- Bitcoin shed plenty of its latest features throughout the week previous Election Night time within the U.S

- Historic patterns pointed to an upcoming bull rally on the charts

After peaking ever nearer to its all-time excessive [ATH] with a value of $73,600, Bitcoin [BTC] took a detour. The truth is, it slid all the way down to a low of $67,459 on 3 November.

Nevertheless, does this decline imply the bear market is again or is it merely a short-term correction?

Why is Bitcoin down?

To reply the query, AMBCrypto took a more in-depth take a look at BTC’s historic knowledge to uncover that the value drop may truly be the latter. As an example, again in 2016, the cryptocurrency depreciated by 10% simply days earlier than the election.

Equally, in 2020, Bitcoin’s worth dropped by 6.2%. BTC’s ongoing decline appears to be mirroring these previous patterns, with Bitcoin dropping over 8% of its worth for the reason that aforementioned excessive.

Election-driven uncertainty

An identical outlook was shared by Quinten Francois, Co-founder of WeRate, who defined that the interval of heightened unpredictability earlier than elections instantly impacts investor sentiment. He posted on X,

“Financial markets don’t like uncertainty. There is a lot of uncertainty going into election week. That’s why $BTC is down.”

The Founding father of CryptoSea, famously often known as Crypto Rover, supported this angle by stating,

“Bitcoin always dumps right before the U.S. elections.”

Right here, it’s value mentioning that at press time, the cryptocurrency had recovered to commerce slightly below $69,000 on the charts.

What’s subsequent for Bitcoin?

With the dip’s trigger seemingly rooted within the uncertainty surrounding the upcoming elections, the urgent query is – What comes subsequent for the king coin?

Properly, earlier patterns dictate that post-election intervals have marked the start of bull runs that stretch nicely into the next 12 months.

In 2016, Bitcoin gained by roughly 60% two months after the election.

Supply: TradingView

Moreover, an approximate acquire of 150% was recorded after the presidential elections in 2020.

Supply: TradingView

So, if historical past repeats itself, BTC may hit a brand new ATH within the upcoming months.

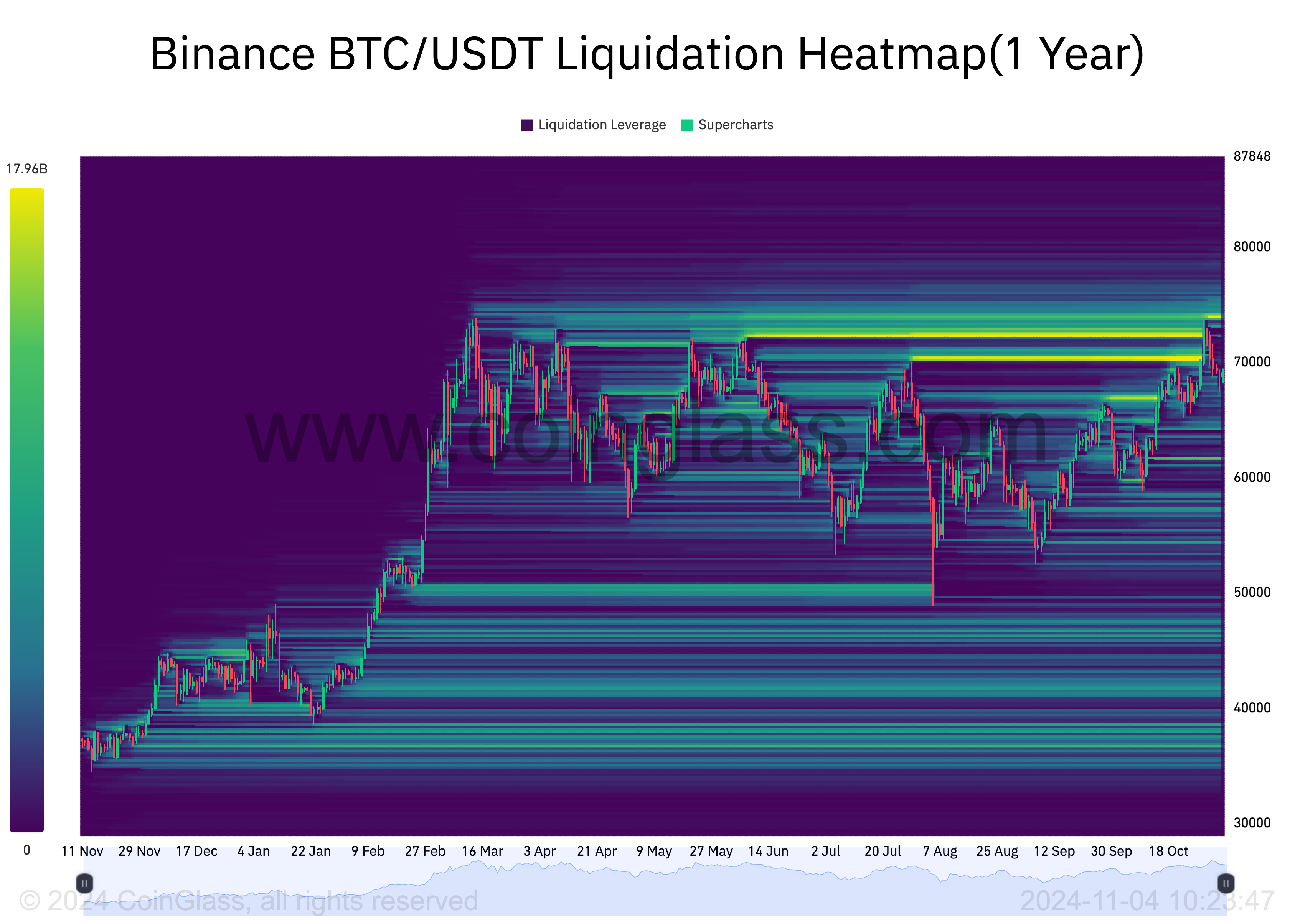

Lastly, AMBCrypto’s evaluation of the 1-year liquidation heatmap from Coinglass additionally alluded to the probability of extra highs.

A robust cluster of liquidity was fashioned round $74,000. This magnetic zone may appeal to the value, marking a brand new ATH for the king coin.

Supply: Coinglass

Altcoin outlook – Trump vs. Harris victory

Whereas a Bitcoin bull run appears possible whatever the election consequence, the outlook for altcoins varies. AMBCrypto beforehand reported {that a} Donald Trump win may imply a extra favorable setting for altcoins.

This, due to presumably relaxed crypto laws from the Republican administration. Clearer SEC tips on which altcoins qualify as securities may additionally set off bull runs for the belongings.

Additionally, AMBCrypto famous that as Bitcoin traders redistribute earnings after elections, some altcoins may see features. Nonetheless, the probability of a long-lasting “altcoin season” stays unsure proper now.