- Destructive sentiment available in the market triggered the rise in outflows from BTC and ETH.

- Projected distribution by a defunct exchanges places the cryptos prone to one other decline

Crypto funding merchandise noticed large inflows for the second consecutive week, CoinShares’ newest report revealed. In keeping with the digital belongings administration, outflows final week have been price $584 million.

This introduced the overall outflows in two weeks to $1.2 billion. As anticipated, Bitcoin [BTC] had the best outflows with$630 million. The report defined that the gloomy notion amongst buyers and projected rate of interest reduce contributed to the capital move.

It defined that,

“We believe this is in reaction to the pessimism amongst investors for the prospect interest rate cuts by the FED this year.”

BTC, ETH play second fiddle to different altcoins

Aside from the outflows, buying and selling quantity of Trade Traded Merchandise (ETPs) fell to $6.9 billion. This was the bottom quantity Bitcoin has had because the tenth of January ETF approval.

Supply: CoinShares

Ethereum [ETH] was second on the record with an outflow of $58.30 million. This was shocking contemplating that the broader market anticipate the Ethereum spot ETFs to start buying and selling in July.

Usually, this was alleged to result in optimism. Nonetheless, that didn’t occur because the report said that,

“Ethereum did not escape the negative sentiment, seeing US$58m in outflows. While a range of altcoins saw inflows after recent price weakness, most notable were Solana, Litecoin and Polygon at US$2.7m, US$1.3m and US$1m respectively.”

At press time, Bitcoin’s value was $60,028 after it briefly fell beneath $59,000. ETH, alternatively, modified palms at $3,349.

It’s the season to use warning

The preliminary decline in costs might be linked to the disclosure that Mt.Gox. supposed to pay again collectors $9 billion price of BTC from July.

Mt.Gox is the defunct Bitcoin change that was hacked in 2011. It then went bankrupt in 2014, resulting in a broader market collapse. If the distribution begins in July, there’s a excessive probability that the recipients would unload among the cash.

Ought to this be the case, BTC might plunge to $54,000 as predicted in some corners. For ETH, the anticipated reside buying and selling of the ETFs might reserve it from one other spherical of correction.

If this occurs, ETH’s value may resist one other draw back, and this might be the ticket to the altcoin season that has failed to seem.

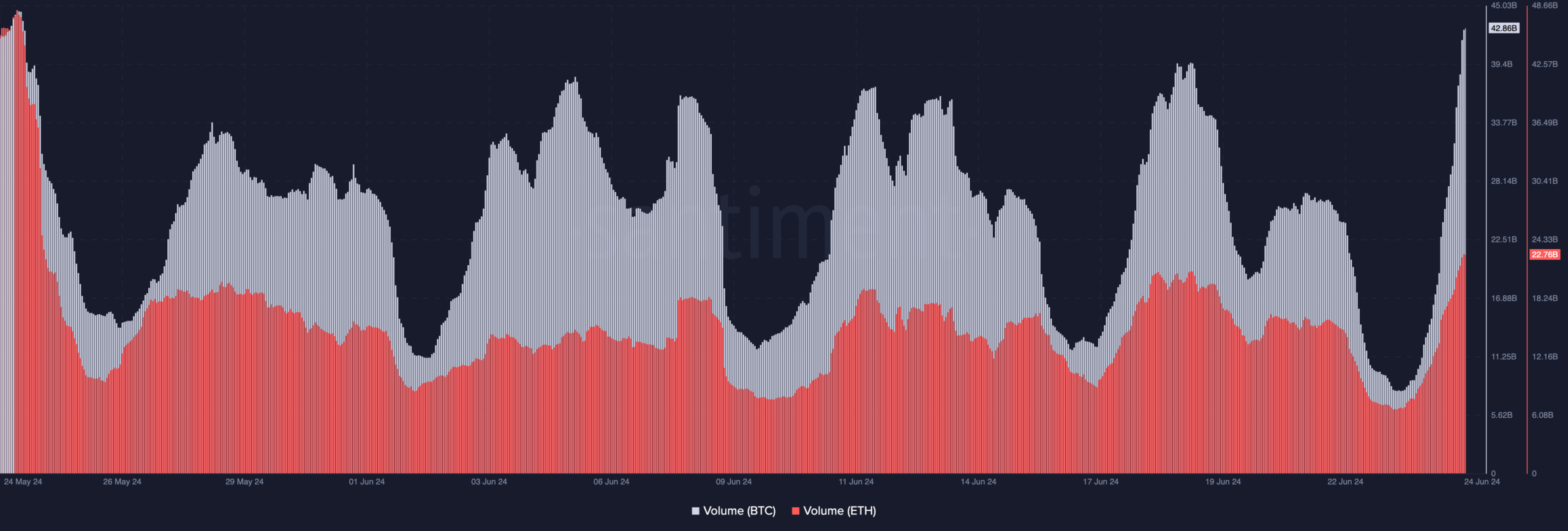

In the meantime, Bitcoin’s quantity neared its month-to-month excessive. At press time, the quantity was $42.86 billion. Quantity measures shopping for and promoting, indicating curiosity in a cryptocurrency.

However contemplating BTC’s decline, it implies that there was extra promoting than shopping for. Whereas ETH’s quantity additionally elevated, it was not the identical as Bitcoin.

Supply: Santiment

Lifelike or not, right here’s ETH’s market cap in BTC phrases

As of this writing, ETH’s quantity on-chain was $22.76 billion. Because it stands, BTC appeared to be resisting an additional decline. If bulls can defend the coin, the value may rebound to $63,000.

In ETH’s case, the worth might revisit $3,500. Nonetheless, if promoting stress will increase, the costs might hit new quarterly-lows.