- Bitcoin’s value has elevated by over 12% within the final seven days.

- Metrics prompt that BTC may flip bearish even earlier than retesting its ATH.

Bitcoin [BTC] has lastly entered its street in the direction of restoration because it crossed the psychological resistance of $60k. The rise in its value hinted at a retest of its all-time excessive within the coming days.

Nonetheless, the coin would face a roadblock proper after its ATH as it could witness a significant rise in liquidation.

Bitcoin to retest its ATH?

CoinMarketCap’s information revealed that BTC’s value elevated by double digits final week. To be exact, the king of cryptos witnessed a 12% value rise up to now seven days.

Within the final 24 hours alone, the coin’s value shot up by greater than 4%. On the time of writing, BTC was buying and selling at $62,543.73 with a market capitalization of over $1.23 trillion.

In the meantime, Ali, a preferred crypto analyst, posted a tweet highlighting an necessary growth. As per the tweet, $5.60 billion briefly positions shall be liquidated if Bitcoin makes a U-turn to $72,300.

This prompt that the probabilities of BTC witnessing a value correction after touching $72.3k had been excessive.

Typically, every time liquidation rises, it causes short-term value corrections. Due to this fact, buyers may witness BTC slowing down or plummeting for a couple of days after it retests its all-time excessive within the coming weeks.

Supply: X

BTC’s street to $72k

Since there have been probabilities of BTC witnessing a value correction at $72k, AMBCrypto deliberate to test its metrics to search out whether or not there have been every other roadblocks forward of that mark.

AMBCrypto’s evaluation of CryptoQuant’s information revealed that Bitcoin’s alternate reserve has elevated, which meant that promoting strain on it was rising.

Its aSORP was pink. This clearly prompt that extra buyers had been promoting at a revenue. In the midst of a bull market, it could possibly point out a market high.

Moreover, its NULP revealed that buyers had been in a perception part the place they had been at present in a state of excessive unrealized income.

At press time, BTC’s worry and greed index had a studying of 69%, suggesting that the market was in a “fear” part. Each time the metric hits that degree, it signifies a doable value correction.

Supply: CFGI.io

Nonetheless, Bitcoin’s Rainbow Chart flagged a purchase sign. As per the metric, BTC was within the “BUY” part, which means that there was nonetheless time for buyers to build up BTC earlier than it reaches new highs.

Supply: Blockchaincenter

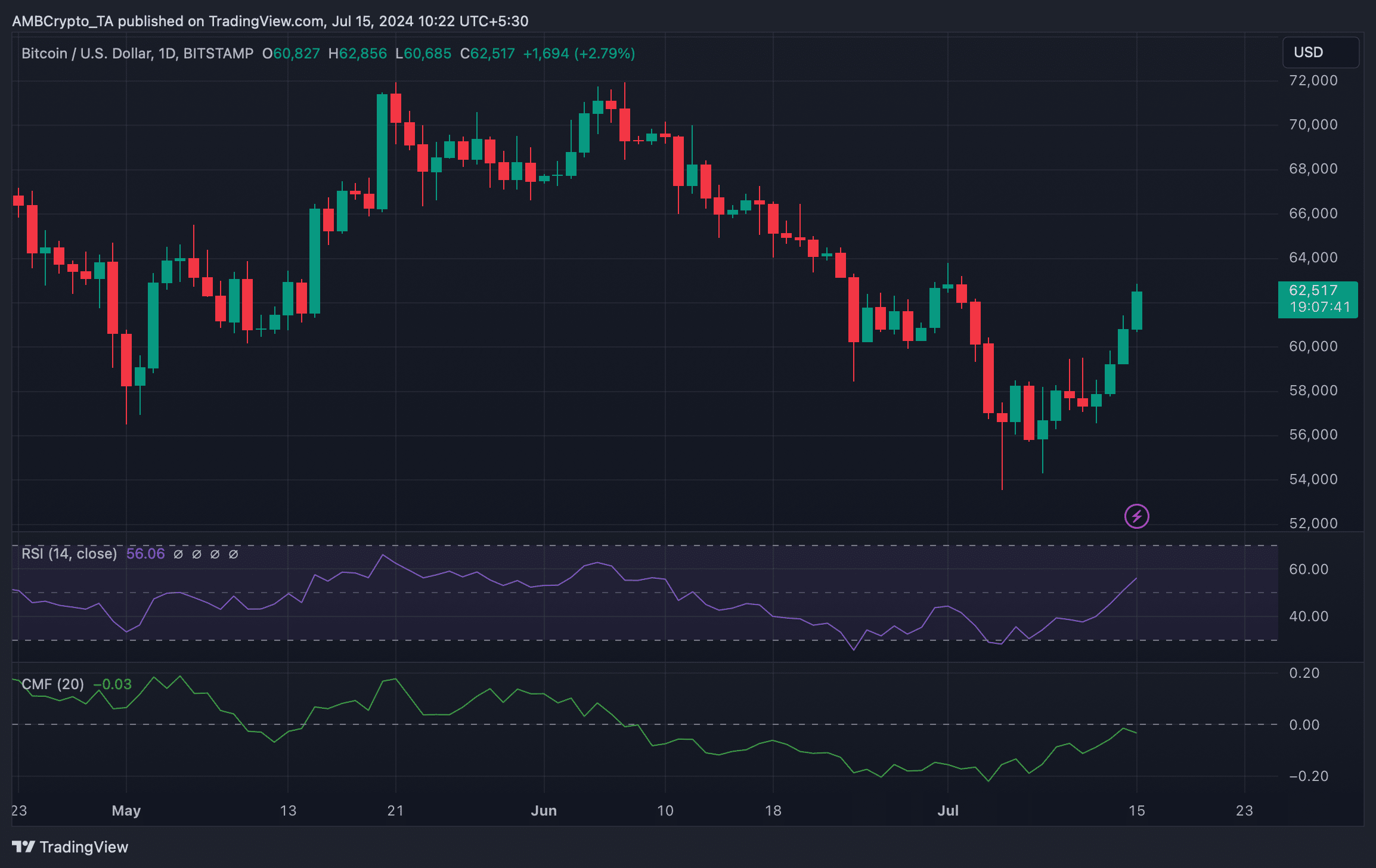

We then deliberate to take a look on the coin’s each day chart to raised perceive whether or not it was anticipating a correction earlier than restarting its journey in the direction of $72k.

Learn Bitcoin (BTC) Worth Prediction 2024-25

We discovered that the Chaikin Cash Circulate (CMF) registered a decline, hinting at a value correction.

Nonetheless, the Relative Energy Index (RSI) remained bullish because it moved additional north from the impartial mark.

Supply: TradingView