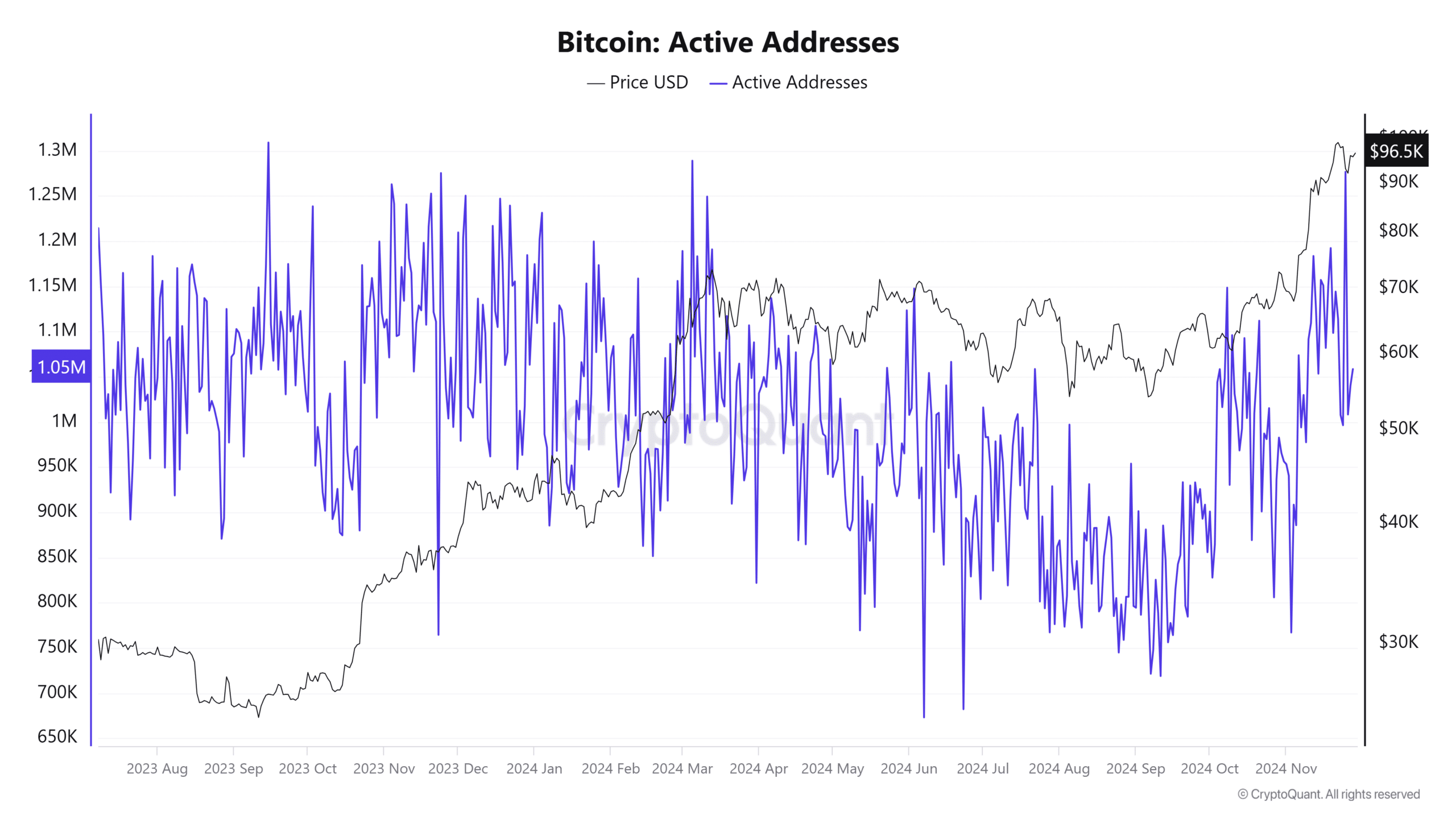

Retail participation weakens

Retail buyers, who play a significant position in asset value actions, present indicators of weakening curiosity because the variety of lively addresses has considerably declined by 35,03%.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

A drop in lively addresses usually means decreased shopping for exercise, which might contribute to a possible value dip for BTC, probably towards the earlier-mentioned demand zone.

Supply: Cryptoquant

If the demand zone maintains its present purchase order quantity and tackle exercise, a value reversal from that degree stays doable.